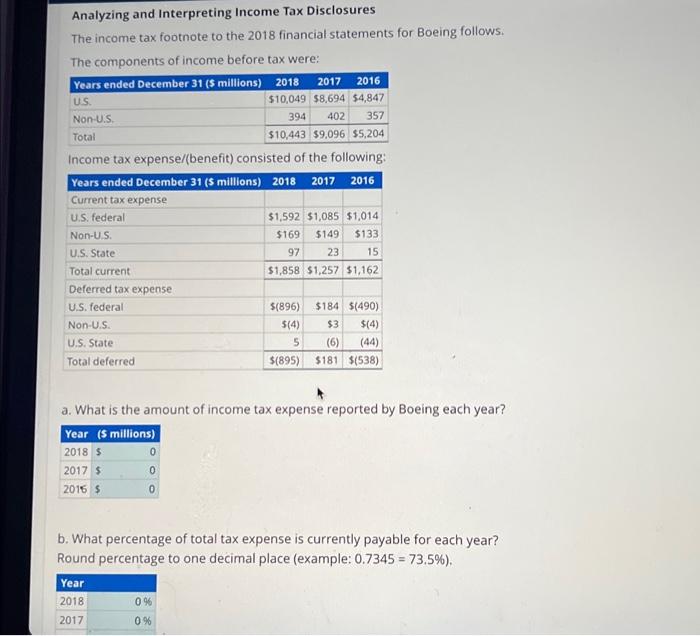

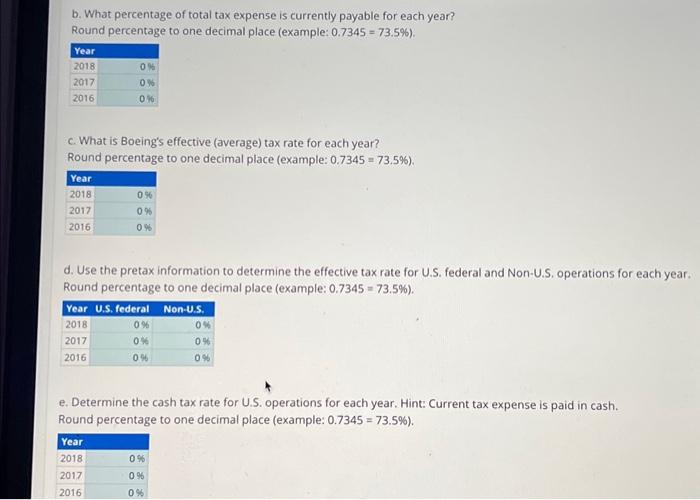

Analyzing and Interpreting Income Tax Disclosures The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax were: Income tax expense/(benefit) consisted of the following: a. What is the amount of income tax expense reported by Boeing each year? b. What percentage of total tax expense is currently payable for each year? Round percentage to one decimal place (example: 0.7345=73.5% ), b. What percentage of total tax expense is currently payable for each year? Round percentage to one decimal place (example: 0.7345=73.5% ). c. What is Boeing's effective (average) tax rate for each year? Round percentage to one decimal place (example: 0.7345=73.5% ). d. Use the pretax information to determine the effective tax rate for U.S. federal and Non-U.S. operations for each year. Round percentage to one decimal place (example: 0.7345=73.5% ). e. Determine the cash tax rate for U.S. operations for each year. Hint: Current tax expense is paid in cash. Round percentage to one decimal place (example: 0.7345=73.5% ). Analyzing and Interpreting Income Tax Disclosures The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax were: Income tax expense/(benefit) consisted of the following: a. What is the amount of income tax expense reported by Boeing each year? b. What percentage of total tax expense is currently payable for each year? Round percentage to one decimal place (example: 0.7345=73.5% ), b. What percentage of total tax expense is currently payable for each year? Round percentage to one decimal place (example: 0.7345=73.5% ). c. What is Boeing's effective (average) tax rate for each year? Round percentage to one decimal place (example: 0.7345=73.5% ). d. Use the pretax information to determine the effective tax rate for U.S. federal and Non-U.S. operations for each year. Round percentage to one decimal place (example: 0.7345=73.5% ). e. Determine the cash tax rate for U.S. operations for each year. Hint: Current tax expense is paid in cash. Round percentage to one decimal place (example: 0.7345=73.5% )