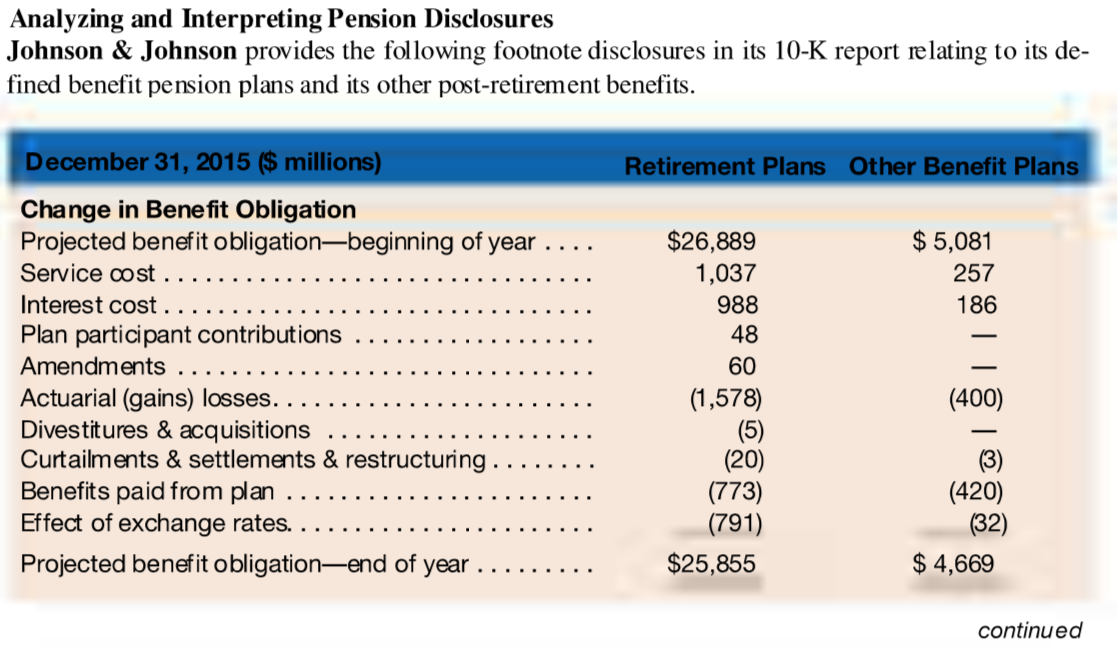

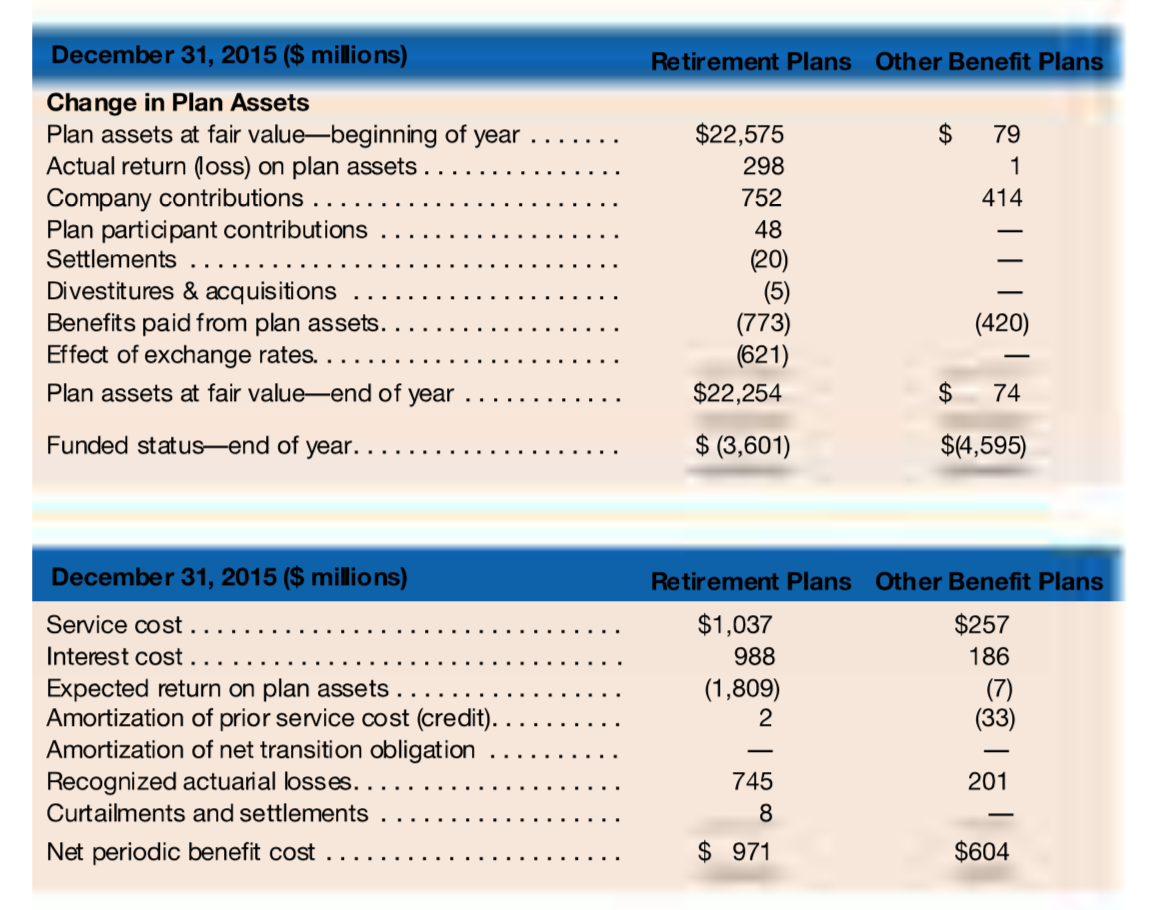

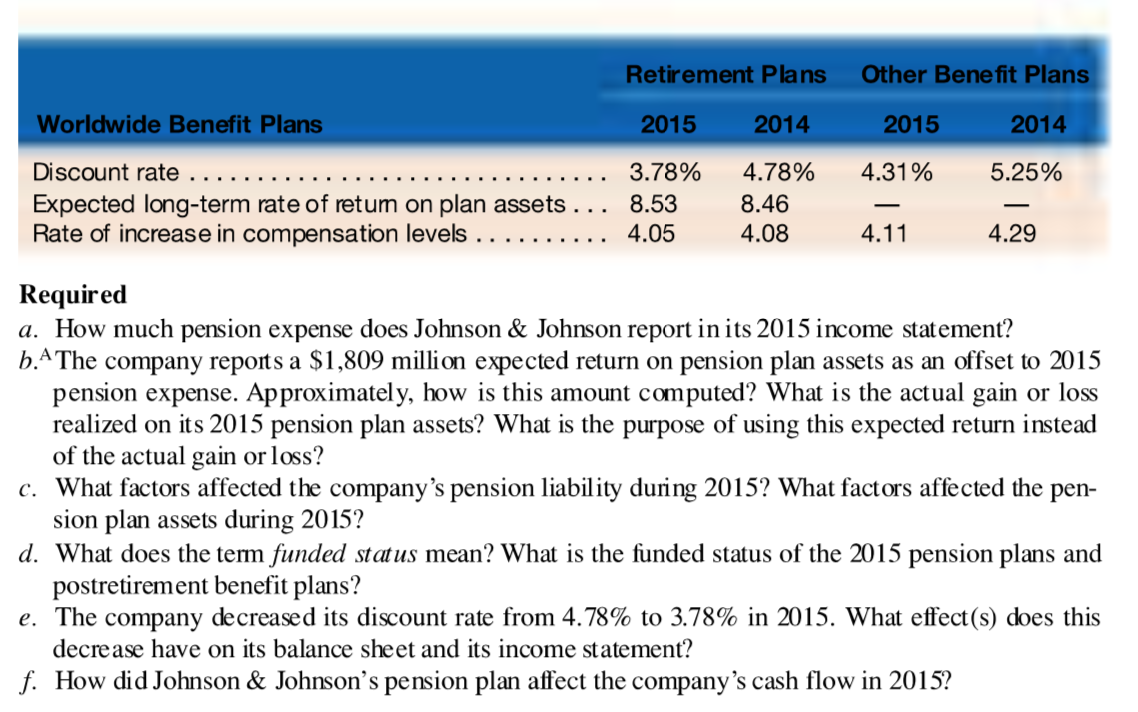

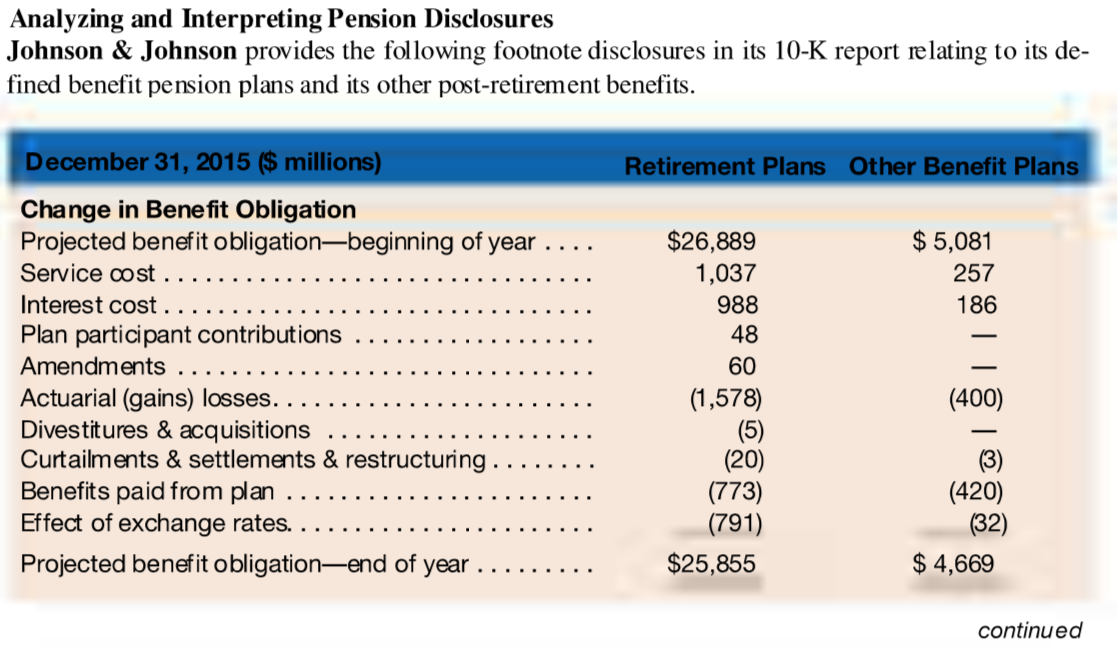

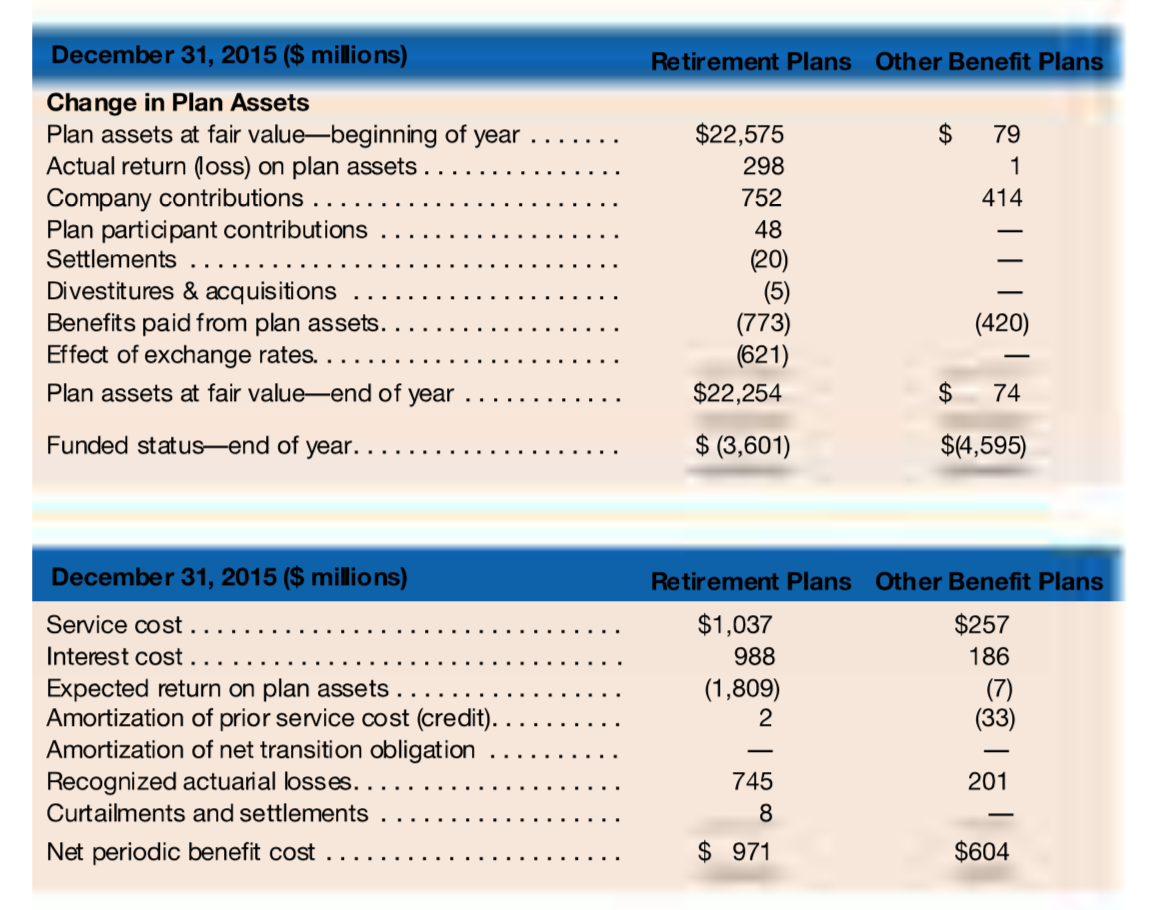

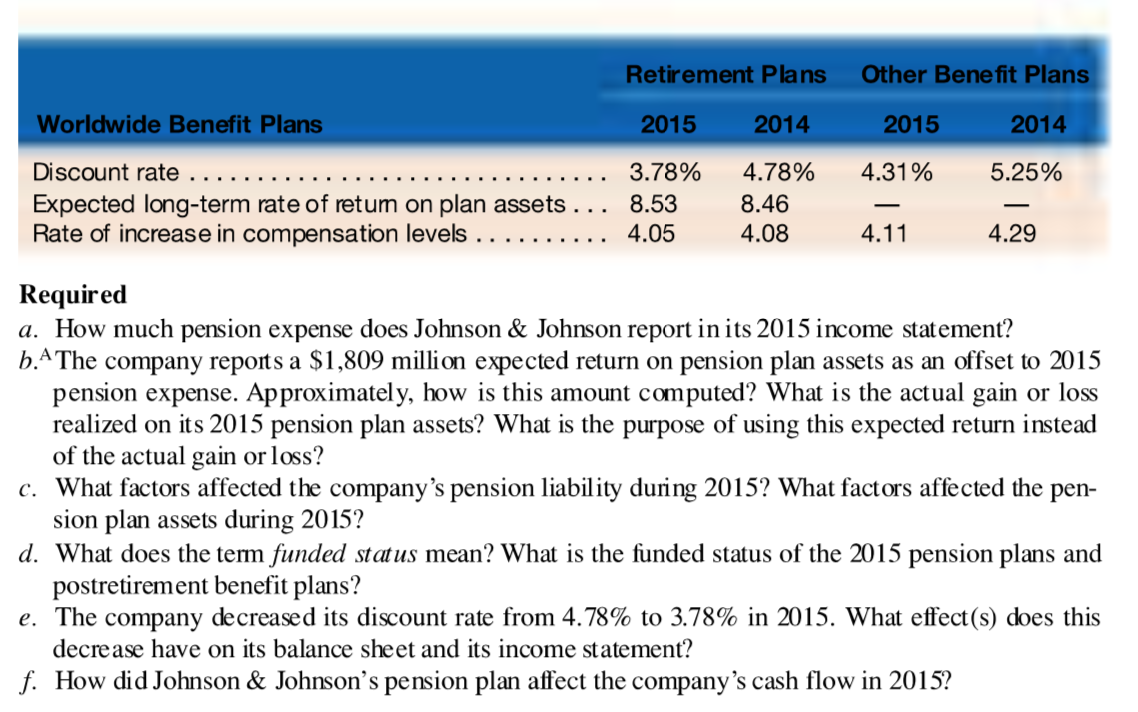

Analyzing and Interpreting Pension Disclosures Johnson & Johnson provides the following footnote disclosures in its 10-K report relating to its de- fined benefit pension plans and its other post-retirement benefits. December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $26,889 1,037 988 $ 5,081 257 186 48 Change in Benefit Obligation Projected benefit obligationbeginning of year .... Service cost .............. Interest cost ............ Plan participant contributions .... Amendments ............. Actuarial (gains) losses. ..... ...... Divestitures & acquisitions ...... Curtailments & settlements & restructuring ..., Benefits paid from plan .... Effect of exchange rates. ....... Projected benefit obligationend of year ......... 60 (1,578) (400) (20) (773) (791) $25,855 (420) (32) $ 4,669 continued December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $ 79 $22,575 298 752 1 414 .. . . . . . . . . . 48 Change in Plan Assets Plan assets at fair value-beginning of year ....... Actual return (loss) on plan assets ........ Company contributions ...... Plan participant contributions .... Settlements ................. Divestitures & acquisitions ..... Benefits paid from plan assets. ... Effect of exchange rates. ...................... Plan assets at fair valueend of year ............ (20) (5) (773) (621) $22,254 (420) $ 74 Funded statusend of year. ........ $ (3,601) $(4,595) December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $1,037 $257 988 186 (1,809) (33) Service cost ................................ Interest cost ................................ Expected return on plan assets ...... Amortization of prior service cost (credit)... Amortization of net transition obligation ..... Recognized actuarial losses. . . . . . . . . . . . .. Curtailments and settlements .................. Net periodic benefit cost ... ...... 201 745 8 $ 971 $604 Retirement Plans Worldwide Benefit Plans 2015 2014 Discount rate. 3.78% 4.78% Expected long-term rate of retum on plan assets... 8.53 8.46 Rate of increase in compensation levels . . . . . . . ... 4.05 4.08 Other Benefit Plans 2015 2014 4.31% 5.25% 4.11 4.29 Required a. How much pension expense does Johnson & Johnson report in its 2015 income statement? b. The company reports a $1,809 million expected return on pension plan assets as an offset to 2015 pension expense. Approximately, how is this amount computed? What is the actual gain or loss realized on its 2015 pension plan assets? What is the purpose of using this expected return instead of the actual gain or loss? c. What factors affected the company's pension liability during 2015? What factors affected the pen- sion plan assets during 2015? d. What does the term funded status mean? What is the funded status of the 2015 pension plans and postretirement benefit plans? e. The company decreased its discount rate from 4.78% to 3.78% in 2015. What effect(s) does this decrease have on its balance sheet and its income statement? f. How did Johnson & Johnson's pension plan affect the company's cash flow in 2015? Analyzing and Interpreting Pension Disclosures Johnson & Johnson provides the following footnote disclosures in its 10-K report relating to its de- fined benefit pension plans and its other post-retirement benefits. December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $26,889 1,037 988 $ 5,081 257 186 48 Change in Benefit Obligation Projected benefit obligationbeginning of year .... Service cost .............. Interest cost ............ Plan participant contributions .... Amendments ............. Actuarial (gains) losses. ..... ...... Divestitures & acquisitions ...... Curtailments & settlements & restructuring ..., Benefits paid from plan .... Effect of exchange rates. ....... Projected benefit obligationend of year ......... 60 (1,578) (400) (20) (773) (791) $25,855 (420) (32) $ 4,669 continued December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $ 79 $22,575 298 752 1 414 .. . . . . . . . . . 48 Change in Plan Assets Plan assets at fair value-beginning of year ....... Actual return (loss) on plan assets ........ Company contributions ...... Plan participant contributions .... Settlements ................. Divestitures & acquisitions ..... Benefits paid from plan assets. ... Effect of exchange rates. ...................... Plan assets at fair valueend of year ............ (20) (5) (773) (621) $22,254 (420) $ 74 Funded statusend of year. ........ $ (3,601) $(4,595) December 31, 2015 ($ millions) Retirement Plans Other Benefit Plans $1,037 $257 988 186 (1,809) (33) Service cost ................................ Interest cost ................................ Expected return on plan assets ...... Amortization of prior service cost (credit)... Amortization of net transition obligation ..... Recognized actuarial losses. . . . . . . . . . . . .. Curtailments and settlements .................. Net periodic benefit cost ... ...... 201 745 8 $ 971 $604 Retirement Plans Worldwide Benefit Plans 2015 2014 Discount rate. 3.78% 4.78% Expected long-term rate of retum on plan assets... 8.53 8.46 Rate of increase in compensation levels . . . . . . . ... 4.05 4.08 Other Benefit Plans 2015 2014 4.31% 5.25% 4.11 4.29 Required a. How much pension expense does Johnson & Johnson report in its 2015 income statement? b. The company reports a $1,809 million expected return on pension plan assets as an offset to 2015 pension expense. Approximately, how is this amount computed? What is the actual gain or loss realized on its 2015 pension plan assets? What is the purpose of using this expected return instead of the actual gain or loss? c. What factors affected the company's pension liability during 2015? What factors affected the pen- sion plan assets during 2015? d. What does the term funded status mean? What is the funded status of the 2015 pension plans and postretirement benefit plans? e. The company decreased its discount rate from 4.78% to 3.78% in 2015. What effect(s) does this decrease have on its balance sheet and its income statement? f. How did Johnson & Johnson's pension plan affect the company's cash flow in 2015