Analyze the Procter & Gamble Company 2020 10-K

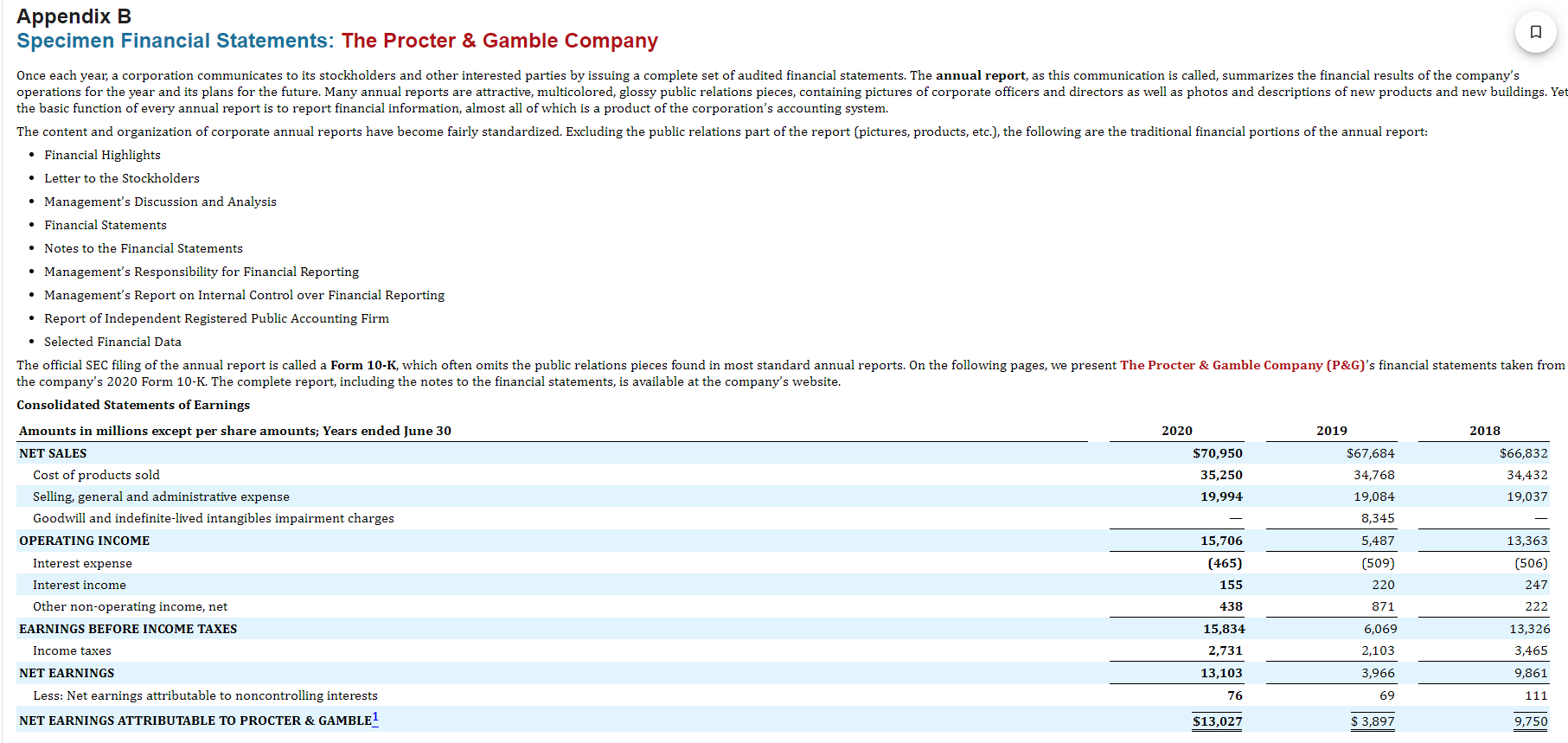

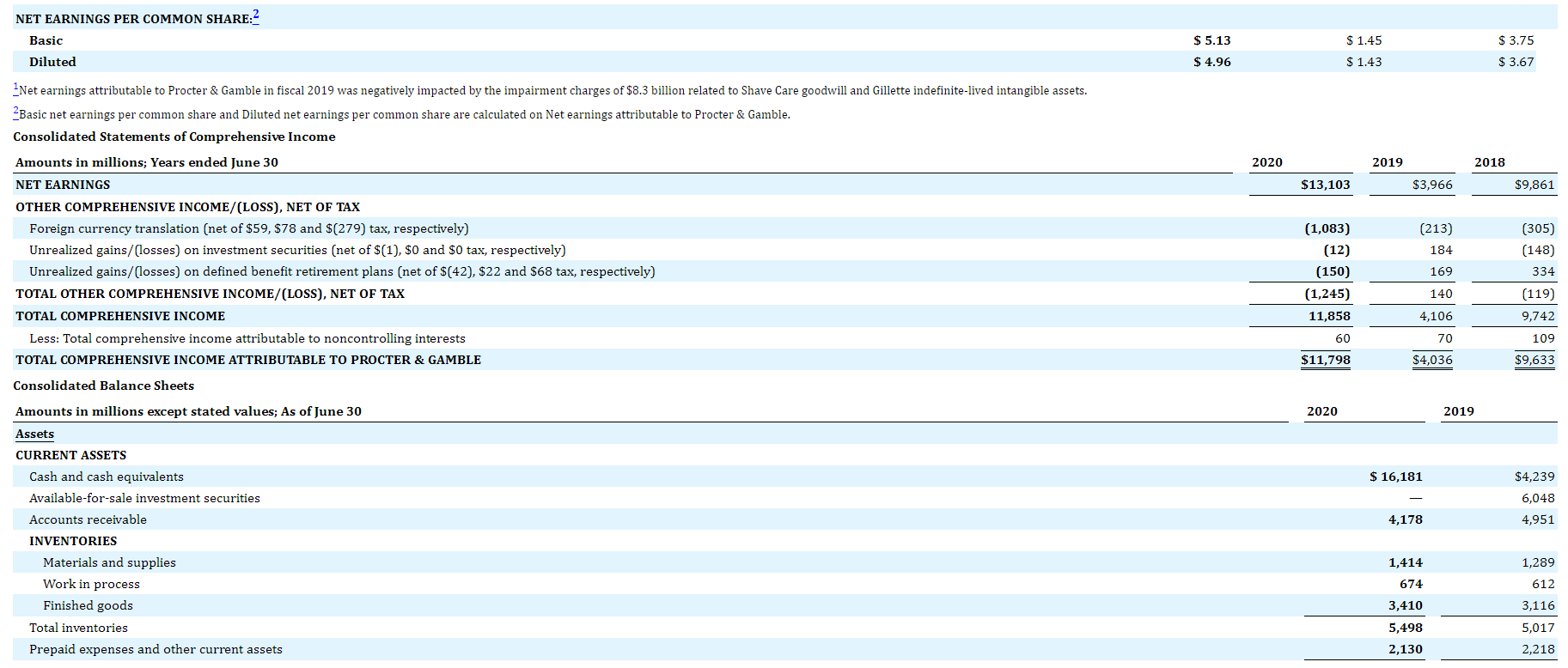

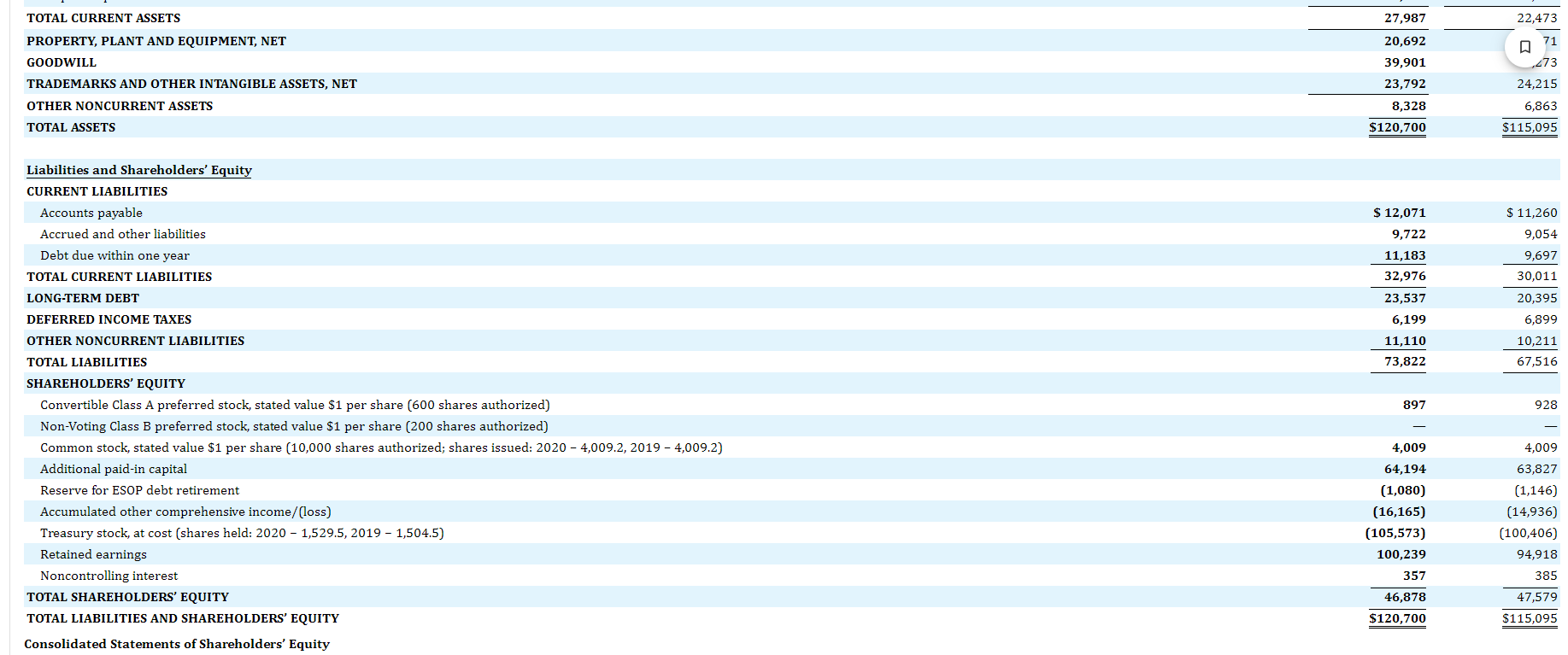

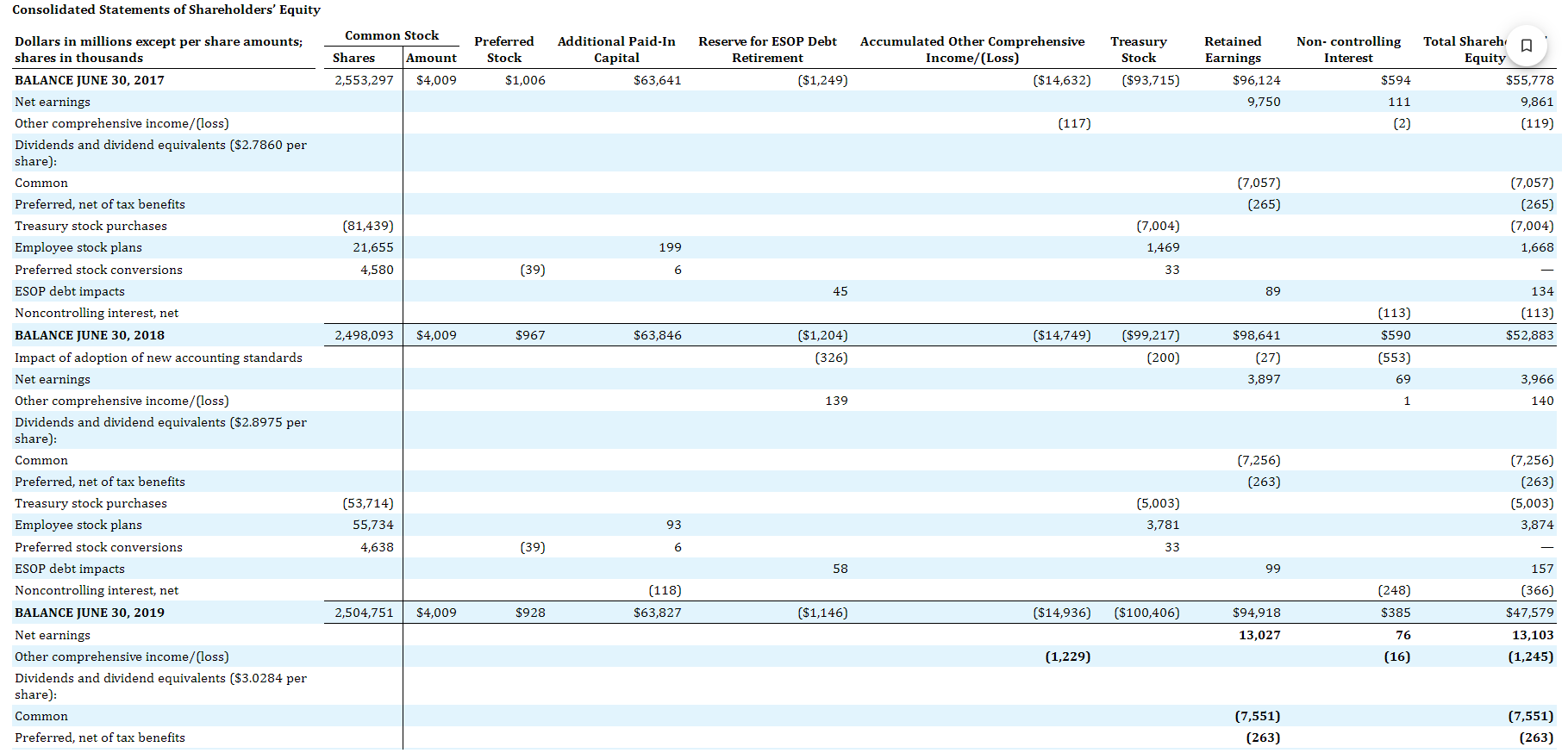

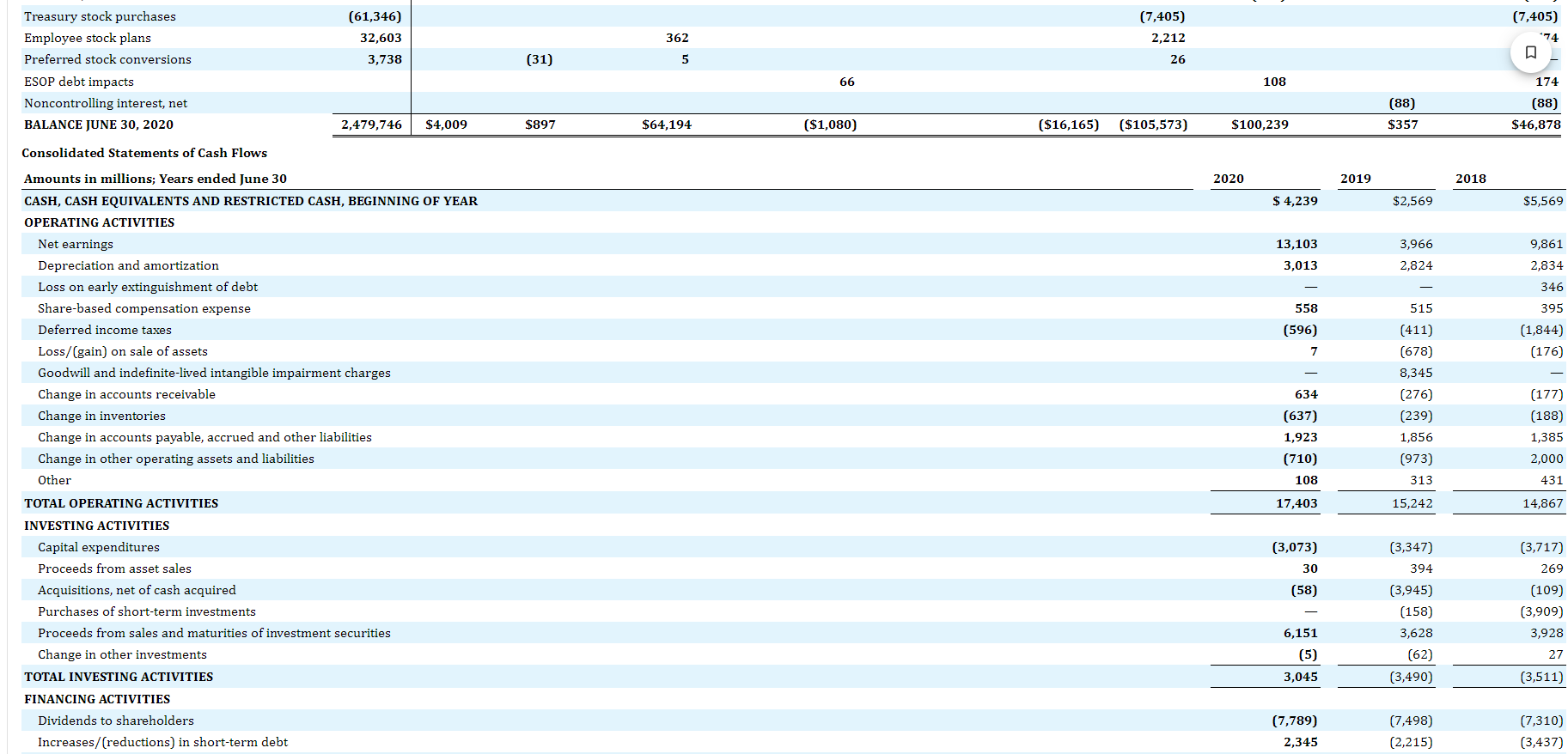

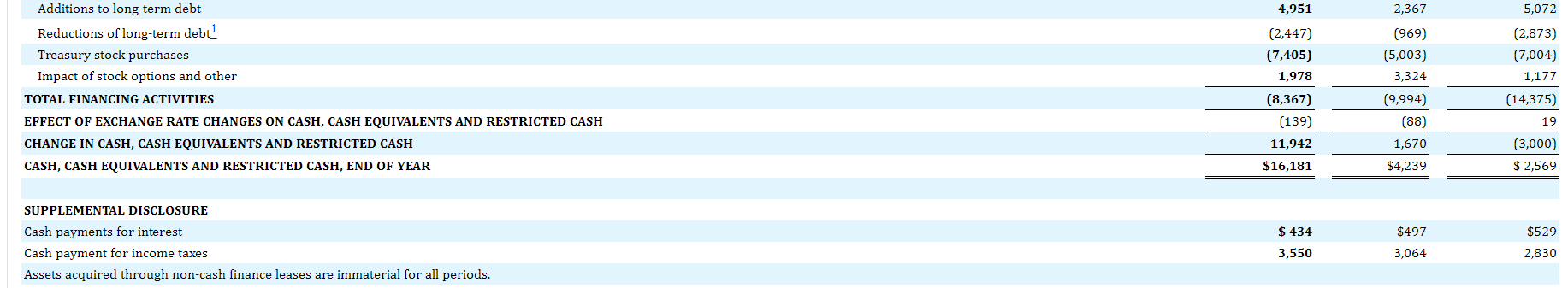

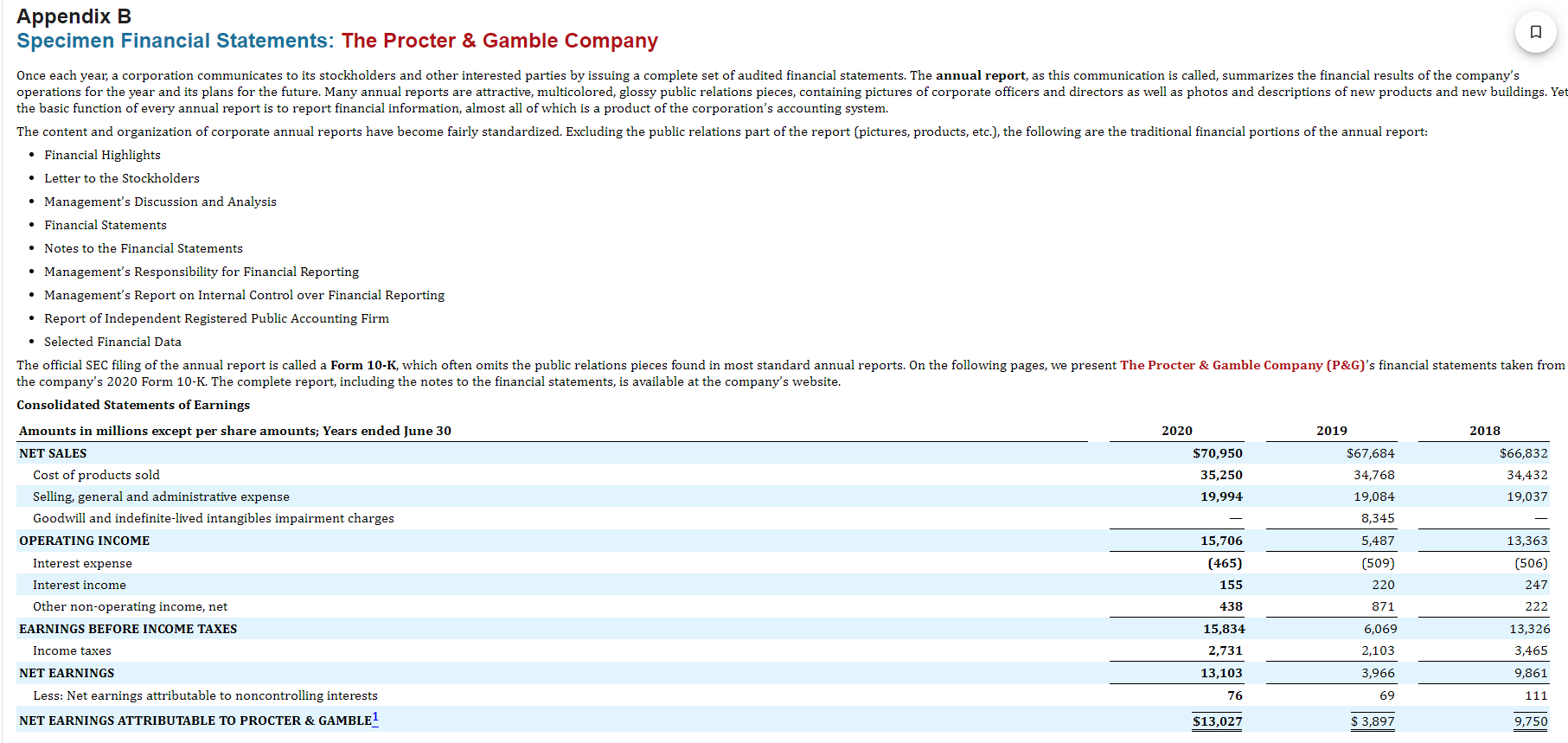

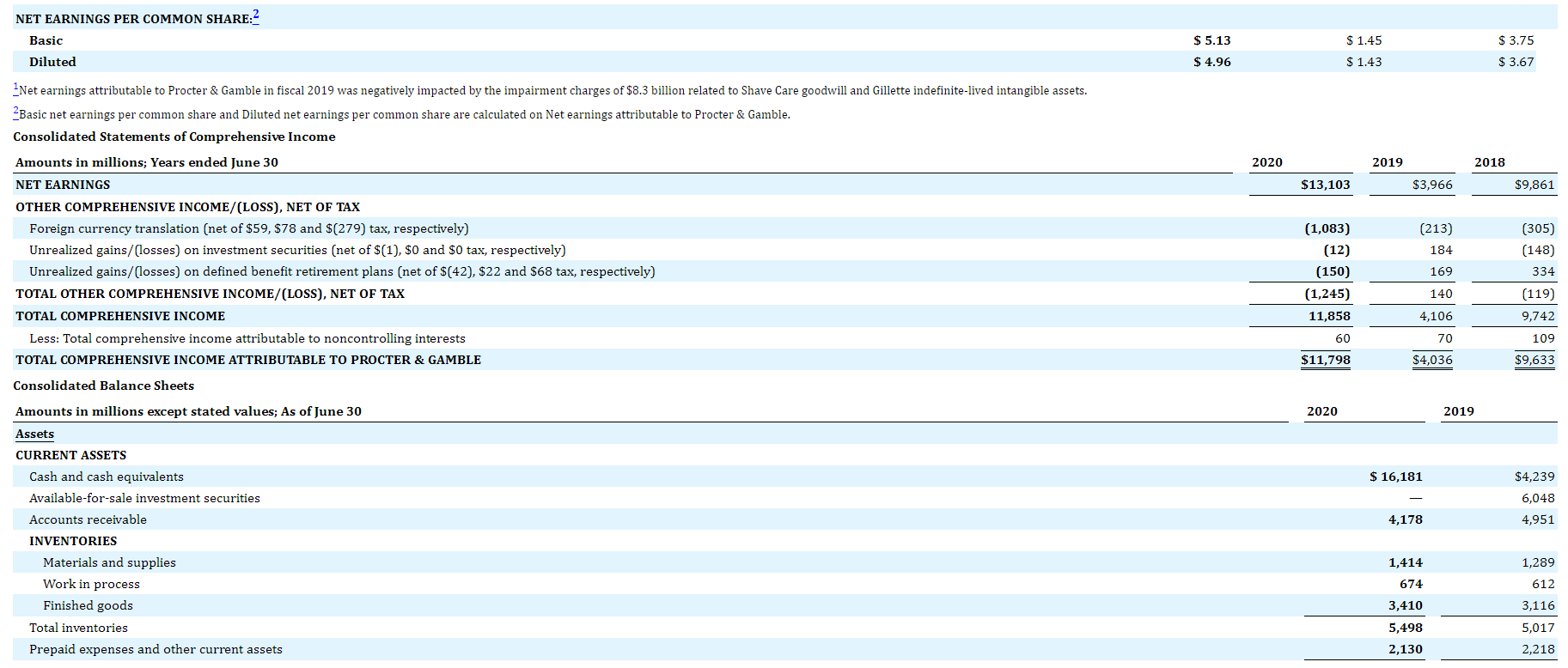

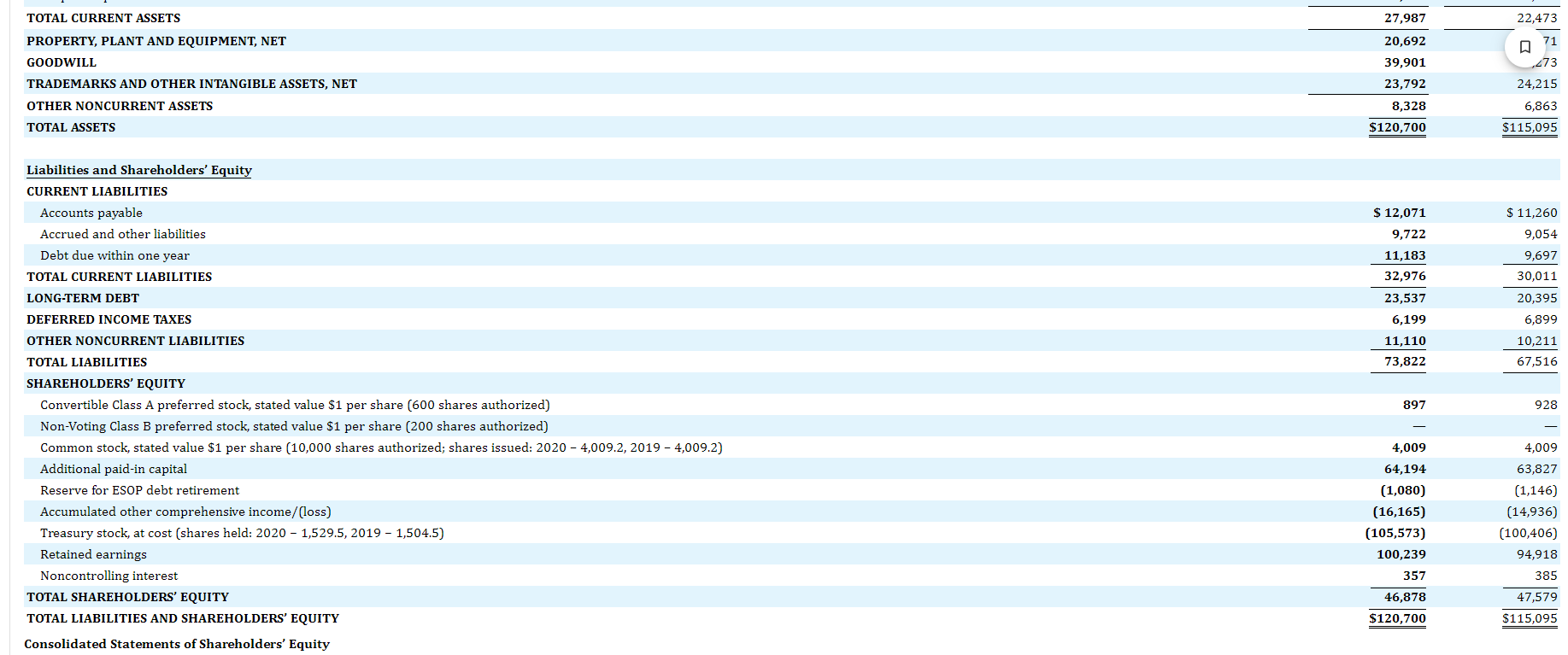

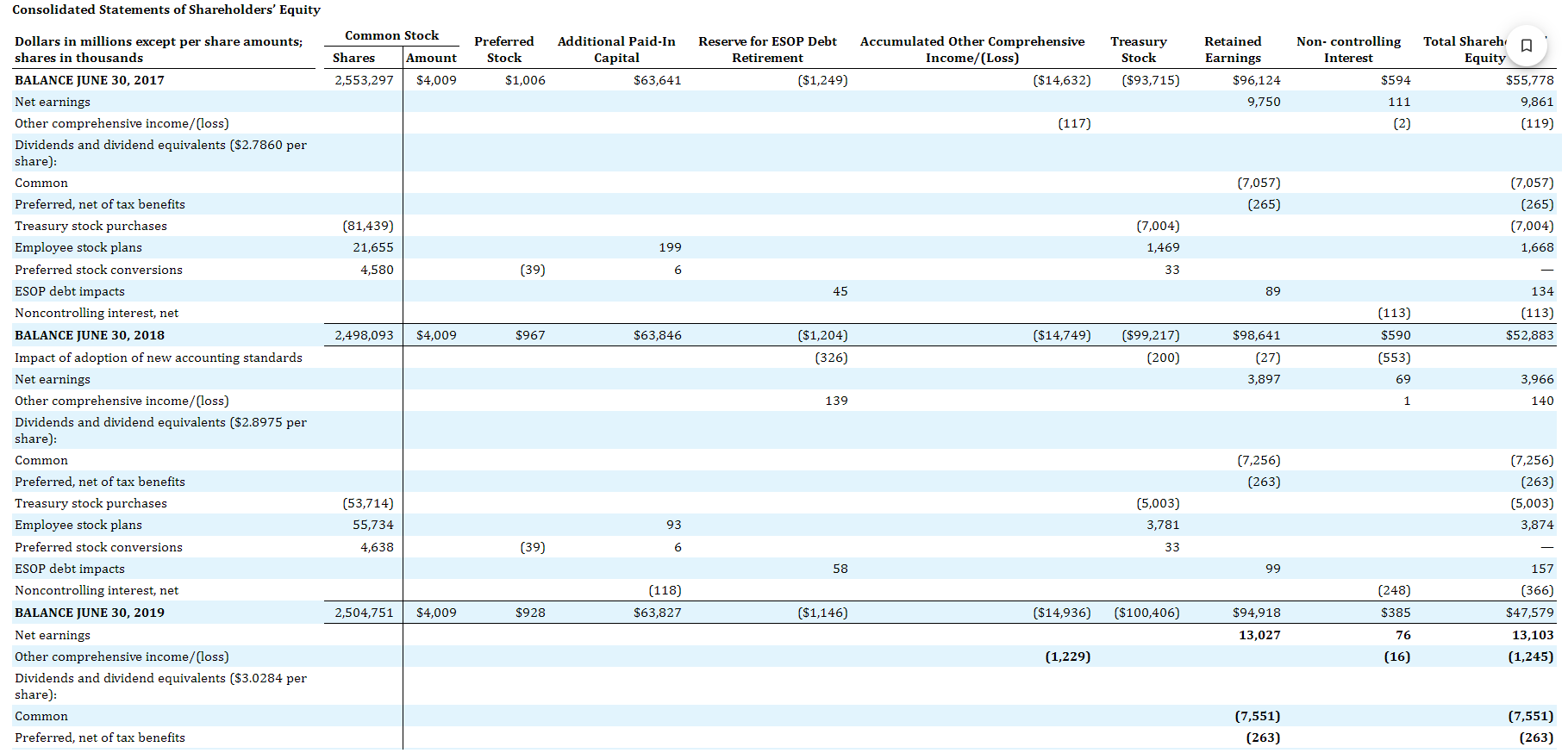

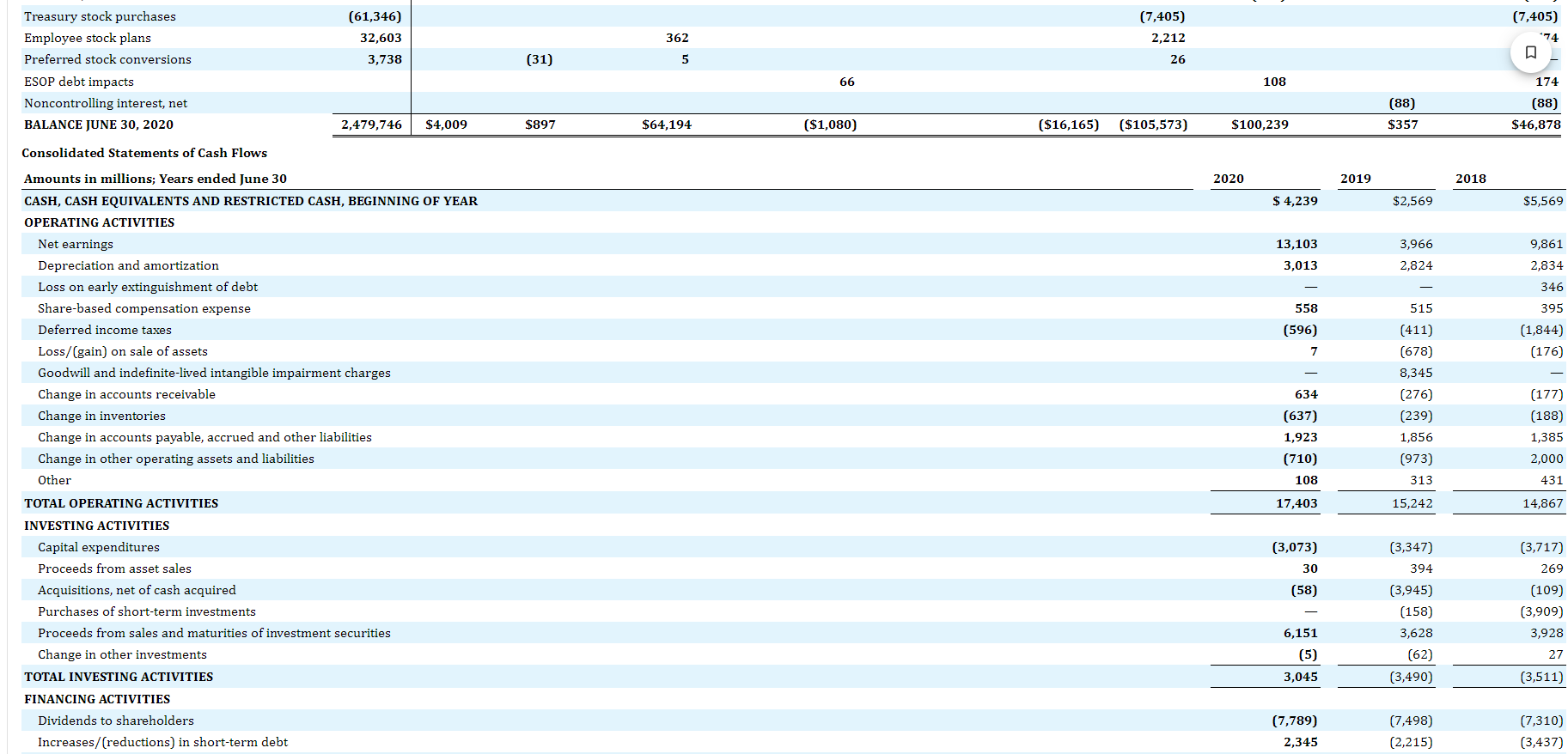

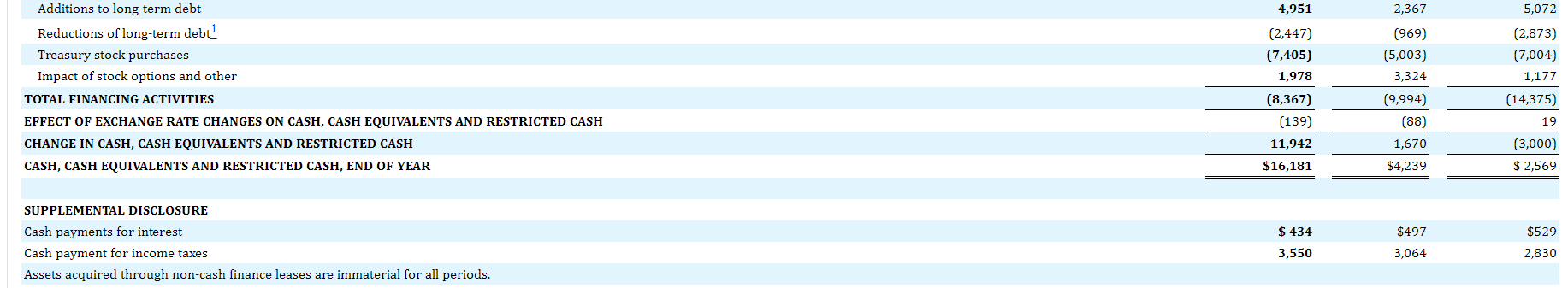

NET EARNINGS PER COMMON SHARE: 2 Basic Diluted $5.13 $1.45 $3.75 22 Basic net earnings per common share and Diluted net earnings per common share are calculated on Net earnings attributable to Procter \& Gamble. Consolidated Statements of Comprehensive Income Amounts in millions; Years ended June 30 NET EARNINGS OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX Foreign currency translation (net of $59,$78 and $(279 ) tax, respectively) Unrealized gains/(losses) on investment securities (net of $(1 ), $0 and $0 tax, respectively) Unrealized gains/(losses) on defined benefit retirement plans (net of \$(42), \$22 and \$68 tax, respectively) TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX TOTAL COMPREHENSIVE INCOME Less: Total comprehensive income attributable to noncontrolling interests TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO PROCTER \& GAMBLE Consolidated Balance Sheets Amounts in millions except stated values; As of June 30 2020 Assets CURRENT ASSETS Cash and cash equivalents Available-for-sale investment securities Accounts receivable INVENTORIES Materials and supplies Work in process Finished goods Total inventories Prepaid expenses and other current assets To answer the following questions, refer to P\&G's 2020 financial statements and the related information in the annual report. - What alternative formats could P&G have adopted for its balance sheet? Which format did it adopt? - Identify the various techniques of disclosure P\&G might have used to disclose additional pertinent financial information. Which technique does it use in its financials? - What was P\&G's cash flows from its operating, investing, and financing activities for 2020 ? What were its trends in net cash provided by operating activities over the period 2018 to 2020 ? Explain why the change in accounts payable and in accrued and other liabilities is added to net income to arrive at net cash provided by operating activities. Consolidated Statements of Shareholders' Equity Specimen Financial Statements: The Procter \& Gamble Company the basic function of every annual report is to report financial information, almost all of which is a product of the corporation's accounting system. - Financial Highlights - Letter to the Stockholders - Management's Discussion and Analysis - Financial Statements - Notes to the Financial Statements - Management's Responsibility for Financial Reporting - Management's Report on Internal Control over Financial Reporting - Report of Independent Registered Public Accounting Firm - Selected Financial Data Additions to long-term debt Reductions of long-term debt_ 1 Treasury stock purchases Impact of stock options and other TOTAL FINANCING ACTIVITIES EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS AND RESTRICTED CASH CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR SUPPLEMENTAL DISCLOSURE Cash payments for interest Cash payment for income taxes TOTAL CURRENT ASSETS PROPERTY, PLANT AND EQUIPMENT, NET GOODWILL TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET OTHER NONCURRENT ASSETS TOTAL ASSETS Liabilities and Shareholders' Equity CURRENT LIABILITIES Accounts payable Accrued and other liabilities Debt due within one year TOTAL CURRENT LIABILITIES LONG-TERM DEBT DEFERRED INCOME TAXES OTHER NONCURRENT LIABILITIES TOTAL LIABILITIES SHAREHOLDERS' EQUITY Convertible Class A preferred stock, stated value $1 per share (600 shares authorized) Non-Voting Class B preferred stock, stated value $1 per share (200 shares authorized) Common stock, stated value $1 per share (10,000 shares authorized; shares issued: 20204,009.2,20194,009.2) Additional paid-in capital Reserve for ESOP debt retirement Accumulated other comprehensive income/(loss) Treasury stock, at cost (shares held: 2020 - 1,529.5, 2019 - 1,504.5) Retained earnings Noncontrolling interest TOTAL SHAREHOLDERS' EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY Consolidated Statements of Shareholders' Equity