Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the performance of Heineken from 2010 to 2015 using ratio analysis. Is Heinekens strategy (business, corporate, international) working? - CASE 16) | HEINEKINI Matens

Analyze the performance of Heineken from 2010 to 2015 using ratio analysis. Is Heinekens strategy (business, corporate, international) working?

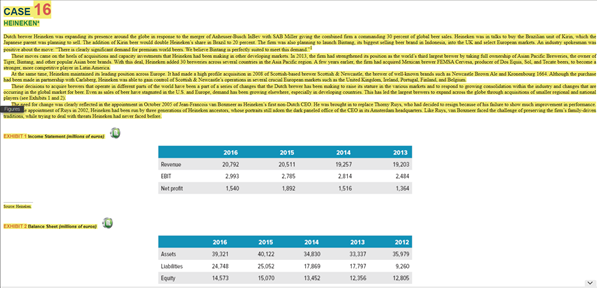

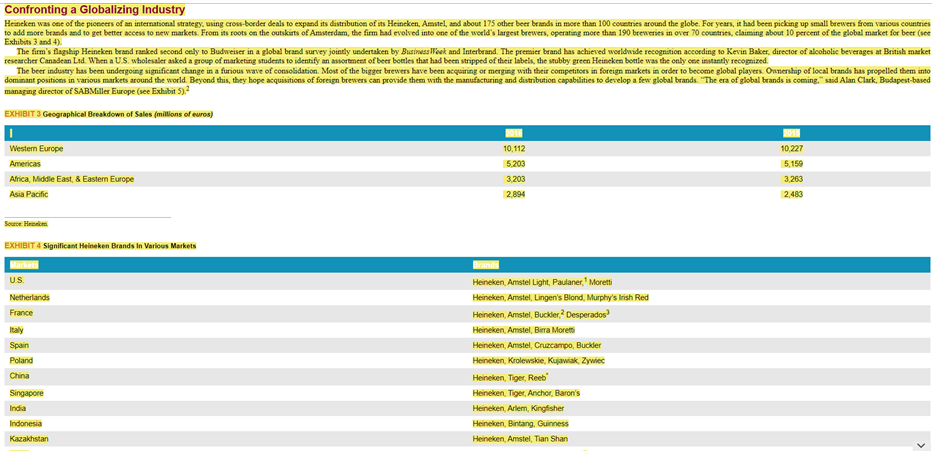

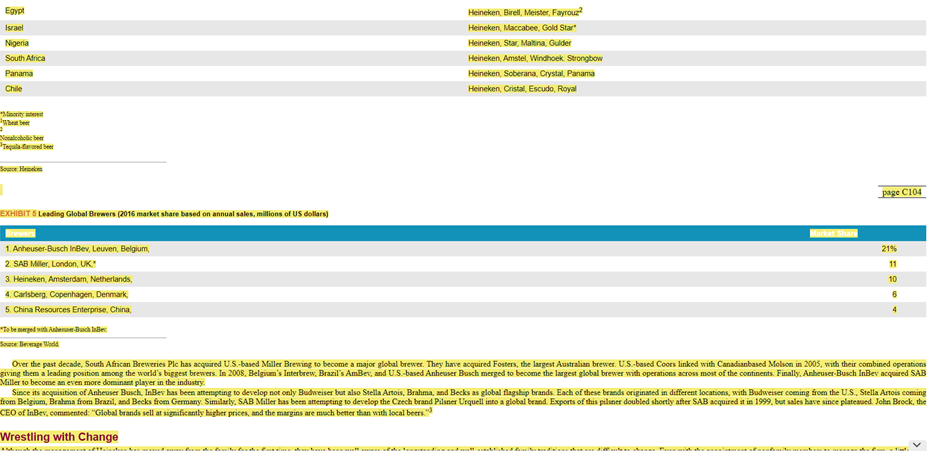

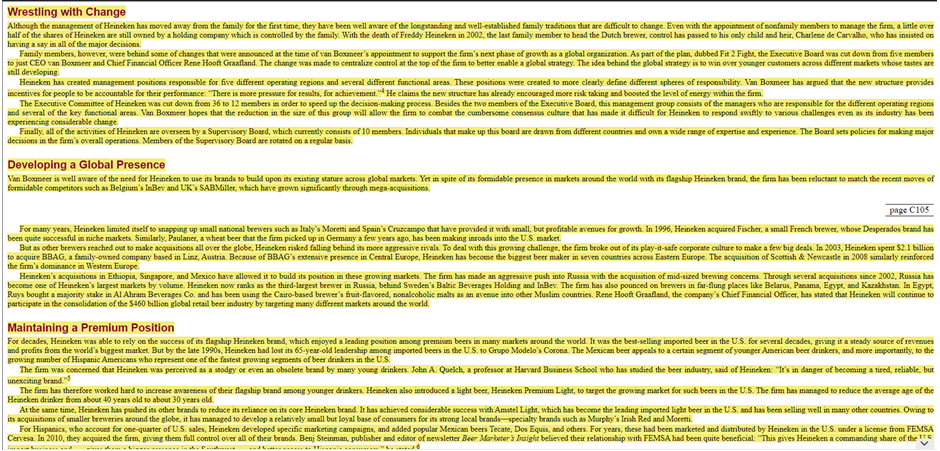

- CASE 16) | HEINEKINI Matens Heacha - he past fans Healamaana Ppaaka theri tala 30 can tr tamil her tristian LKaliar palan - - 2011, at a Tige. Bengan berpopuler Asia berada dalam led 30 bere alcohe Air Polepo. A few years wie fehlendence ENSAC, producer of Design, sol, med en bom, to become "tn pa amona tape 1 prote an orama tamil thaana sernamithananaaaa aaa enais there is a trantheans 1 nee pain bar , , . 2005 Maamalai ECO Mahahah - 2002 Tharisals 2014 2015 20,792 2.991) 2015 20,511 2013 19,200 | 4) 516 an 2015 1.131) 214 | 2015 40,122 | 2014 34.00 17. 2013 11.17 | 2012 K. 1N7| 12 15070 Confronting a Globalizing Industry Heineken was one of the pioneers of an international strategy, using cross-border deals to expand its distribution of its Heineken, Amstel, and about 175 other beer brands in more than 100 countries around the globe. For years, it had been picking up small brewers from various countries to add more brands and to get better access to new markets. From its roots on the outskirts of Amsterdam, the firm had evolved into one of the world's largest brewers, operating more than 190 breweries in over 70 countries, claiming about 10 percent of the global market for beer (see Exhibits 3 and 4). The firm's flagship Heineken brand ranked second only to Budweiser in a global brand survey jointly undertaken by Business Week and Interbrand. The premier brand has achieved worldwide recognition according to Kevin Baker, director of alcoholic beverages at British market researcher Canadean Lid. When a US wholesaler asked a group of marketing students to identify an assortment of beer boules that had been stripped of their labels, the stubby green Heineken bottle was the only one instantly recognized The beer industry has been undergoing significant change in a furious wave of consolidation. Most of the bigger brewers have been acquiring or merging with their competitors in foreign markets in order to become global players. Onership of local brands has propelled them into dominant positions in various markets around the world. Beyond this, they hope acquisitions of foreign brewers can provide them with the manufacturing and distribution capabilities to develop a few global brands, "The era of global brands is coming." saad Alan Clark, Budapest-based managing director of SABMiller Europe (see Exhibit) EXHIBIT 3 Geographical Breakdown of Sales (milions of euros) 10,112 5.203 Western Europe Americas Africa, Middle East & Eastern Europe Asia Pacific 10,227 5,159 3.263 3.203 2894 2.483 Source EXHIBIT 4 Significant Heineken Brands In Various Markets Market US Netherlands France Italy Spain Poland China Singapore India Indonesia Kazakhstan Heineken, Amstel Light, Paulaner, Moretti Heineken, Amstel, Lingen's Blond, Murphy's Irish Red Heineken, Amstel, Buckler, Desperados Heineken, Amstel, Birra Moretti Heineken, Amstel, Cruzcampo, Buckler Heineken, Krolewskie, Kujawiak Zywiec Heineken, Tiger Reeb Heineken Tiger Anchor, Baron's Heineken, Arlem, Kingfisher Heineken, Bintang, Guinness Heineken, Amstel, Tian Shan Egypt Israel Nigeria South Africa Heineken, Birell, Meister Fayrouz? Heineken, Maccabee, Gold Star Heineken Star, Maltina, Gulder Heineken, Amstel Windhoek Strongbow Heineken, Soberana, Crystal Panama Heineken Cristal, Escudo, Royal Panama Chile Tequil.Geceber page C104 EXHIBIT 6 Leading Global Brewers (2016 market share based on annual sales, millions of US dollars) Market Share 21% 11 10 1. Anheuser-Busch InBev, Leuven, Belgium 2. SABMiller, London, UK 3. Heineken, Amsterdam, Netherlands, 4. Carlsberg, Copenhagen, Denmark 5. China Resources Enterprise, China, *To be merece 6 4 Orier the past decade, South African Breweries Plc has acquired U.S.-based Miller Brening to become a major global brewer. They have acquired Fosters, the largest Australian brewer. U.S.-based Coors linked with Canadianbased Molson in 2005, with their combined operations giving them a leading position among the world's biggest brewers. In 2008. Belgium's Interbrew. Brazil's AmBex, and U.S.-based Anheuser Busch merged to become the largest global brewer with operations across most of the continents. Finally, Anheuser Busch InBev acquired SAB Miller to become an even more dominant player in the industry Since its acquisition of Anheuser Busch. InBev has been attempting to develop not only Budweiser but also Stella Artois, Brahma, and Becks as global flagship brands. Each of these brands originated in different locations, with Budweiser coming from the U.S. Stella Artois coming from Belgium, Brahma from Brazil, and Becks from Germany. Similarly, SAB Miller has been attempting to develop the Czech brand Pilsner Urquell into a global brand. Exports of this pilsner doubled shortly after SAB acquired it in 1999, but sales have since platened. John Brock, the CEO of InBev.commented: "Global brands sell at significantly higher prices, and the margins are much better than with local beers." Wrestling with Change Wrestling with Change Although the management of Heineken has moved away from the family for the first time, they have been well aware of the longstanding and well-established family traditions that are difficult to change. Even with the appointment of nonfamily members to manage the firm, alimle over half of the shares of Heineken are still owned by a holding company which is controlled by the family. With the death of Freddy Heineken in 2002, the last family member to head the Dutch brewer, control has passed to his only child and heir, Charlene de Carvalho, who has insisted on having a say in all of the major decisions Family members, however, were behind some of changes that were announced at the time of van Boxmeer's appointment to support the firm's next phase of growth as a global organization. As part of the plan, dubbed Fit 2 Fight, the Executive Board was cut down from five members to just CEO van Boxmeer and Chief Financial Officer Rene Hooft Graafland. The change was made to centralize control at the top of the firm to better enable a global strategy. The idea behind the global strategy is to win over younger customers across different markets whose tastes are still developing Heineken has created management positions responsible for five different operating regions and several different functional areas. These positions were created to more clearly define different spheres of responsibility. Van Boxmeer has argued that the new structure provides incentives for people to be accountable for their performance: "There is more pressure for results, for achievement. He claims the new structure has already encouraged more risk taking and boosted the level of energy within the firm. The Executive Committee of Heineken was cut down from 36 to 12 members in order to speed up the decision-making process. Besides the two members of the Executive Board, this management group consists of the managers who are responsible for the different operating regions and several of the key functional areas. Van Boxmeer hopes that the reduction in the size of this group will allow the firm to combat the cumbersome consensus culture that has made it difficult for Heineken to respond swiftly to various challenges even as its industry has been experiencing considerable change Finally, all of the activities of Heineken are overseen by a Supervisory Board, which currently consists of 10 members. Individuals that make up this board are drawn from different countries and own a wide range of expertise and experience. The Board sets policies for making major decisions in the firm's overall operations. Members of the Supervisory Board are rotated on a regular basis. Developing a Global Presence Van Boxmeer as well aware of the need for Heineken to use its brands to build upon its existing stature across global markets. Yet in spite of its formidable presence in markets around the world with its flagship Heineken brand, the firm has been reluctant to match the recent moves of formidable competitors such as Belgium's InBev and UK'S SABMiller, which have grown significantly through mega-acquisitions page CIOS For many years. Heineken limited itself to snapping up small national brewers such as Italy's Moretti and Spain's Cruzcampo that have provided it with small, but profitable arvenues for growth In 1996, Heineken acquired Fischer, a small French brewer, whose Desperados brand has been quite successful in niche markets. Similarly, Paulaner, a wheat beer that the firm picked up in Germany a few years ago, has been making inroads into the U.S. market But as other brewers reached out to make acquisitions all over the globe, Heineken risked falling behind its more aggressive mvals. To deal with this growing challenge, the firm broke out of its play-it-safe corporate culture to make a few big deals. In 2003, Heineken spent $2.1 billion to acquire BBAG, a family-owned company based in Linz, Austria. Because of BBAG's extensive presence in Central Europe. Heineken has become the biggest beer maker in seven countries across Eastern Europe. The acquisition of Scottish & Newcastle in 2008 similarly reinforced the firm's dominance in Western Europe. Heineken's acquisitions in Ethiopia, Singapore, and Mexico have allowed it to build its position in these growing markets. The firm has made an aggressive push into Russia with the acquisition of mid-sized brewing concerns. Through several acquisitions since 2002, Russia has become one of Heineken's largest markets by volume. Heineken now ranks as the third-largest brewer in Russia, behind Sweden's Baltic Beverages Holding and InBes. The firm has also pounced on brewers in far-flung places like Belarus, Panama, Egypt, and Kazakhstan. In Egypt Ruys bought a majority stake in Al Ahram Beverages Co. and has been using the Cairo-based brewer's fruit-flavored, nonalcoholic malts as an avenue into other Muslim countries. Rene Hooft Graafland, the company's Chief Financial Officer, has stated that Heineken will continue to participate in the consolidation of the $460 billion global retail beer industry by targeting many different markets around the world. Maintaining a Premium Position For decades, Heineken was able to rely on the success of its flagship Heineken brand, which enjoyed a leading position among premium beers in many markets around the world. It was the best-selling imported beer in the U.S.for several decades, giving it a steady source of revenues and profits from the world's biggest market. But by the late 1990s. Heineken had lost its 65-year-old leadership among imported beers in the U.S. to Grupo Modelo's Corona. The Mexican beer appeals to a certain segment of younger American beer drinkers, and more importantly, to the growing number of Hispanic Americans who represent one of the fastest growing segments of beer drinkers in the US The firm was concemed that Heineken was perceived as a stodgy or even an obsolete brand by many young drinkers. John A. Quelch, a professor at Harvard Business School who has stadied the beer industry, said of Heineken: "It's in danger of becoming a tired, reliable, but unexciting brands The firm has therefore worked hard to increase awareness of their flagship brand among younger drinkers. Heineken also introduced a light beer, Heineken Premium Light, to target the growing market for such beers in the U.S. The firm has managed to reduce the average age of the Heineken drinker from about 40 years old to about 30 years old At the same time, Heineken has pushed its other brands to reduce its reliance on its core Heineken brand. It has achieved considerable success with Amstel Light, which has become the leading imported light beer in the US and has been selling well in many other countries. Owing to its acquisitions of smaller breweries around the globe, it has managed to develop a relatively small but loyal base of consumers for its strong local brandsspecialty brands such as Murphy's Irish Red and Moretti For Hispanics, who account for one-quarter of US sales, Heineken developed specific marketing campaigns, and added popular Mexican beers Tecate. Dos Eques, and others. For years, these had been marketed and distributed by Heineken in the U.S. under a license from FEMSA Cervesa. In 2010, they acquired the firm, giving them full control over all of their brands. Benj Steinman, publisher and editor of newsletter Beer Marketers besight believed their relationship with FEMSA had been quite beneficial: "This gives Heineken a commanding share of the page C105 For many years. Heineken limited itself to snapping up small national brewers such as Italy's Moretti and Spain's Cruzcampo that have provided it with small, but profitable avenues for growth In 1996, Heineken acquired Fischer, a small French brewer, whose Desperados brand has been quite successful in niche markets. Similarly, Paulaner, a wheat beer that the firm picked up in Germany a few years ago, has been making inroads into the U.S. market But as other brewers reached out to make acquisitions all over the globe, Heineken risked falling behind its more aggressive rivals. To deal with this growing challenge, the firm broke out of its play-it-safe corporate culture to make a few big deals. In 2003. Heineken spent $2.1 billion to acquire BBAG, a family-owned company based in Linz, Austria. Because of BBAG's extensive presence in Central Europe, Heineken has become the biggest beer maker in seven countries across Eastern Europe. The acquisition of Scottish & Newcastle in 2008 similarly reinforced the firm's dominance in Western Europe Heineken's acquisitions in Ethiopia, Singapore, and Mexico have allowed it to build its position in these growing markets. The firm has made an aggressive push into Russia with the acquisition of mid-sized brewing concerns. Through several acquisitions since 2002, Russia has become one of Heineken's largest markets by volume. Heineken now ranks as the third-largest brewer in Russia, behind Sweden's Baltic Beverages Holding and InBev. The firm has also pounced on brewers in far-flung places like Belarus, Panama, Egypt, and Kazakhstan. In Egypt Ruys bought a majority stake in Al Ahram Beverages Co. and has been using the Cairo-based brewer's fruit-flavored, nonalcoholic malts as an avenue into other Muslim countries. Rene Hooft Graafland, the company's Chief Financial Officer, has stated that Heineken will continue to participate in the consolidation of the $460 billion global retail beer industry by targeting many different markets around the world Maintaining a Premium Position For decades. Heineken was able to rely on the success of its flagship Heineken brand, which enjoyed a leading position among premium beers in many markets around the world. It was the best-selling imported beer in the U.S. for several decades, prving it a steady source of revenues and profits from the world's biggest market. But by the late 1990s, Heineken had lost its 65-year-old leadership among imported beers in the U.S. 1o Grupo Modelo's Corona The Mexican beer appeals to a certain segment of younger American beer drinkers, and more importantly, to the growing number of Hispanic Americans who represent one of the fastest growing segments of beer drinkers in the US The firm was concerned that Heineken was perceived as a stodgy or even an obsolete brand by many young drinkers. John A. Quelch, a professor at Harvard Business School who has studied the beer industry, said of Heineken: "I's in danger of becoming a tired, reliable, but unexciting brand The firm has therefore worked hard to increase awareness of their flagship brand among younger drinkers. Heineken also introduced a light beer, Heineken Premium Light, to target the growing market for such beers in the U.S. The firm has managed to reduce the average age of the Heineken drinker from about 40 years old to about 30 years old. At the same time. Heineken has pushed its other brands to reduce its reliance on its core Heineken brand. It has achieved considerable success with Amstel Light, which has become the leading imported light beer in the US and has been selling well in many other countries. Owing to its acquisitions of smaller breweries around the globe, it has managed to develop a relatively small but loyal base of consumers for its strong local brandsspecialty brands such as Murphy's Inish Red and Moretti For Hispanics, who account for one-quarter of U.S. sales, Heineken developed specific marketing campaigns, and added popular Mexican beers Tecate, Dos Equis, and others. For years, these had been marketed and distributed by Heineken in the U.S. under a license from FEMSA Cervesa. In 2010, they acquired the firm, gising them full control over all of their brands. Benj Steinman, publisher and editor of newsletter Beer Marketers Busigle believed their relationship with FEMSA had been quite beneficial: "This gives Heineken a commanding share of the U.S. import business and ... gives them a bigger presence in the Southwest ... and better access to Hispanic consumers," he stated. Above all, Heineken wants to maintain its leadership in the premium beer industry, which represents the most profitable segment of the beer business. In this category, the firm's brands face competition in the US from domestic beers such as Anheuser's Budweiser Select and imported beers such as InBev's Stella Artois. Premium brews often have slightly higher alcohol content than standard beers, and they are developed through a more exclusive positioning of the brand. This allows a firm to charge a higher price for their premium brands. The flagship Heineken brand remains positioned as a premium beer. A six-pack of Heineken, for example, costs $9. versus around S6 for a six-pack of Budweiser. Just-drinks.com, a London-based online research service, estimates that the market for premium beer will continue to expand over the next decade Building on Its Past The acquisitions in different parts of the world-Asia, Africa, Latin America and Europe-represent an important step in Heineken's quest to build on its global stature. Most analysts expect that van Boxmeer and his team will continue to build Heineken into a powerful global competitor. Without providing any specific details, Graafland, the firm's CFO, makes it clear that the firm's management will take initiatives to drive long-term growth. In his words: "We are positive that the momentum in the company and trends will continue. page C106 Since taking over the helm at Heineken, van Boxmeer has committed himself to accelerating the speed of decision making. There has been some expectation both inside and outside the firm that the new management would try to break loose from the conservative style of the family Instead, the affable 46-year-old Belgian has indicated that he is trying to streamline the firm's decision-making process rather than to make any drastic shifts in the company's existing culture Van Boxmeer's devotion to the firm is evident. Heineken's first non-Dutch CEO spent 20 years working his way up within the firm. He sports cufflinks that are silver miniatures of a Heineken bottle top and opener. "We are in the logical flow of history," he explained. "Every time you have a new leader you have a new kind of vision. It is not radically different, because you are defined by what your company is and what your brands are Furthermore, van Boxmeer seems comfortable working within the family-controlled structure "Since 1952 Hustory has proved it is the right concept," he stated about the current ownership structure. "The whole business about family restraint on us is absolutely untrue. Without its spirit and guidance, the company would not have been able to build a world leader - CASE 16) | HEINEKINI Matens Heacha - he past fans Healamaana Ppaaka theri tala 30 can tr tamil her tristian LKaliar palan - - 2011, at a Tige. Bengan berpopuler Asia berada dalam led 30 bere alcohe Air Polepo. A few years wie fehlendence ENSAC, producer of Design, sol, med en bom, to become "tn pa amona tape 1 prote an orama tamil thaana sernamithananaaaa aaa enais there is a trantheans 1 nee pain bar , , . 2005 Maamalai ECO Mahahah - 2002 Tharisals 2014 2015 20,792 2.991) 2015 20,511 2013 19,200 | 4) 516 an 2015 1.131) 214 | 2015 40,122 | 2014 34.00 17. 2013 11.17 | 2012 K. 1N7| 12 15070 Confronting a Globalizing Industry Heineken was one of the pioneers of an international strategy, using cross-border deals to expand its distribution of its Heineken, Amstel, and about 175 other beer brands in more than 100 countries around the globe. For years, it had been picking up small brewers from various countries to add more brands and to get better access to new markets. From its roots on the outskirts of Amsterdam, the firm had evolved into one of the world's largest brewers, operating more than 190 breweries in over 70 countries, claiming about 10 percent of the global market for beer (see Exhibits 3 and 4). The firm's flagship Heineken brand ranked second only to Budweiser in a global brand survey jointly undertaken by Business Week and Interbrand. The premier brand has achieved worldwide recognition according to Kevin Baker, director of alcoholic beverages at British market researcher Canadean Lid. When a US wholesaler asked a group of marketing students to identify an assortment of beer boules that had been stripped of their labels, the stubby green Heineken bottle was the only one instantly recognized The beer industry has been undergoing significant change in a furious wave of consolidation. Most of the bigger brewers have been acquiring or merging with their competitors in foreign markets in order to become global players. Onership of local brands has propelled them into dominant positions in various markets around the world. Beyond this, they hope acquisitions of foreign brewers can provide them with the manufacturing and distribution capabilities to develop a few global brands, "The era of global brands is coming." saad Alan Clark, Budapest-based managing director of SABMiller Europe (see Exhibit) EXHIBIT 3 Geographical Breakdown of Sales (milions of euros) 10,112 5.203 Western Europe Americas Africa, Middle East & Eastern Europe Asia Pacific 10,227 5,159 3.263 3.203 2894 2.483 Source EXHIBIT 4 Significant Heineken Brands In Various Markets Market US Netherlands France Italy Spain Poland China Singapore India Indonesia Kazakhstan Heineken, Amstel Light, Paulaner, Moretti Heineken, Amstel, Lingen's Blond, Murphy's Irish Red Heineken, Amstel, Buckler, Desperados Heineken, Amstel, Birra Moretti Heineken, Amstel, Cruzcampo, Buckler Heineken, Krolewskie, Kujawiak Zywiec Heineken, Tiger Reeb Heineken Tiger Anchor, Baron's Heineken, Arlem, Kingfisher Heineken, Bintang, Guinness Heineken, Amstel, Tian Shan Egypt Israel Nigeria South Africa Heineken, Birell, Meister Fayrouz? Heineken, Maccabee, Gold Star Heineken Star, Maltina, Gulder Heineken, Amstel Windhoek Strongbow Heineken, Soberana, Crystal Panama Heineken Cristal, Escudo, Royal Panama Chile Tequil.Geceber page C104 EXHIBIT 6 Leading Global Brewers (2016 market share based on annual sales, millions of US dollars) Market Share 21% 11 10 1. Anheuser-Busch InBev, Leuven, Belgium 2. SABMiller, London, UK 3. Heineken, Amsterdam, Netherlands, 4. Carlsberg, Copenhagen, Denmark 5. China Resources Enterprise, China, *To be merece 6 4 Orier the past decade, South African Breweries Plc has acquired U.S.-based Miller Brening to become a major global brewer. They have acquired Fosters, the largest Australian brewer. U.S.-based Coors linked with Canadianbased Molson in 2005, with their combined operations giving them a leading position among the world's biggest brewers. In 2008. Belgium's Interbrew. Brazil's AmBex, and U.S.-based Anheuser Busch merged to become the largest global brewer with operations across most of the continents. Finally, Anheuser Busch InBev acquired SAB Miller to become an even more dominant player in the industry Since its acquisition of Anheuser Busch. InBev has been attempting to develop not only Budweiser but also Stella Artois, Brahma, and Becks as global flagship brands. Each of these brands originated in different locations, with Budweiser coming from the U.S. Stella Artois coming from Belgium, Brahma from Brazil, and Becks from Germany. Similarly, SAB Miller has been attempting to develop the Czech brand Pilsner Urquell into a global brand. Exports of this pilsner doubled shortly after SAB acquired it in 1999, but sales have since platened. John Brock, the CEO of InBev.commented: "Global brands sell at significantly higher prices, and the margins are much better than with local beers." Wrestling with Change Wrestling with Change Although the management of Heineken has moved away from the family for the first time, they have been well aware of the longstanding and well-established family traditions that are difficult to change. Even with the appointment of nonfamily members to manage the firm, alimle over half of the shares of Heineken are still owned by a holding company which is controlled by the family. With the death of Freddy Heineken in 2002, the last family member to head the Dutch brewer, control has passed to his only child and heir, Charlene de Carvalho, who has insisted on having a say in all of the major decisions Family members, however, were behind some of changes that were announced at the time of van Boxmeer's appointment to support the firm's next phase of growth as a global organization. As part of the plan, dubbed Fit 2 Fight, the Executive Board was cut down from five members to just CEO van Boxmeer and Chief Financial Officer Rene Hooft Graafland. The change was made to centralize control at the top of the firm to better enable a global strategy. The idea behind the global strategy is to win over younger customers across different markets whose tastes are still developing Heineken has created management positions responsible for five different operating regions and several different functional areas. These positions were created to more clearly define different spheres of responsibility. Van Boxmeer has argued that the new structure provides incentives for people to be accountable for their performance: "There is more pressure for results, for achievement. He claims the new structure has already encouraged more risk taking and boosted the level of energy within the firm. The Executive Committee of Heineken was cut down from 36 to 12 members in order to speed up the decision-making process. Besides the two members of the Executive Board, this management group consists of the managers who are responsible for the different operating regions and several of the key functional areas. Van Boxmeer hopes that the reduction in the size of this group will allow the firm to combat the cumbersome consensus culture that has made it difficult for Heineken to respond swiftly to various challenges even as its industry has been experiencing considerable change Finally, all of the activities of Heineken are overseen by a Supervisory Board, which currently consists of 10 members. Individuals that make up this board are drawn from different countries and own a wide range of expertise and experience. The Board sets policies for making major decisions in the firm's overall operations. Members of the Supervisory Board are rotated on a regular basis. Developing a Global Presence Van Boxmeer as well aware of the need for Heineken to use its brands to build upon its existing stature across global markets. Yet in spite of its formidable presence in markets around the world with its flagship Heineken brand, the firm has been reluctant to match the recent moves of formidable competitors such as Belgium's InBev and UK'S SABMiller, which have grown significantly through mega-acquisitions page CIOS For many years. Heineken limited itself to snapping up small national brewers such as Italy's Moretti and Spain's Cruzcampo that have provided it with small, but profitable arvenues for growth In 1996, Heineken acquired Fischer, a small French brewer, whose Desperados brand has been quite successful in niche markets. Similarly, Paulaner, a wheat beer that the firm picked up in Germany a few years ago, has been making inroads into the U.S. market But as other brewers reached out to make acquisitions all over the globe, Heineken risked falling behind its more aggressive mvals. To deal with this growing challenge, the firm broke out of its play-it-safe corporate culture to make a few big deals. In 2003, Heineken spent $2.1 billion to acquire BBAG, a family-owned company based in Linz, Austria. Because of BBAG's extensive presence in Central Europe. Heineken has become the biggest beer maker in seven countries across Eastern Europe. The acquisition of Scottish & Newcastle in 2008 similarly reinforced the firm's dominance in Western Europe. Heineken's acquisitions in Ethiopia, Singapore, and Mexico have allowed it to build its position in these growing markets. The firm has made an aggressive push into Russia with the acquisition of mid-sized brewing concerns. Through several acquisitions since 2002, Russia has become one of Heineken's largest markets by volume. Heineken now ranks as the third-largest brewer in Russia, behind Sweden's Baltic Beverages Holding and InBes. The firm has also pounced on brewers in far-flung places like Belarus, Panama, Egypt, and Kazakhstan. In Egypt Ruys bought a majority stake in Al Ahram Beverages Co. and has been using the Cairo-based brewer's fruit-flavored, nonalcoholic malts as an avenue into other Muslim countries. Rene Hooft Graafland, the company's Chief Financial Officer, has stated that Heineken will continue to participate in the consolidation of the $460 billion global retail beer industry by targeting many different markets around the world. Maintaining a Premium Position For decades, Heineken was able to rely on the success of its flagship Heineken brand, which enjoyed a leading position among premium beers in many markets around the world. It was the best-selling imported beer in the U.S.for several decades, giving it a steady source of revenues and profits from the world's biggest market. But by the late 1990s. Heineken had lost its 65-year-old leadership among imported beers in the U.S. to Grupo Modelo's Corona. The Mexican beer appeals to a certain segment of younger American beer drinkers, and more importantly, to the growing number of Hispanic Americans who represent one of the fastest growing segments of beer drinkers in the US The firm was concemed that Heineken was perceived as a stodgy or even an obsolete brand by many young drinkers. John A. Quelch, a professor at Harvard Business School who has stadied the beer industry, said of Heineken: "It's in danger of becoming a tired, reliable, but unexciting brands The firm has therefore worked hard to increase awareness of their flagship brand among younger drinkers. Heineken also introduced a light beer, Heineken Premium Light, to target the growing market for such beers in the U.S. The firm has managed to reduce the average age of the Heineken drinker from about 40 years old to about 30 years old At the same time, Heineken has pushed its other brands to reduce its reliance on its core Heineken brand. It has achieved considerable success with Amstel Light, which has become the leading imported light beer in the US and has been selling well in many other countries. Owing to its acquisitions of smaller breweries around the globe, it has managed to develop a relatively small but loyal base of consumers for its strong local brandsspecialty brands such as Murphy's Irish Red and Moretti For Hispanics, who account for one-quarter of US sales, Heineken developed specific marketing campaigns, and added popular Mexican beers Tecate. Dos Eques, and others. For years, these had been marketed and distributed by Heineken in the U.S. under a license from FEMSA Cervesa. In 2010, they acquired the firm, giving them full control over all of their brands. Benj Steinman, publisher and editor of newsletter Beer Marketers besight believed their relationship with FEMSA had been quite beneficial: "This gives Heineken a commanding share of the page C105 For many years. Heineken limited itself to snapping up small national brewers such as Italy's Moretti and Spain's Cruzcampo that have provided it with small, but profitable avenues for growth In 1996, Heineken acquired Fischer, a small French brewer, whose Desperados brand has been quite successful in niche markets. Similarly, Paulaner, a wheat beer that the firm picked up in Germany a few years ago, has been making inroads into the U.S. market But as other brewers reached out to make acquisitions all over the globe, Heineken risked falling behind its more aggressive rivals. To deal with this growing challenge, the firm broke out of its play-it-safe corporate culture to make a few big deals. In 2003. Heineken spent $2.1 billion to acquire BBAG, a family-owned company based in Linz, Austria. Because of BBAG's extensive presence in Central Europe, Heineken has become the biggest beer maker in seven countries across Eastern Europe. The acquisition of Scottish & Newcastle in 2008 similarly reinforced the firm's dominance in Western Europe Heineken's acquisitions in Ethiopia, Singapore, and Mexico have allowed it to build its position in these growing markets. The firm has made an aggressive push into Russia with the acquisition of mid-sized brewing concerns. Through several acquisitions since 2002, Russia has become one of Heineken's largest markets by volume. Heineken now ranks as the third-largest brewer in Russia, behind Sweden's Baltic Beverages Holding and InBev. The firm has also pounced on brewers in far-flung places like Belarus, Panama, Egypt, and Kazakhstan. In Egypt Ruys bought a majority stake in Al Ahram Beverages Co. and has been using the Cairo-based brewer's fruit-flavored, nonalcoholic malts as an avenue into other Muslim countries. Rene Hooft Graafland, the company's Chief Financial Officer, has stated that Heineken will continue to participate in the consolidation of the $460 billion global retail beer industry by targeting many different markets around the world Maintaining a Premium Position For decades. Heineken was able to rely on the success of its flagship Heineken brand, which enjoyed a leading position among premium beers in many markets around the world. It was the best-selling imported beer in the U.S. for several decades, prving it a steady source of revenues and profits from the world's biggest market. But by the late 1990s, Heineken had lost its 65-year-old leadership among imported beers in the U.S. 1o Grupo Modelo's Corona The Mexican beer appeals to a certain segment of younger American beer drinkers, and more importantly, to the growing number of Hispanic Americans who represent one of the fastest growing segments of beer drinkers in the US The firm was concerned that Heineken was perceived as a stodgy or even an obsolete brand by many young drinkers. John A. Quelch, a professor at Harvard Business School who has studied the beer industry, said of Heineken: "I's in danger of becoming a tired, reliable, but unexciting brand The firm has therefore worked hard to increase awareness of their flagship brand among younger drinkers. Heineken also introduced a light beer, Heineken Premium Light, to target the growing market for such beers in the U.S. The firm has managed to reduce the average age of the Heineken drinker from about 40 years old to about 30 years old. At the same time. Heineken has pushed its other brands to reduce its reliance on its core Heineken brand. It has achieved considerable success with Amstel Light, which has become the leading imported light beer in the US and has been selling well in many other countries. Owing to its acquisitions of smaller breweries around the globe, it has managed to develop a relatively small but loyal base of consumers for its strong local brandsspecialty brands such as Murphy's Inish Red and Moretti For Hispanics, who account for one-quarter of U.S. sales, Heineken developed specific marketing campaigns, and added popular Mexican beers Tecate, Dos Equis, and others. For years, these had been marketed and distributed by Heineken in the U.S. under a license from FEMSA Cervesa. In 2010, they acquired the firm, gising them full control over all of their brands. Benj Steinman, publisher and editor of newsletter Beer Marketers Busigle believed their relationship with FEMSA had been quite beneficial: "This gives Heineken a commanding share of the U.S. import business and ... gives them a bigger presence in the Southwest ... and better access to Hispanic consumers," he stated. Above all, Heineken wants to maintain its leadership in the premium beer industry, which represents the most profitable segment of the beer business. In this category, the firm's brands face competition in the US from domestic beers such as Anheuser's Budweiser Select and imported beers such as InBev's Stella Artois. Premium brews often have slightly higher alcohol content than standard beers, and they are developed through a more exclusive positioning of the brand. This allows a firm to charge a higher price for their premium brands. The flagship Heineken brand remains positioned as a premium beer. A six-pack of Heineken, for example, costs $9. versus around S6 for a six-pack of Budweiser. Just-drinks.com, a London-based online research service, estimates that the market for premium beer will continue to expand over the next decade Building on Its Past The acquisitions in different parts of the world-Asia, Africa, Latin America and Europe-represent an important step in Heineken's quest to build on its global stature. Most analysts expect that van Boxmeer and his team will continue to build Heineken into a powerful global competitor. Without providing any specific details, Graafland, the firm's CFO, makes it clear that the firm's management will take initiatives to drive long-term growth. In his words: "We are positive that the momentum in the company and trends will continue. page C106 Since taking over the helm at Heineken, van Boxmeer has committed himself to accelerating the speed of decision making. There has been some expectation both inside and outside the firm that the new management would try to break loose from the conservative style of the family Instead, the affable 46-year-old Belgian has indicated that he is trying to streamline the firm's decision-making process rather than to make any drastic shifts in the company's existing culture Van Boxmeer's devotion to the firm is evident. Heineken's first non-Dutch CEO spent 20 years working his way up within the firm. He sports cufflinks that are silver miniatures of a Heineken bottle top and opener. "We are in the logical flow of history," he explained. "Every time you have a new leader you have a new kind of vision. It is not radically different, because you are defined by what your company is and what your brands are Furthermore, van Boxmeer seems comfortable working within the family-controlled structure "Since 1952 Hustory has proved it is the right concept," he stated about the current ownership structure. "The whole business about family restraint on us is absolutely untrue. Without its spirit and guidance, the company would not have been able to build a world leaderStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started