Analyze: What percentage of authorized common stock has been issued as of January 1, 2022?

Analyze: What percentage of authorized common stock has been issued as of January 1, 2022?

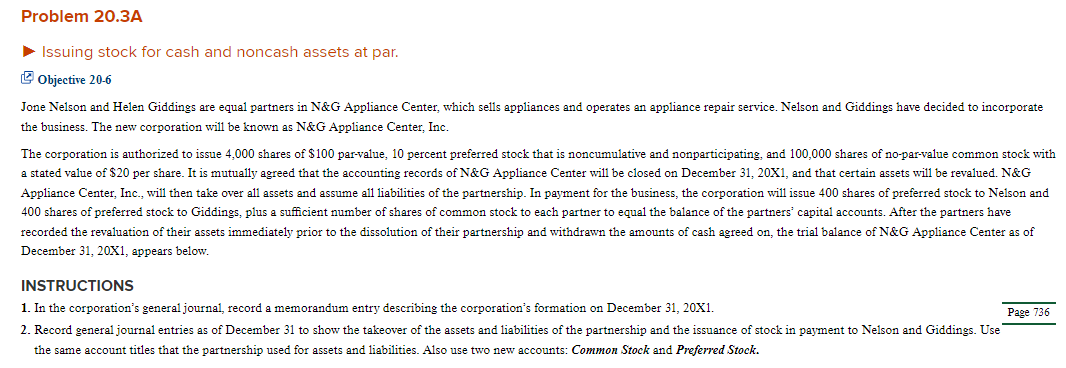

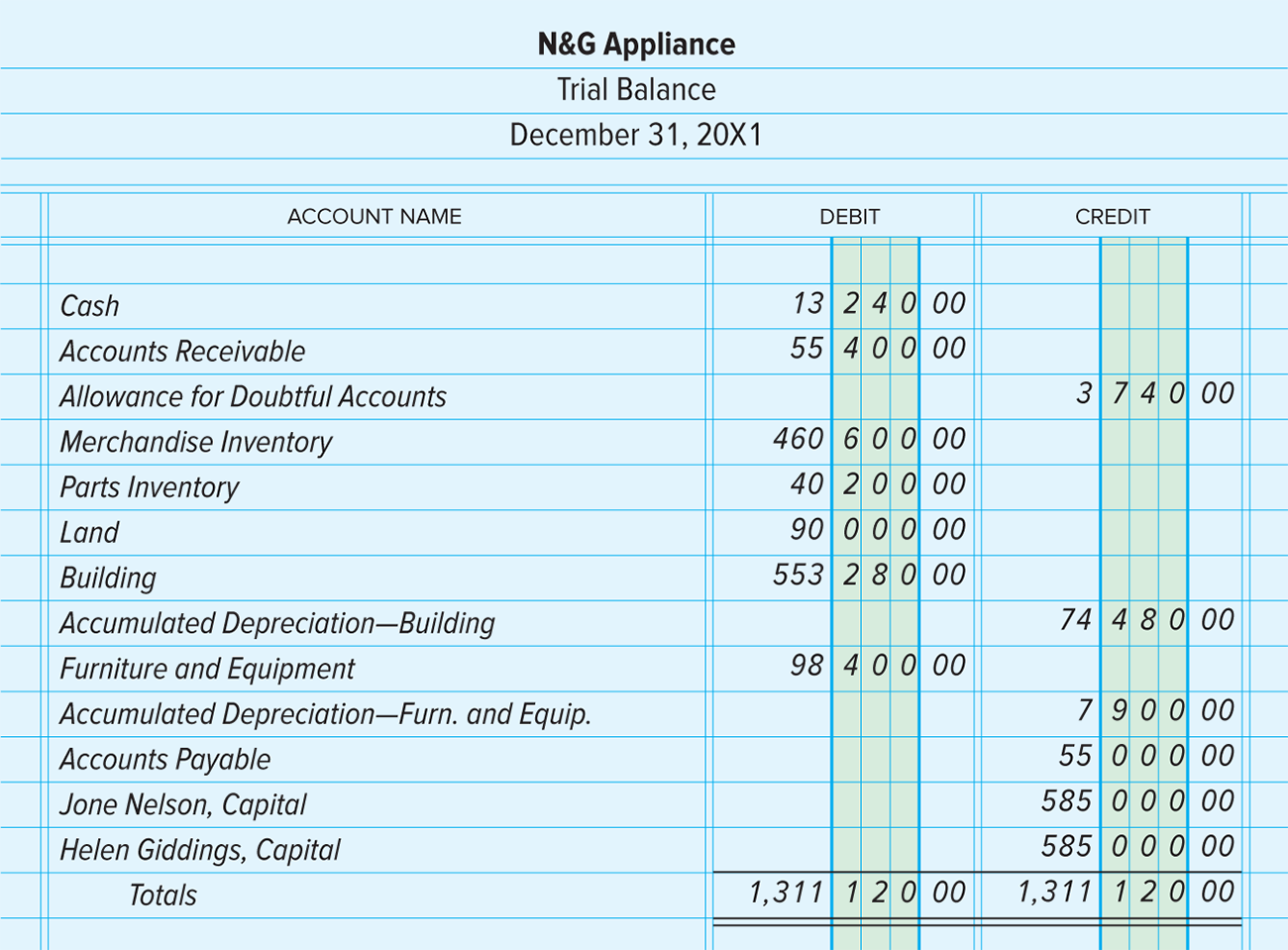

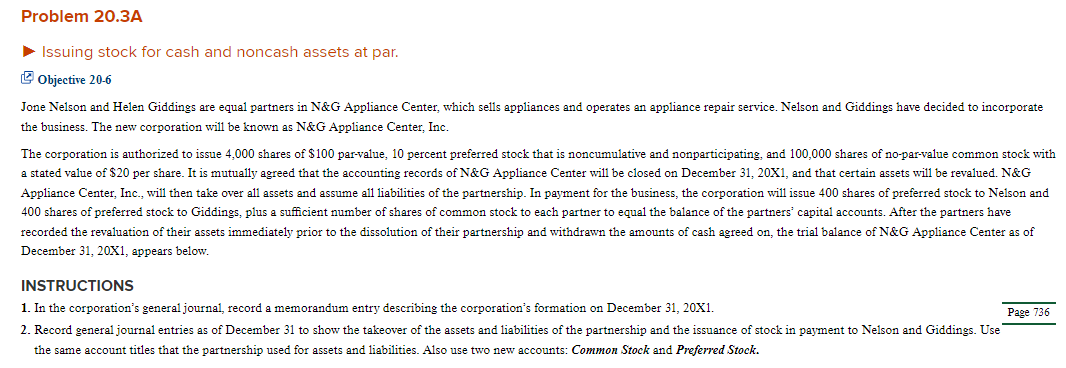

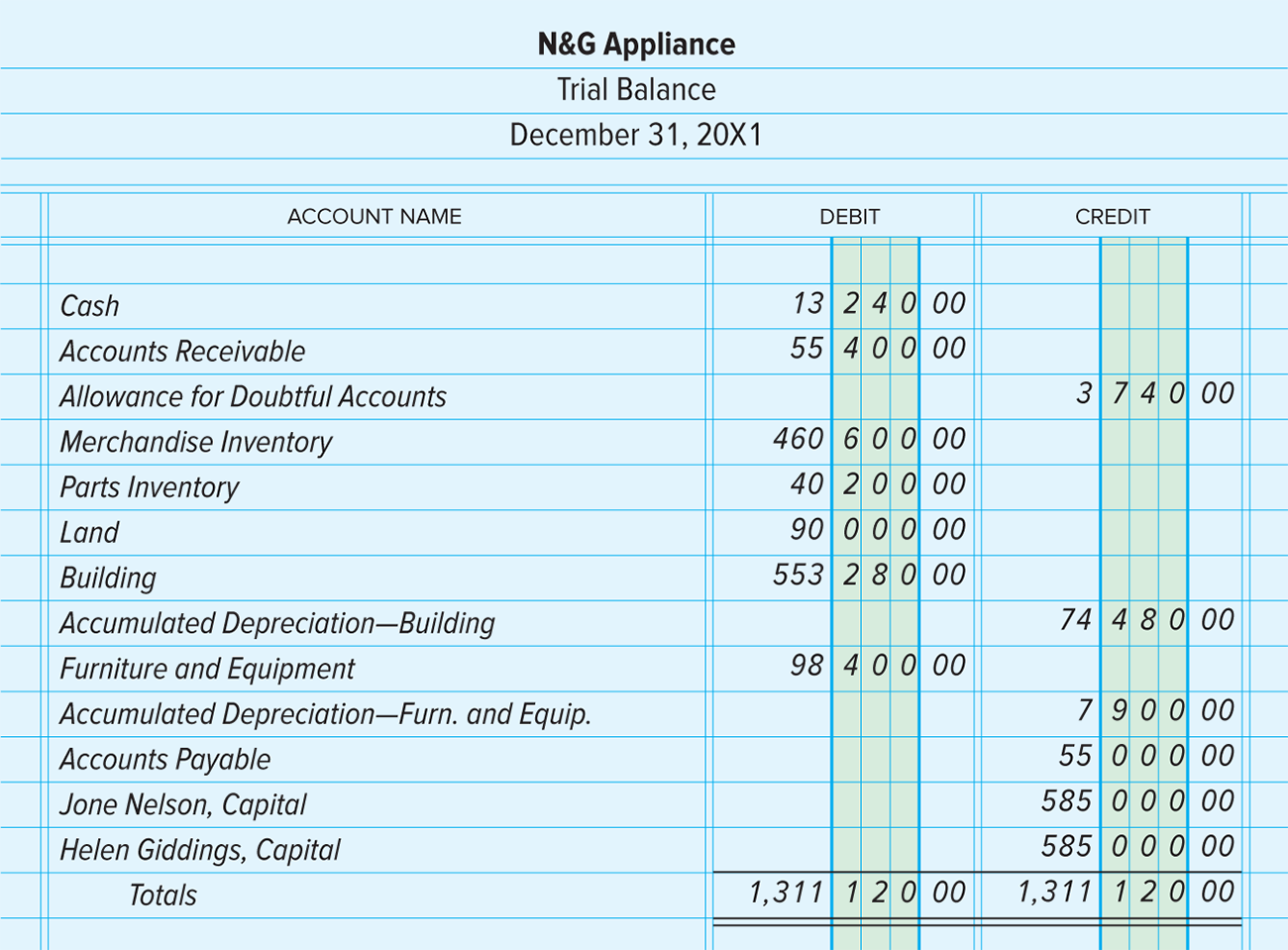

Issuing stock for cash and noncash assets at par. () Objective 20-6 Jone Nelson and Helen Giddings are equal partners in N\&G Appliance Center, which sells appliances and operates an appliance repair service. Nelson and Giddings have decided to incorporate the business. The new corporation will be known as N&A Appliance Center, Inc. The corporation is authorized to issue 4,000 shares of $100 par-value, 10 percent preferred stock that is noncumulative and nonparticipating, and 100,000 shares of no-par-value common stock with a stated value of $20 per share. It is mutually agreed that the accounting records of N&G Appliance Center will be closed on December 31,20X1, and that certain assets will be revalued. N\&G Appliance Center, Inc., will then take over all assets and assume all liabilities of the partnership. In payment for the business, the corporation will issue 400 shares of preferred stock to Nelson and 400 shares of preferred stock to Giddings, plus a sufficient number of shares of common stock to each partner to equal the balance of the partners' capital accounts. After the partners have recorded the revaluation of their assets immediately prior to the dissolution of their partnership and withdrawn the amounts of cash agreed on, the trial balance of N\&G Appliance Center as of December 31,20X1, appears below. INSTRUCTIONS 1. In the corporation's general journal, record a memorandum entry describing the corporation's formation on December 31,20X1. Page 736 2. Record general journal entries as of December 31 to show the takeover of the assets and liabilities of the partnership and the issuance of stock in payment to Nelson and Giddings. Use the same account titles that the partnership used for assets and liabilities. Also use two new accounts: Common Stock and Preferred Stock. N\&G Appliance Trial Balance December 31, 20X1 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Parts Inventory Land Building Accumulated Depreciation-Building Furniture and Equipment Accumulated Depreciation-Furn. and Equip. Accounts Payable Jone Nelson, Capital Helen Giddings, Capital Totals Issuing stock for cash and noncash assets at par. () Objective 20-6 Jone Nelson and Helen Giddings are equal partners in N\&G Appliance Center, which sells appliances and operates an appliance repair service. Nelson and Giddings have decided to incorporate the business. The new corporation will be known as N&A Appliance Center, Inc. The corporation is authorized to issue 4,000 shares of $100 par-value, 10 percent preferred stock that is noncumulative and nonparticipating, and 100,000 shares of no-par-value common stock with a stated value of $20 per share. It is mutually agreed that the accounting records of N&G Appliance Center will be closed on December 31,20X1, and that certain assets will be revalued. N\&G Appliance Center, Inc., will then take over all assets and assume all liabilities of the partnership. In payment for the business, the corporation will issue 400 shares of preferred stock to Nelson and 400 shares of preferred stock to Giddings, plus a sufficient number of shares of common stock to each partner to equal the balance of the partners' capital accounts. After the partners have recorded the revaluation of their assets immediately prior to the dissolution of their partnership and withdrawn the amounts of cash agreed on, the trial balance of N\&G Appliance Center as of December 31,20X1, appears below. INSTRUCTIONS 1. In the corporation's general journal, record a memorandum entry describing the corporation's formation on December 31,20X1. Page 736 2. Record general journal entries as of December 31 to show the takeover of the assets and liabilities of the partnership and the issuance of stock in payment to Nelson and Giddings. Use the same account titles that the partnership used for assets and liabilities. Also use two new accounts: Common Stock and Preferred Stock. N\&G Appliance Trial Balance December 31, 20X1 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Parts Inventory Land Building Accumulated Depreciation-Building Furniture and Equipment Accumulated Depreciation-Furn. and Equip. Accounts Payable Jone Nelson, Capital Helen Giddings, Capital Totals

Analyze: What percentage of authorized common stock has been issued as of January 1, 2022?

Analyze: What percentage of authorized common stock has been issued as of January 1, 2022?