Answered step by step

Verified Expert Solution

Question

1 Approved Answer

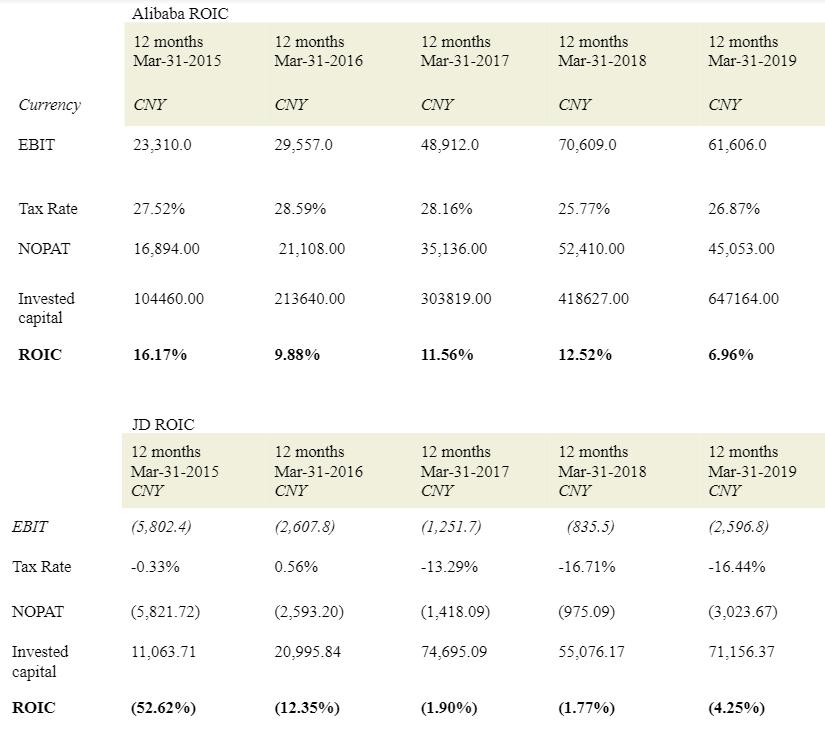

Analyze the ROIC of both firms over the five-year period. Currency EBIT Tax Rate NOPAT Invested capital ROIC EBIT Tax Rate NOPAT Invested capital ROIC

Analyze the ROIC of both firms over the five-year period.

Currency EBIT Tax Rate NOPAT Invested capital ROIC EBIT Tax Rate NOPAT Invested capital ROIC Alibaba ROIC 12 months Mar-31-2015 CNY 23,310.0 27.52% 16,894.00 104460.00 16.17% JD ROIC 12 months Mar-31-2015 CNY (5,802.4) -0.33% (5,821.72) 11,063.71 (52.62%) 12 months Mar-31-2016 CNY 29,557.0 28.59% 21,108.00 213640.00 9.88% 12 months Mar-31-2016 CNY (2,607.8) 0.56% (2,593.20) 20,995.84 (12.35%) 12 months Mar-31-2017 CNY 48,912.0 28.16% 35,136.00 303819.00 11.56% 12 months Mar-31-2017 CNY (1,251.7) -13.29% (1,418.09) 74,695.09 (1.90%) 12 months Mar-31-2018 CNY 70,609.0 25.77% 52,410.00 418627.00 12.52% 12 months Mar-31-2018 CNY (835.5) -16.71% (975.09) 55,076.17 (1.77%) 12 months Mar-31-2019 CNY 61,606.0 26.87% 45,053.00 647164.00 6.96% 12 months Mar-31-2019 CNY (2,596.8) -16.44% (3,023.67) 71,156.37 (4.25%)

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the ROIC of both firms over the fiveyear period we need to calculate the ROIC for each ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started