Answered step by step

Verified Expert Solution

Question

1 Approved Answer

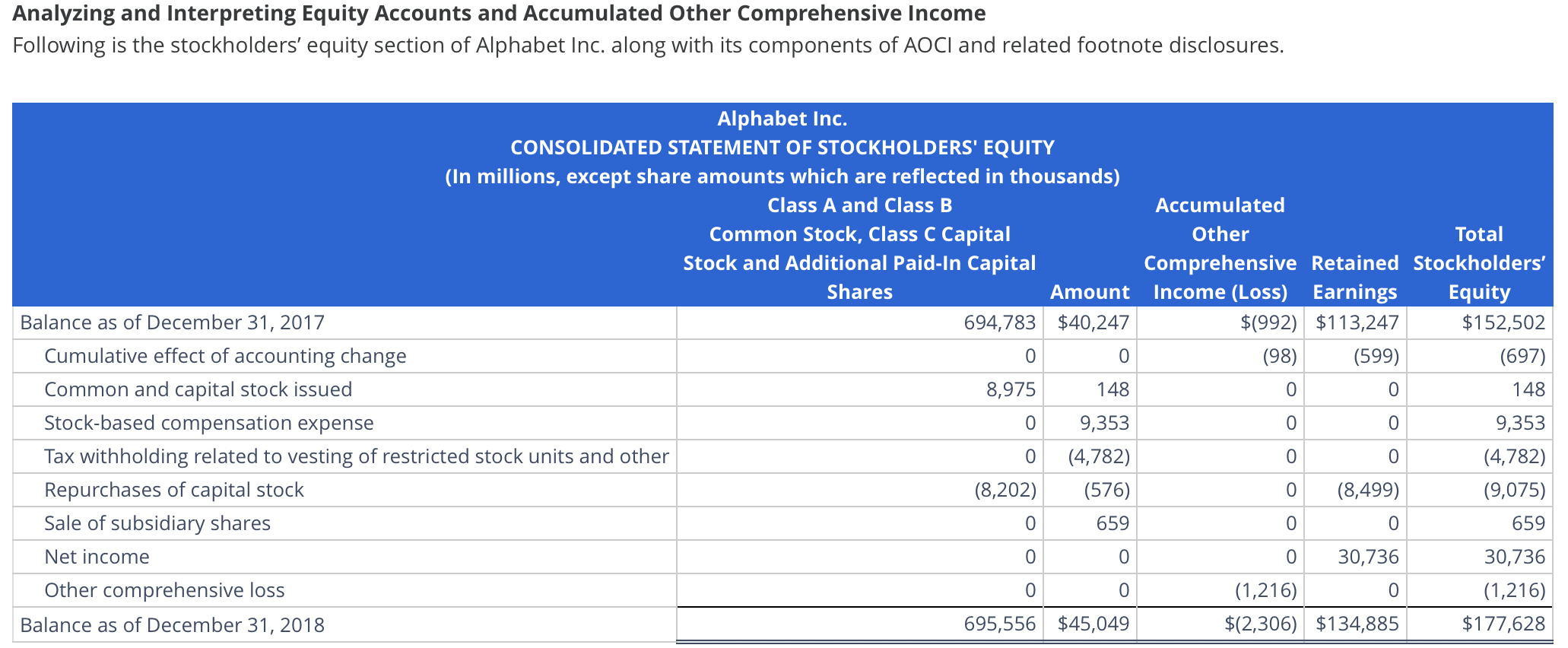

Analyzing and Interpreting Equity Accounts and Accumulated Other Comprehensive Income Following is the stockholders' equity section of Alphabet Inc. along with its components of

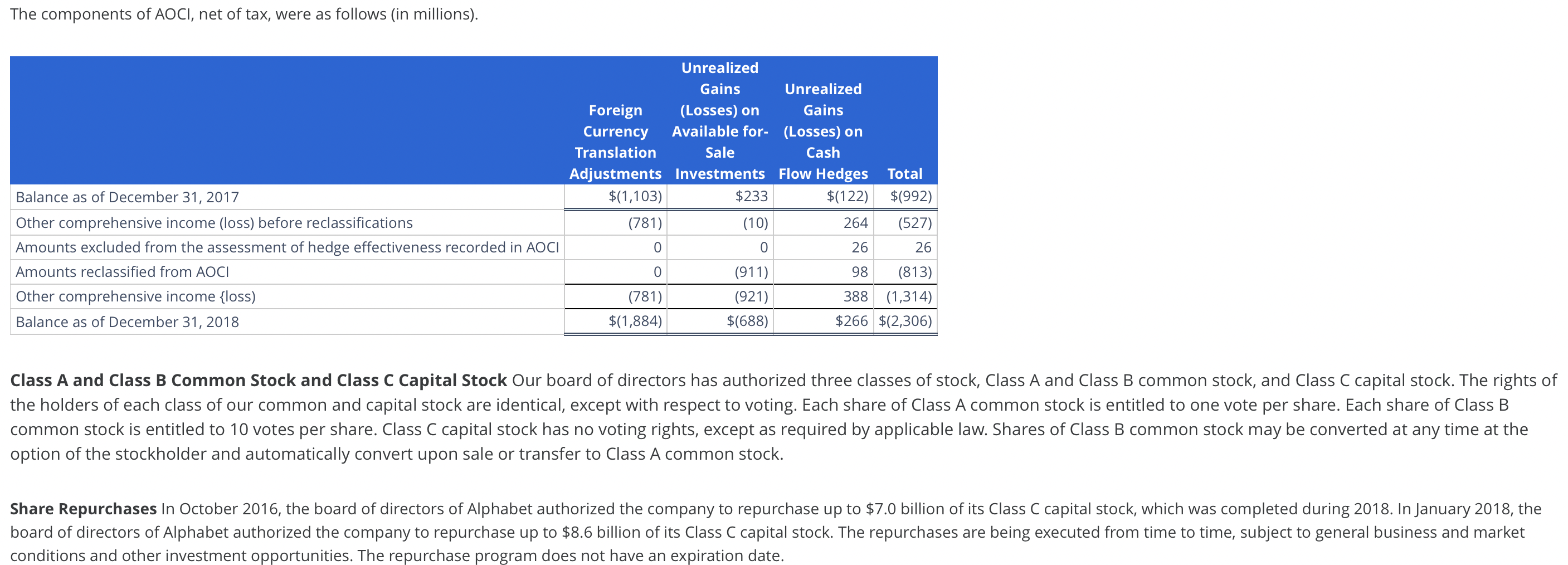

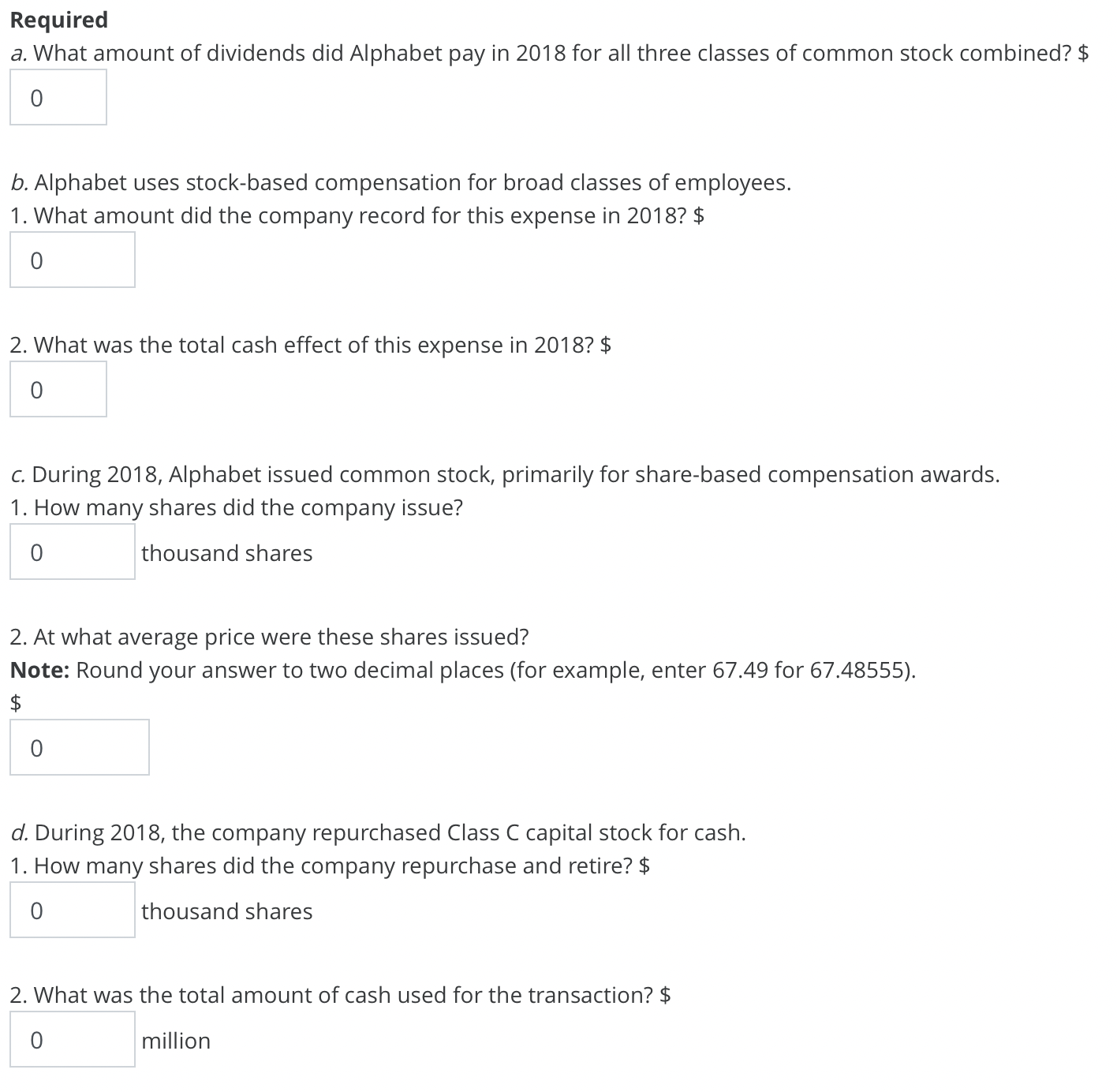

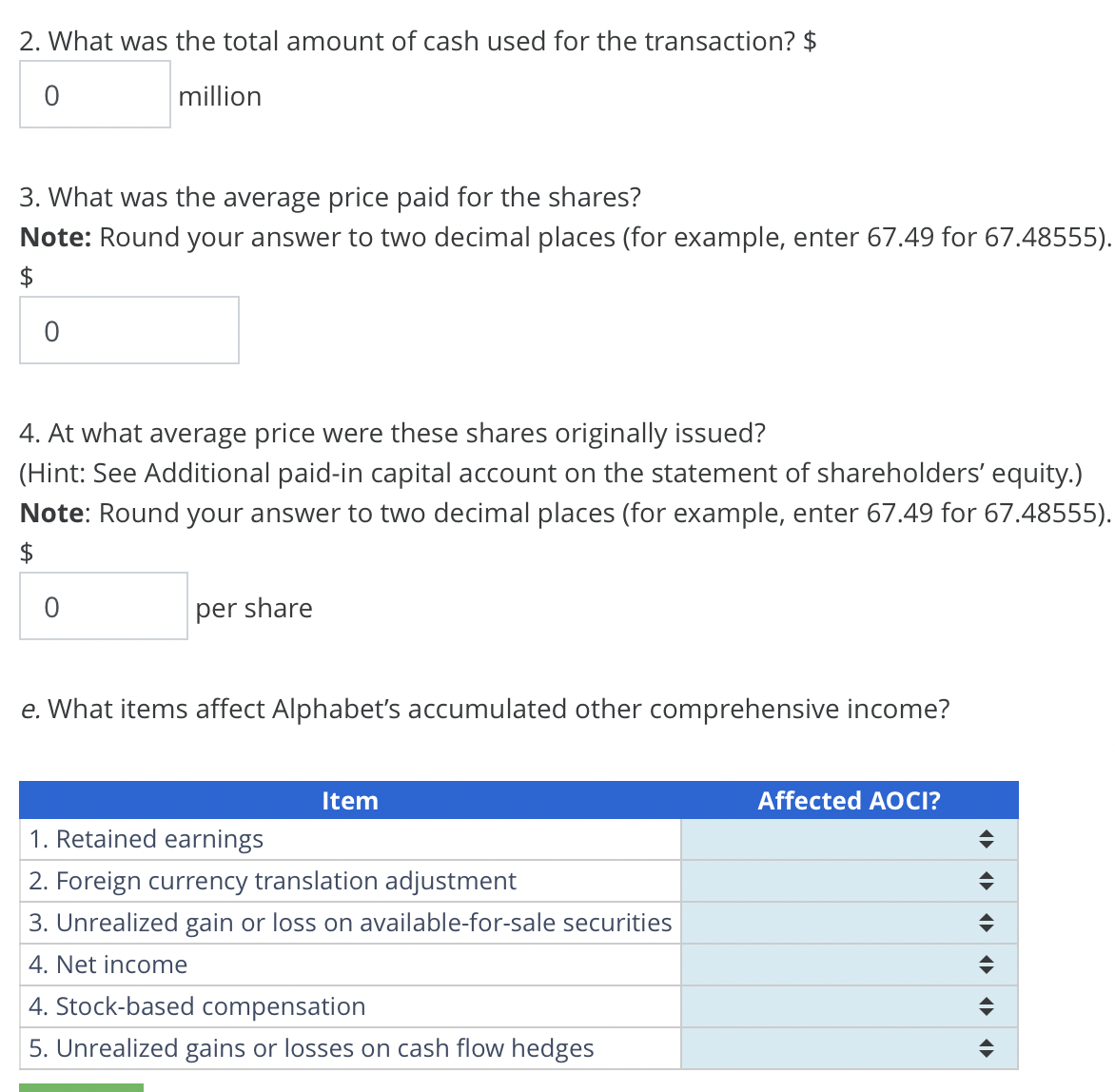

Analyzing and Interpreting Equity Accounts and Accumulated Other Comprehensive Income Following is the stockholders' equity section of Alphabet Inc. along with its components of AOCI and related footnote disclosures. Alphabet Inc. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY (In millions, except share amounts which are reflected in thousands) Class A and Class B Common Stock, Class C Capital Stock and Additional Paid-In Capital Shares Accumulated Other Balance as of December 31, 2017 694,783 Amount $40,247 Total Comprehensive Retained Stockholders' Income (Loss) Earnings Equity $(992) $113,247 $152,502 Cumulative effect of accounting change 0 0 (98) (599) (697) Common and capital stock issued 8,975 148 0 0 148 Stock-based compensation expense 0 9,353 0 0 9,353 Tax withholding related to vesting of restricted stock units and other 0 (4,782) 0 0 (4,782) Repurchases of capital stock (8,202) (576) 0 (8,499) (9,075) Sale of subsidiary shares 0 659 0 0 659 Net income Other comprehensive loss Balance as of December 31, 2018 0 0 0 30,736 30,736 0 0 (1,216) 0 (1,216) 695,556 $45,049 $(2,306) $134,885 $177,628 The components of AOCI, net of tax, were as follows (in millions). Unrealized Foreign Currency Translation Gains (Losses) on Available for- Sale Unrealized Gains (Losses) on Cash Adjustments Investments Flow Hedges Total Balance as of December 31, 2017 Other comprehensive income (loss) before reclassifications $(1,103) $233 $(122) $(992) (781) (10) 264 (527) Amounts excluded from the assessment of hedge effectiveness recorded in AOCI 0 0 26 26 Amounts reclassified from AOCI 0 (911) 98 (813) Other comprehensive income {loss) Balance as of December 31, 2018 (781) $(1,884) (921) $(688) 388 (1,314) $266 $(2,306) Class A and Class B Common Stock and Class C Capital Stock Our board of directors has authorized three classes of stock, Class A and Class B common stock, and Class C capital stock. The rights of the holders of each class of our common and capital stock are identical, except with respect to voting. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to 10 votes per share. Class C capital stock has no voting rights, except as required by applicable law. Shares of Class B common stock may be converted at any time at the option of the stockholder and automatically convert upon sale or transfer to Class A common stock. Share Repurchases In October 2016, the board of directors of Alphabet authorized the company to repurchase up to $7.0 billion of its Class C capital stock, which was completed during 2018. In January 2018, the board of directors of Alphabet authorized the company to repurchase up to $8.6 billion of its Class C capital stock. The repurchases are being executed from time to time, subject to general business and market conditions and other investment opportunities. The repurchase program does not have an expiration date. Required a. What amount of dividends did Alphabet pay in 2018 for all three classes of common stock combined? $ 0 b. Alphabet uses stock-based compensation for broad classes of employees. 1. What amount did the company record for this expense in 2018? $ 0 2. What was the total cash effect of this expense in 2018? $ 0 c. During 2018, Alphabet issued common stock, primarily for share-based compensation awards. 1. How many shares did the company issue? 0 thousand shares 2. At what average price were these shares issued? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 0 d. During 2018, the company repurchased Class C capital stock for cash. 1. How many shares did the company repurchase and retire? $ 0 thousand shares 2. What was the total amount of cash used for the transaction? $ 0 million 2. What was the total amount of cash used for the transaction? $ 0 million 3. What was the average price paid for the shares? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 4. At what average price were these shares originally issued? (Hint: See Additional paid-in capital account on the statement of shareholders' equity.) Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ per share e. What items affect Alphabet's accumulated other comprehensive income? Item 1. Retained earnings 2. Foreign currency translation adjustment 3. Unrealized gain or loss on available-for-sale securities 4. Net income 4. Stock-based compensation 5. Unrealized gains or losses on cash flow hedges Affected AOCI?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started