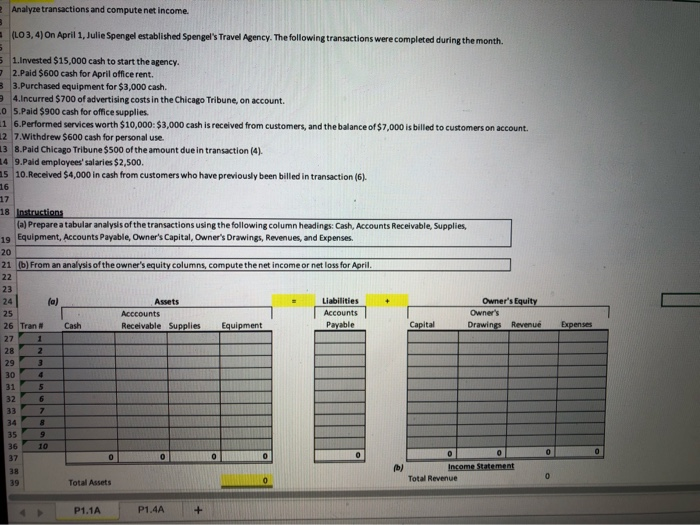

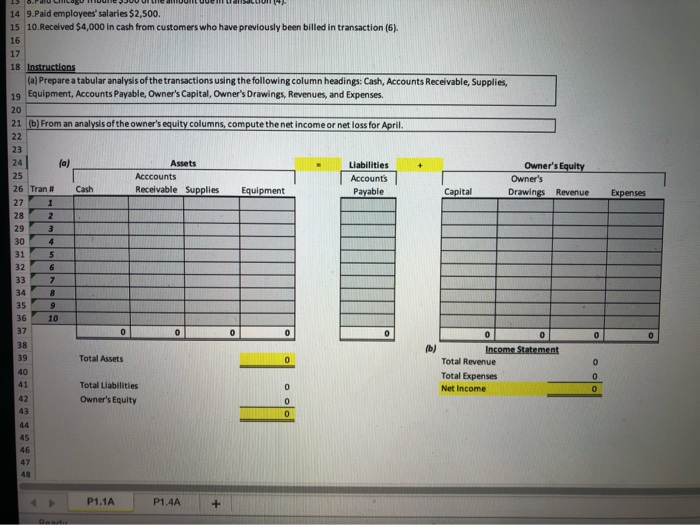

Analyze transactions and compute net income. 3 (LO3, 4) On April 1, Julie Spengel established Spengel's Travel Agency. The following transactions were completed during the month. 5 5 1.Invested $15,000 cash to start the agency. 2.Pald $600 cash for April officerent. 3 3.Purchased equipment for $3,000 cash. 4.Incurred $700 of advertising costs in the Chicago Tribune, on account. LO 5.Paid $900 cash for office supplies. 16.Performed services worth $10,000: $3,000 cash is received from customers, and the balance of $7,000 is billed to customers on account. 12 7.Withdrew $600 cash for personal use. 13 8.Paid Chicago Tribune $500 of the amount due in transaction (4) 14 9.Paid employees' salaries $2,500. 5 10. Received $4,000 in cash from customers who have previously been billed in transaction (6). 16 17 18 Instructions (a) Prepare a tabular analysis of the transactions using the following column headings: Cash, Accounts Receivable, Supplies, 19 Equipment, Accounts Payable, Owner's Capital, Owner's Drawings, Revenues, and Expenses. 20 21 (b) From an analysis of the owner's equity columns, compute the net income or net loss for April 22 23 24 fo) Assets Liabilities Owner's Equity 25 Accounts Accounts Owner's 26 Tran | Cash Receivable Supplies Equipment Payable Capital Drawings Revenue 27 1 28 2 29 3 30 4 31 5 32 6 33 7 Expenses 8 9 10 35 36 37 38 39 0 0 0 0 0 Income Statement Total Revenue Total Assets 0 P1.1A P1.4A + Expenses 14 9.Paid employees' salaries $2,500. 15 10. Received $4,000 in cash from customers who have previously been billed in transaction (6). 16 17 18 Instructions (a) Prepare a tabular analysis of the transactions using the following column headings: Cash, Accounts Receivable, Supplies, 19 Equipment, Accounts Payable, Owner's Capital, Owner's Drawings, Revenues, and expenses. 20 21 (b) From an analysis of the owner's equity columns, compute the net income or net loss for April. 22 23 24 Assets Liabilities Owner's Equity 25 ACCCounts Accounts Owner's 26 Tran | Cash Receivable Supplies Equipment Payable Capital Drawings Revenue 27 1 28 2 29 3 30 4 31 5 32 33 7 34 8 35 9 36 10 37 0 0 0 0 38 (b) Income Statement 39 Total Assets Total Revenue 0 40 Total Expenses Total Liabilities Net Income Owner's Equity 43 6 0 0 0 0 0 0 41 0 0 0 0 45 46 P1.1A P1.4A