Analyzing Accounting Data

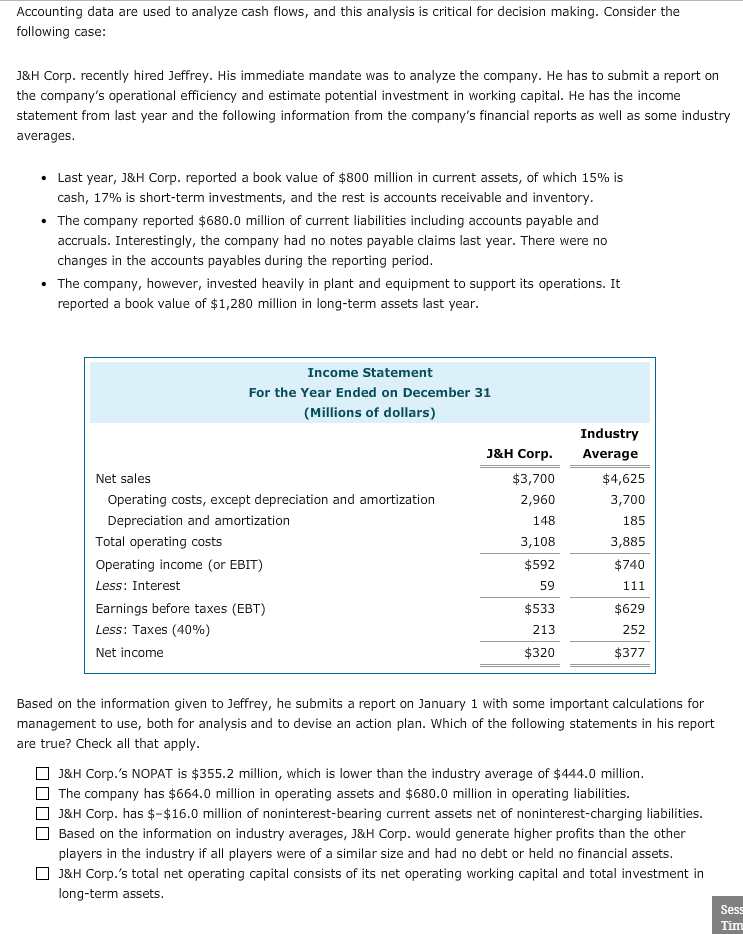

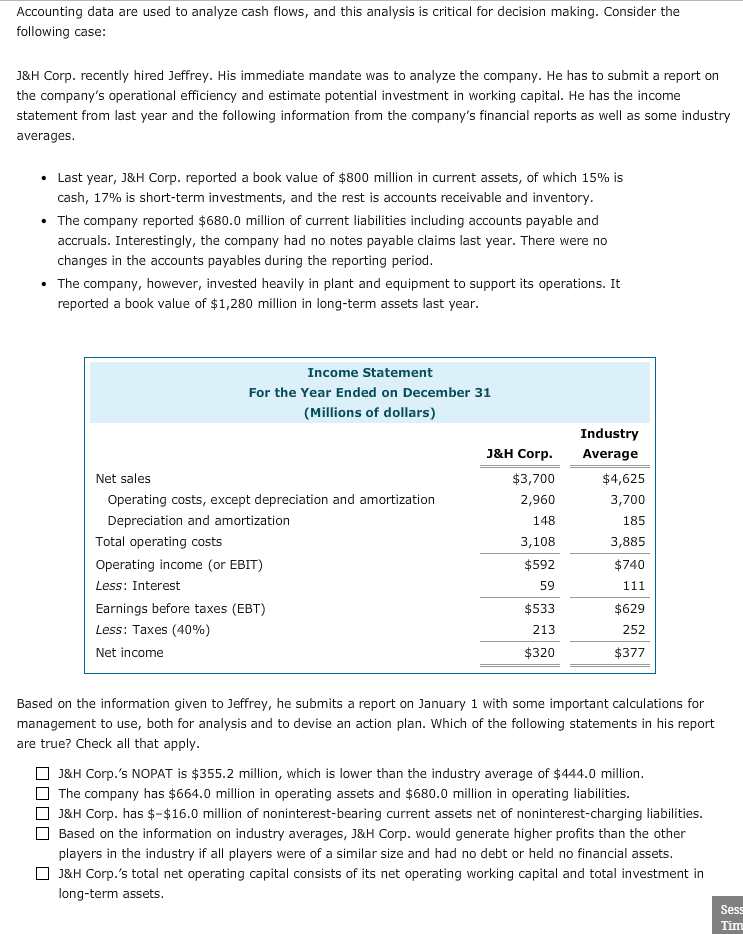

Accounting data are used to analyze cash flows, and this analysis is critical for decision making. Consider the following case: J&H Corp. recently hired Jeffrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages . Last year, J&H Corp. reported a book value of $800 million in current assets, of which 15% is cash, 17% is short-term investments, and the rest is accounts receivable and inventory The company reported $680.0 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period . The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,280 million in long-term assets last year Income Statement For the Year Ended on December 31 (Millions of dollars) Industry Average J&H Corp $3,700 2,960 148 3,108 $592 59 $533 213 $320 $4,625 3,700 185 3,885 $740 Net sales Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs Operating income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net income $629 252 $377 Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply J&H Corp.'s NOPAT is $355.2 million, which is lower than the industry average of $444.0 million The company has $664.0 million in operating assets and $680.0 million in operating liabilities. J&H Corp. has $-$16.0 million of noninterest-bearing current assets net of noninterest-charging liabilities Based on the information on industry averages, J&H Corp. would generate higher profits than the other players in the industry if all players were of a similar size and had no debt or held no financial assets J&H Corp.'s total net operating capital consists of its net operating working capital and total investment in long-term assets Sess Tim Accounting data are used to analyze cash flows, and this analysis is critical for decision making. Consider the following case: J&H Corp. recently hired Jeffrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages . Last year, J&H Corp. reported a book value of $800 million in current assets, of which 15% is cash, 17% is short-term investments, and the rest is accounts receivable and inventory The company reported $680.0 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period . The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,280 million in long-term assets last year Income Statement For the Year Ended on December 31 (Millions of dollars) Industry Average J&H Corp $3,700 2,960 148 3,108 $592 59 $533 213 $320 $4,625 3,700 185 3,885 $740 Net sales Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs Operating income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net income $629 252 $377 Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply J&H Corp.'s NOPAT is $355.2 million, which is lower than the industry average of $444.0 million The company has $664.0 million in operating assets and $680.0 million in operating liabilities. J&H Corp. has $-$16.0 million of noninterest-bearing current assets net of noninterest-charging liabilities Based on the information on industry averages, J&H Corp. would generate higher profits than the other players in the industry if all players were of a similar size and had no debt or held no financial assets J&H Corp.'s total net operating capital consists of its net operating working capital and total investment in long-term assets Sess Tim