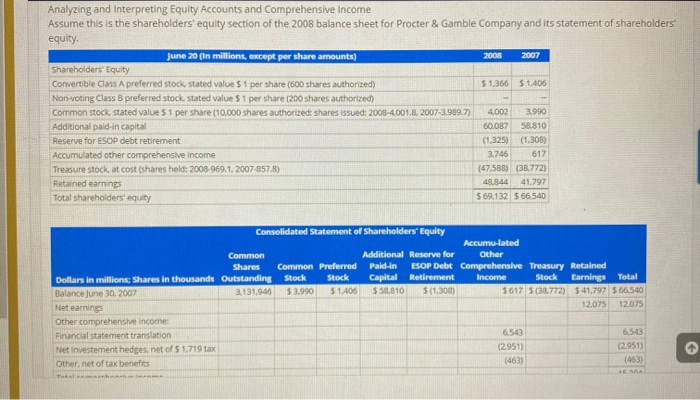

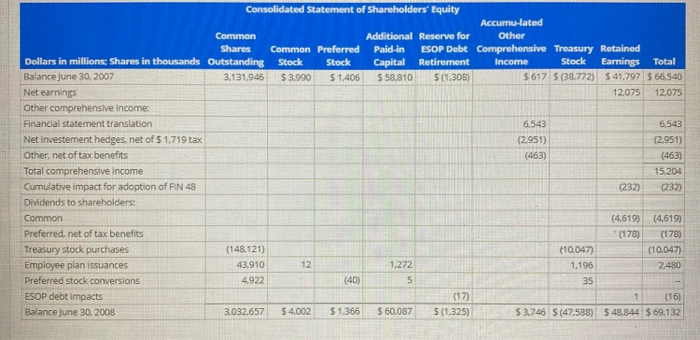

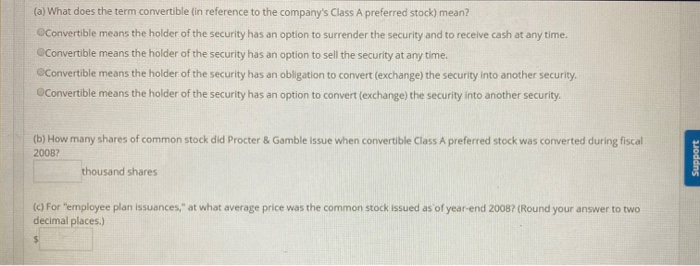

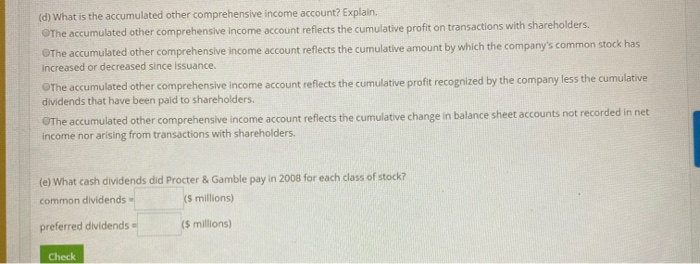

Analyzing and Interpreting Equity Accounts and Comprehensive Income Assume this is the shareholders' equity section of the 2008 balance sheet for Procter & Gamble Company and its statement of shareholders equity. June 20 (In millions, except per share amounts) 2007 2008 Shareholders Equity Convertible Class A preferred stock, stated value $1 per share (600 shares authorized) Non-voting Class B preferred stock, stated value S1 per share (200 shares authorized) Common stock, stated value S1 per share (10.000 shares authorized: shares issued: 2008-4.001.8, 2007-3,989.7) $ 1.366 $1.406 4,002 3.990 60,087 58.810 Additional paid-in capital (1,325) (1.308) Reserve for ESOP debt retirement Accumulated other comprehensive income 617 3.746 (47,588) (38,772) Treasure stock, at cost (shares held: 2008-969.1. 2007-857.8) 41.797 Retained earnings 48,844 S 69.132 $ 66.540 Total shareholders' equity of Shareholders' Equity Consolidated Statem Accumu-lated Additional Reserve for Other Common Common Preferred Stock ESOP Debt Comprehensive Treasury Retained Shares Paid-in Dollars in millions; Shares in thousands Outstanding 3,131.946 Stock Capital Retirement Income Stock Earnings Total 5617 S(38,772) $41,797 5 66,540 $ 58.810 $ (1.308) $1,406 Balance June 30, 2007 Net earnings $3.990 12.075 12.075 Other comprehensive income: 6.543 Financial statement translation Net investement hedges, net of $ 1.719 tax 6.543 (2.951) (2951) (463) (463) Other, net of tax benefits Taal maenhan nnn Consolidated Statement of Shareholders' Equity Accumu-lated Additional Reserve for Other Common Shares Common Preferred Paid-in ESOP Debt Comprehensive Treasury Retained Earnings Total $ 617 S (38.772) $41,797 $ 66.540 Dollars in millions; Shares in thousandsOutstanding Stock Stock Stock Capital Retirement Income 5 58.810 Balance June 30, 2007 3,131.946 $3,990 S(1.308) $1,406 Net earnings 12.075 12.075 Other comprehensive income: Financial statement translation 6.543 6,543 (2.951) Net investement hedges, net of $ 1,719 tax (2.951) Other, net of tax benefits (463) (463) Total comprehensive income Cumulative impact for adoption of FIN 48 Dividends to shareholders: 15,204 (232) (232) (4,619) *(178) (4,619) Common Preferred, net of tax benefits (178) Treasury stock purchases Employee plan issuances Preferred stock conversions ESOP debt impacts (148121) (10.047) (10,047) 43,910 1,272 2480 1,196 4,922 (40) 35 (17) (16) $ 4.002 $ 60,087 $ 3,746 S(47,588) $ 48,844 $ 69.132 Balance June 30. 2008 $1.366 $(1,325) 3.032.657 12 (a) What does the term convertible (in reference to the company's Class A preferred stock) mean? OConvertible means the holder of the security has an option to surrender the security and to receive cash at any time. OConvertible means the holder of the security has an option to sell the security at any time. OConvertible means the holder of the security has an obligation to convert (exchange) the security into another security. OConvertible means the holder of the security has an option to convert (exchange) the security into another security. (b) How many shares of common stock did Procter & Gamble Issue when convertible Class A preferred stock was converted during fiscal 20087 thousand shares (C) For "employee plan issuances," at what average price was the common stock issued as of year-end 20087 (Round your answer to two decimal places.) uoddns (d) What is the accumulated other comprehensive income account? Explain. OThe accumulated other comprehensive income account reflects the cumulative profit on transactions with shareholders. OThe accumulated other comprehensive income account reflects the cumulative amount by which the company's common stock has increased or decreased since issuance. OThe accumulated other comprehensive income account reflects the cumulative profit recognized by the company less the cumulative dividends that have been paid to shareholders. OThe accumulated other comprehensive income account reflects the cumulative change in balance sheet accounts not recorded in net income nor arising from transactions with shareholders. (e) What cash dividends did Procter & Gamble pay in 2008 for each class of stock? (S millions) common dividends (S millions) preferred dividends Check