Analyze these financial statements qualitatively, state the benefits of the financial performance of the company, the negative aspects of its status, and how to reform it

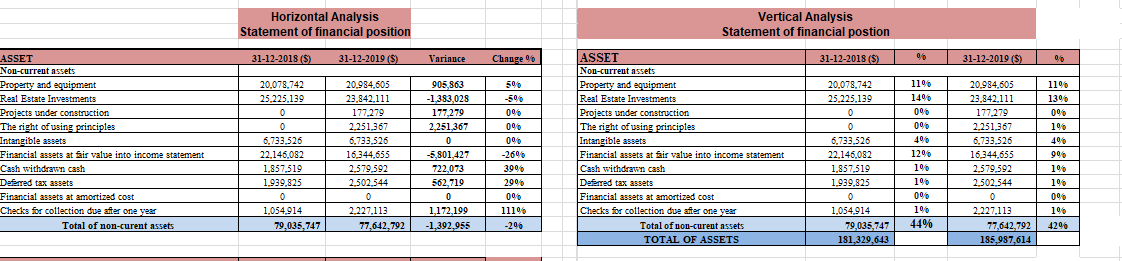

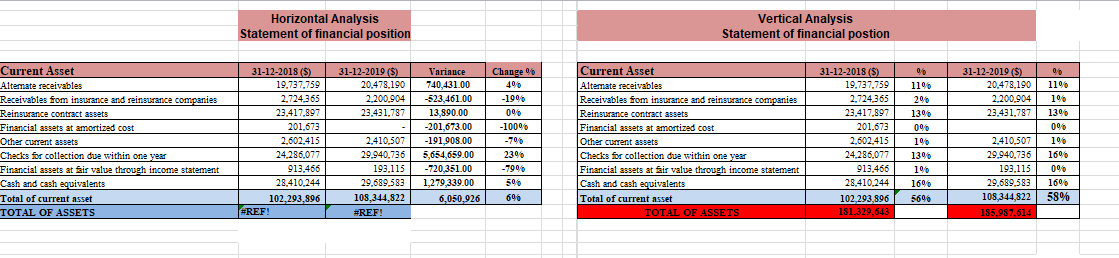

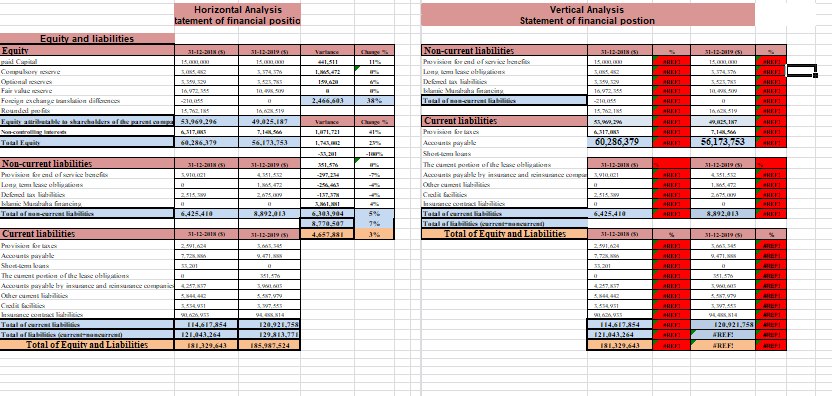

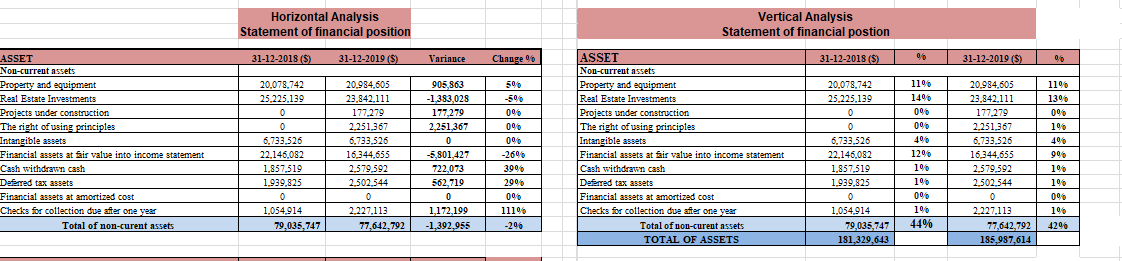

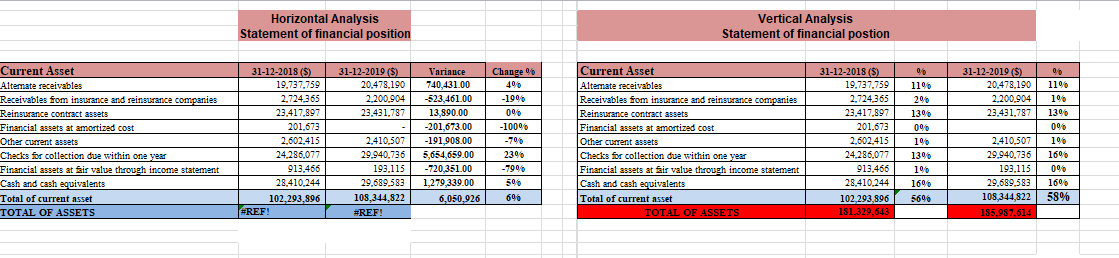

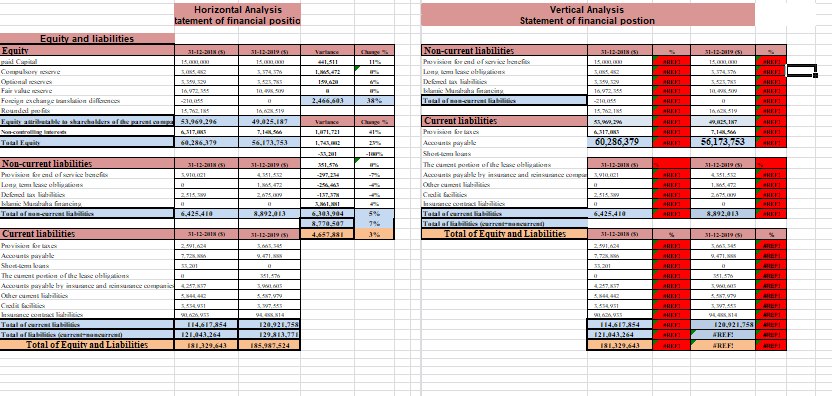

Horizontal Analysis Statement of financial position Vertical Analysis Statement of financial postion 31-12-2018 ($) 31-12-2019 ($) Variance Change 06 31-12-2018 (5) 06 31-12-2019 ($) 00 1196 1306 096 106 ASSET Nou-current assets Property and equipment Real Estate Investments Projects under construction The right of using principles Intangible assets Financial assets at fair valve into income statement Cash withdrawn cash Deferred tax assets Financial assets at amortized cost Checks for collection due after one year Total of non-curent assets 20,078,742 25,225,139 0 0 6,733,526 22,146,082 1.857,519 1,939,825 20.984.605 23,842,111 177279 2.251.367 6.733.526 16.344,655 2,579,592 2.502.544 0 2.227.113 77,642,792 905,863 -1,383,028 177,279 2,251,367 0 5,801,427 722,073 562,719 0 1,172,199 -1,392,955 096 00 09 -2696 3906 2900 06 000 11106 -296 ASSET Nou-current assets Property and equipment Real Estate Investments Projects under construction The right of using principles Intangible assets Financial assets at Sir valve into income statement Cash withdrawn cash Deferred tax assets Financial assets at amortized cost Checks for collection due after one year Total of non-curent assets TOTAL OF ASSETS 20.078.742 25,225,139 0 0 6.733.526 22,146,082 1.857,519 1,939,825 0 1,054,914 79,035, 747 181.329,643 1106 14% 096 09 496 12% 106 106 09 106 44% 20.984.605 23.842,111 177.279 2.251.367 6,733.326 16,344,655 2.579.592 2.502.544 0 2.227.113 77,642,792 185.987,614 906 196 106 006 106 1,054.914 79,035,747 4296 Horizontal Analysis Statement of financial position Vertical Analysis Statement of financial postion 31-12-2019 ($) 20.478.190 2,200,904 23.431.787 31-12-2019 (5) 20,478,190 2,200,904 23,431,787 Current Asset Alternate receivables Receivables from insurance and reinsurance companies Reinsurance contract assets Financial assets at amortized cost Other current assets Checks for collection due within one year Financial assets at fair value through income statement Cash and cash equivalents Total of current asset TOTAL OF ASSETS 31-12-2018 ($) 19,737,759 2.724,365 23.417.897 201,673 2.602.415 24,286,077 913.466 28.410.244 102.293,896 REF: Variance 740.431.00 -523.461.00 13,890.00 -201,673.00 -191 908.00 5,654,659.00 -720,351.00 1,279,339.00 6,050,926 Change 96 496 -1996 096 -100% -70% 2300 -7906 500 696 2,410,507 29.940.736 193,115 29.689.383 108,344.822 #REF! Current Asset Alternate receivables Receivables from insurance and reinsurance companies Reinsurance contract assets Financial assets at amortized cost Other current assets Checks for collection due within one year Financial assets at Sir value through income statement Cash and cash equivalents Total of current asset TOTAL OF ASSETS 31-12-2018 ($) 19.737.759 2.724.365 23.417.897 201,673 2,602.415 24.286.077 913.466 28.410.244 102,293,896 181,329,643 06 1196 206 1396 096 106 1306 106 160 2.410.507 29.940.736 193.115 29,689,583 108,344,822 185,987,614 110 106 1306 000 106 16% 006 169 58% 5696 Horizontal Analysis tatement of financial positio Vertical Analysis Statement of financial postion SI5 SI- INS ISININ Nou-current liabilities Procon orond of science Lancome olan Decals SI-12-2015 1.III 4.SI e Equity and liabilities Equity ISININ Compbyxor Optionale Fake TA F exhares arein Haari Roundai 13.71121 Feuih atributable to sharchades of this part 53.969.296 controles Total Equity 60,286,379 REF REF! RE! REF: REF: REF TIL 16.25 10.30 2.466.603 REF REF: 10.519 49,025.17 13.IN 5. 1,2,319 INT REF: 1.471,721 1.72 56.173.753 60,286,379 REF 56,173,753 REF! Current liabilities Proverb Accounts payake Short-licom os The cum potion of the love obite Anurts paryasrely iraamTLE Other Com Ca SI-12-2015 CM SI-12-INS 31-12-31195 SI-12-BIN SVIII VICI REF: Non-current linbilities Procon Bord of science lony male obligations Decimaler i Bhai: Midai Tatalanul 1. W REF: REF 351 - 11 REF: AN 6.425,410 8.892.000 6,425,410 REF: 8.892.01 REF: 6.10.1994 8,770,507 4.651.881 795 Tatal al curricabili Tatlarla Total of Equity and Liabilities 31-12-2015 SI-12-30 LIEF! HEFI 7.73 WRI Current liabilities Pro BB Accounts paye Sholm The comportion of the lene olan Anure: parpattle isy insurance are insurare 581.575 REF ELIS TVN WS SSLC SIEWS LES 114.617.854 121.04.3.264 Tatalar bila Tatalar bilan Total of Equity and Liabilities 120,921,758 129 13.30 185,981,524 114.617,854 121.04.1.164 181,329,643 REF: REF: REF 120.921,758 AREF: REF REF REFI LFI REF 181,129. Horizontal Analysis Statement of financial position Vertical Analysis Statement of financial postion 31-12-2018 ($) 31-12-2019 ($) Variance Change 06 31-12-2018 (5) 06 31-12-2019 ($) 00 1196 1306 096 106 ASSET Nou-current assets Property and equipment Real Estate Investments Projects under construction The right of using principles Intangible assets Financial assets at fair valve into income statement Cash withdrawn cash Deferred tax assets Financial assets at amortized cost Checks for collection due after one year Total of non-curent assets 20,078,742 25,225,139 0 0 6,733,526 22,146,082 1.857,519 1,939,825 20.984.605 23,842,111 177279 2.251.367 6.733.526 16.344,655 2,579,592 2.502.544 0 2.227.113 77,642,792 905,863 -1,383,028 177,279 2,251,367 0 5,801,427 722,073 562,719 0 1,172,199 -1,392,955 096 00 09 -2696 3906 2900 06 000 11106 -296 ASSET Nou-current assets Property and equipment Real Estate Investments Projects under construction The right of using principles Intangible assets Financial assets at Sir valve into income statement Cash withdrawn cash Deferred tax assets Financial assets at amortized cost Checks for collection due after one year Total of non-curent assets TOTAL OF ASSETS 20.078.742 25,225,139 0 0 6.733.526 22,146,082 1.857,519 1,939,825 0 1,054,914 79,035, 747 181.329,643 1106 14% 096 09 496 12% 106 106 09 106 44% 20.984.605 23.842,111 177.279 2.251.367 6,733.326 16,344,655 2.579.592 2.502.544 0 2.227.113 77,642,792 185.987,614 906 196 106 006 106 1,054.914 79,035,747 4296 Horizontal Analysis Statement of financial position Vertical Analysis Statement of financial postion 31-12-2019 ($) 20.478.190 2,200,904 23.431.787 31-12-2019 (5) 20,478,190 2,200,904 23,431,787 Current Asset Alternate receivables Receivables from insurance and reinsurance companies Reinsurance contract assets Financial assets at amortized cost Other current assets Checks for collection due within one year Financial assets at fair value through income statement Cash and cash equivalents Total of current asset TOTAL OF ASSETS 31-12-2018 ($) 19,737,759 2.724,365 23.417.897 201,673 2.602.415 24,286,077 913.466 28.410.244 102.293,896 REF: Variance 740.431.00 -523.461.00 13,890.00 -201,673.00 -191 908.00 5,654,659.00 -720,351.00 1,279,339.00 6,050,926 Change 96 496 -1996 096 -100% -70% 2300 -7906 500 696 2,410,507 29.940.736 193,115 29.689.383 108,344.822 #REF! Current Asset Alternate receivables Receivables from insurance and reinsurance companies Reinsurance contract assets Financial assets at amortized cost Other current assets Checks for collection due within one year Financial assets at Sir value through income statement Cash and cash equivalents Total of current asset TOTAL OF ASSETS 31-12-2018 ($) 19.737.759 2.724.365 23.417.897 201,673 2,602.415 24.286.077 913.466 28.410.244 102,293,896 181,329,643 06 1196 206 1396 096 106 1306 106 160 2.410.507 29.940.736 193.115 29,689,583 108,344,822 185,987,614 110 106 1306 000 106 16% 006 169 58% 5696 Horizontal Analysis tatement of financial positio Vertical Analysis Statement of financial postion SI5 SI- INS ISININ Nou-current liabilities Procon orond of science Lancome olan Decals SI-12-2015 1.III 4.SI e Equity and liabilities Equity ISININ Compbyxor Optionale Fake TA F exhares arein Haari Roundai 13.71121 Feuih atributable to sharchades of this part 53.969.296 controles Total Equity 60,286,379 REF REF! RE! REF: REF: REF TIL 16.25 10.30 2.466.603 REF REF: 10.519 49,025.17 13.IN 5. 1,2,319 INT REF: 1.471,721 1.72 56.173.753 60,286,379 REF 56,173,753 REF! Current liabilities Proverb Accounts payake Short-licom os The cum potion of the love obite Anurts paryasrely iraamTLE Other Com Ca SI-12-2015 CM SI-12-INS 31-12-31195 SI-12-BIN SVIII VICI REF: Non-current linbilities Procon Bord of science lony male obligations Decimaler i Bhai: Midai Tatalanul 1. W REF: REF 351 - 11 REF: AN 6.425,410 8.892.000 6,425,410 REF: 8.892.01 REF: 6.10.1994 8,770,507 4.651.881 795 Tatal al curricabili Tatlarla Total of Equity and Liabilities 31-12-2015 SI-12-30 LIEF! HEFI 7.73 WRI Current liabilities Pro BB Accounts paye Sholm The comportion of the lene olan Anure: parpattle isy insurance are insurare 581.575 REF ELIS TVN WS SSLC SIEWS LES 114.617.854 121.04.3.264 Tatalar bila Tatalar bilan Total of Equity and Liabilities 120,921,758 129 13.30 185,981,524 114.617,854 121.04.1.164 181,329,643 REF: REF: REF 120.921,758 AREF: REF REF REFI LFI REF 181,129