Answered step by step

Verified Expert Solution

Question

1 Approved Answer

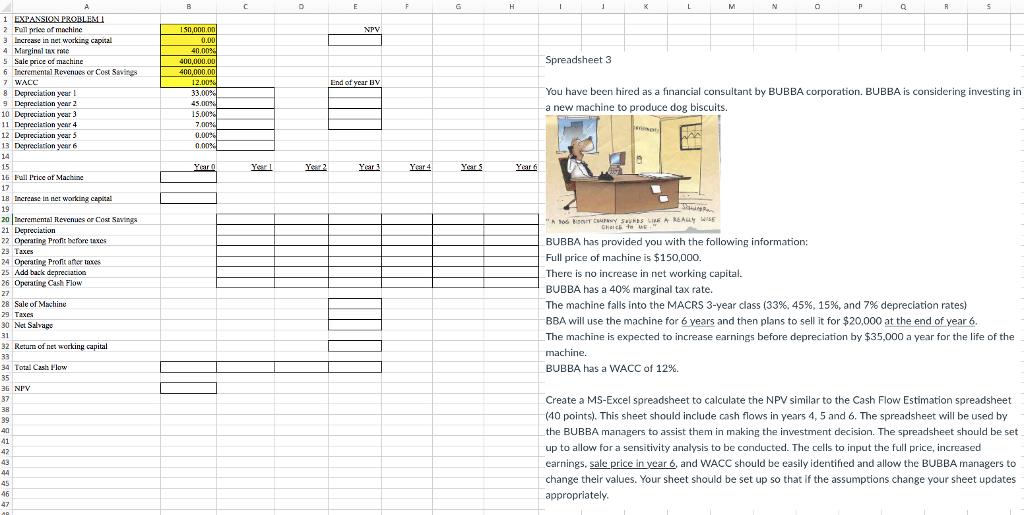

1 EXPANSION PROBLEM I 2 Full price of machine 3 Increase in networking capital 4 Marginal tax re 5 Sale price of machine 6

1 EXPANSION PROBLEM I 2 Full price of machine 3 Increase in networking capital 4 Marginal tax re 5 Sale price of machine 6 Incremental Revenues or Cost Savings 7 WACC 8 Depreciation year 1 9 Depreciation year 2 10 10 Depreciation year 3 11 Depreciation year 4 12 Depreciation year 5 13 Depreclation year 6 14 15 16 Full Price of Machine 17 18 Increase in net working capital 19 20 Incremental Revenues or Cost Savings 21 Depreciation 22 Operating Profit before taxes 23 Taxes 24 Operating Profit after taxes 25 Add back depreciation 26 Operating Cash Flow 27 28 Sale of Machine 29 Taxes 30 Net Salvage 31 32 Return of net working capital 33 34 Total Cash Flow 25 35 36 NPV 37 38 39 40 41 42 43 44 45 46 47 B 150,000.00 0.00 40,00 % 400,000.00 400,000,00 12.00% 33.00% 45.00% 15.00 % 7.00% 0.00% 0,00% Year 0 C Year 1 D Year 2 E NPV End of year BV Year 3 F Year 4 G Year 5 H Year 6 I J Spreadsheet 3 X L Not M B MITSHUNDRA "AS05 BIT COMPANY SOUNDS LIKE A REALLY WISE Chich to " N 0 P Q R You have been hired as a financial consultant by BUBBA corporation. BUBBA is considering investing in a new machine to produce dog biscuits. S BUBBA has provided you with the following information: Full price of machine is $150,000. There is no increase in net working capital. BUBBA has a 40% marginal tax rate. The machine falls into the MACRS 3-year class (33 %, 45%, 15%, and 7% depreciation rates) BBA will use the machine for 6 years and then plans to sell it for $20,000 at the end of year 6. The machine is expected to increase earnings before depreciation by $35,000 a year for the life of the machine. BUBBA has a WACC of 12%. Create a MS-Excel spreadsheet to calculate the NPV similar to the Cash Flow Estimation spreadsheet (40 points). This sheet should include cash flows in years 4, 5 and 6. The spreadsheet will be used by the BUBBA managers to assist them in making the investment decision. The spreadsheet should be set up to allow for a sensitivity analysis to be conducted. The cells to input the full price, increased earnings, sale price in year 6, and WACC should be easily identified and allow the BUBBA managers to change their values. Your sheet should be set up so that if the assumptions change your sheet updates. appropriately.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started