Analyze the following transactions and show their effects the basic accounting equation: B d. e. a. t b. C. d. K e. f. clit

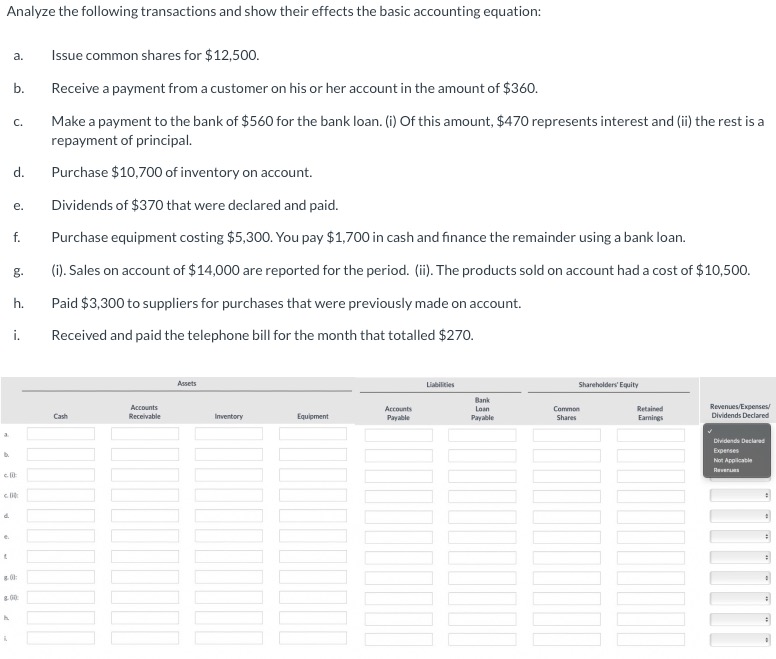

Analyze the following transactions and show their effects the basic accounting equation: B d. e. a. t b. C. d. K e. f. clit g. c. 00: h. i. 8.00 g.00: Issue common shares for $12,500. Receive a payment from a customer on his or her account in the amount of $360. Make a payment to the bank of $560 for the bank loan. (i) Of this amount, $470 represents interest and (ii) the rest is a repayment of principal. Purchase $10,700 of inventory on account. Dividends of $370 that were declared and paid. Purchase equipment costing $5,300. You pay $1,700 in cash and finance the remainder using a bank loan. (i). Sales on account of $14,000 are reported for the period. (ii). The products sold on account had a cost of $10,500. Paid $3,300 to suppliers for purchases that were previously made on account. Received and paid the telephone bill for the month that totalled $270. Cash Accounts Receivable Assets Inventory Equipment Accounts Payable Liabilities Bank Loan Payable Shareholders' Equity Common Shares Retained Earnings Revenues/Expenses/ Dividends Declared Dividends Declared Expenses Not Applicable Revenues

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Basic Accounting Equation Accounting Equation For the p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started