Answered step by step

Verified Expert Solution

Question

1 Approved Answer

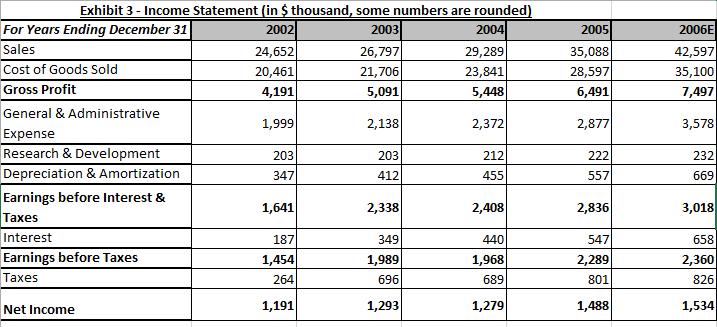

Analyze the key profitability ratios and identify the reason for the change in them by answering the following questions., Keep in mind the following assumptions

Analyze the key profitability ratios and identify the reason for the change in them by answering the following questions.,

Keep in mind the following assumptions for solving this question:

The key profitability ratios are Variable Margin (as a % of sales), Operating Margin, Return on Equity and Return on Average Capital Employed.

Assume that there is no change in the capital employed during the year 2002 so that the capital employed at the beginning of the year is the same as that during the ending of the year.

The gross profit is also known as the variable margin./

Question 4A: Calculate the key profitability ratios for the years 2002 to 2006(E). (8 marks, 2 for each key ratio)please answer in the excel sheet containing with all the workings and formulas used for this question.

Question 4B: What is the trend in ROE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in ROE by assessing the drivers of ROE and explain your answer.

Question 4C: What is the trend in ROACE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in ROACE by assessing the drivers of ROACE and Explain your answer.

Keep in mind the following assumptions for solving this question:

The key profitability ratios are Variable Margin (as a % of sales), Operating Margin, Return on Equity and Return on Average Capital Employed.

Assume that there is no change in the capital employed during the year 2002 so that the capital employed at the beginning of the year is the same as that during the ending of the year.

The gross profit is also known as the variable margin./

Question 4A: Calculate the key profitability ratios for the years 2002 to 2006(E). (8 marks, 2 for each key ratio)please answer in the excel sheet containing with all the workings and formulas used for this question.

Question 4B: What is the trend in ROE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in ROE by assessing the drivers of ROE and explain your answer.

Question 4C: What is the trend in ROACE from 2002 to 2006(E)? List down at least one reason for the increase/decrease in ROACE by assessing the drivers of ROACE and Explain your answer.

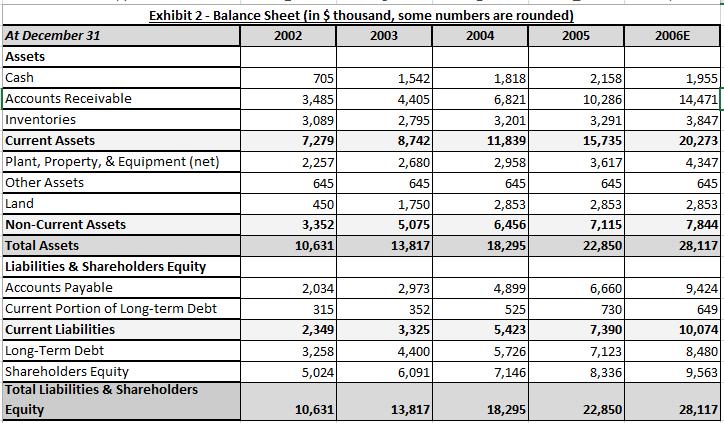

At December 31 Assets Cash Accounts Receivable Inventories Exhibit 2- Balance Sheet (in $ thousand, some numbers are rounded) 2002 2003 2004 Current Assets Plant, Property, & Equipment (net) Other Assets Land Non-Current Assets Total Assets Liabilities & Shareholders Equity Accounts Payable Current Portion of Long-term Debt Current Liabilities Long-Term Debt Shareholders Equity Total Liabilities & Shareholders Equity 705 3,485 3,089 7,279 2,257 645 450 3,352 10,631 2,034 315 2,349 3,258 5,024 10,631 1,542 4,405 2,795 8,742 2,680 645 1,750 5,075 13,817 2,973 352 3,325 4,400 6,091 13,817 1,818 6,821 3,201 11,839 2,958 645 2,853 6,456 18,295 4,899 525 5,423 5,726 7,146 18,295 2005 2,158 10,286 3,291 15,735 3,617 645 2,853 7,115 22,850 6,660 730 7,390 7,123 8,336 22,850 2006E 1,955 14,471 3,847 20,273 4,347 645 2,853 7,844 28,117 9,424 649 10,074 8,480 9,563 28,117

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Question 4A Calculation of Key Profitability Ratios Variable Margin Operating Margin ROE ROACE Varia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started