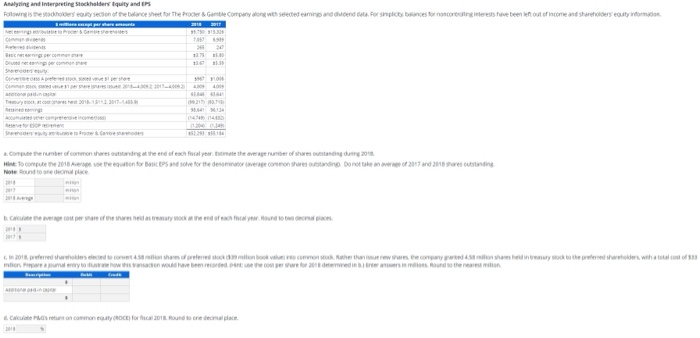

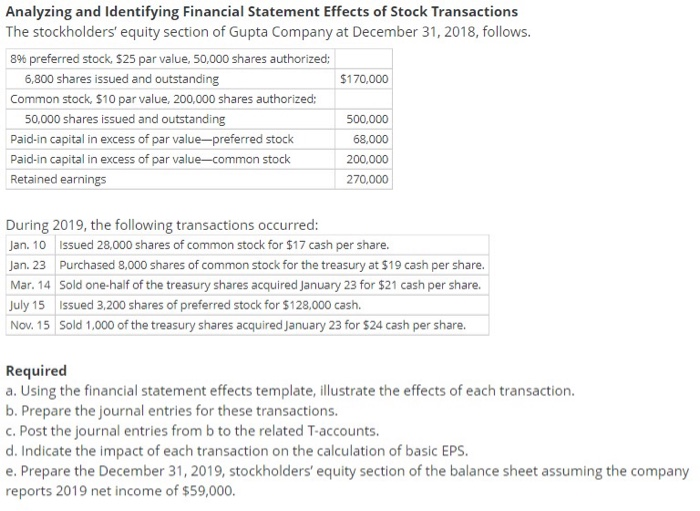

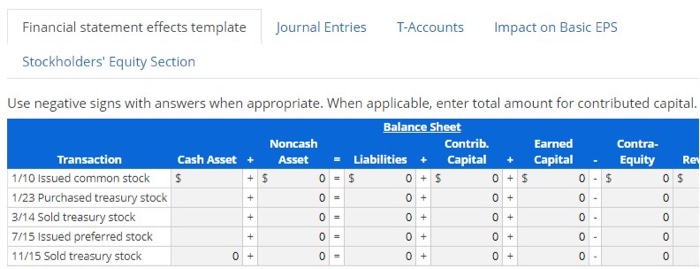

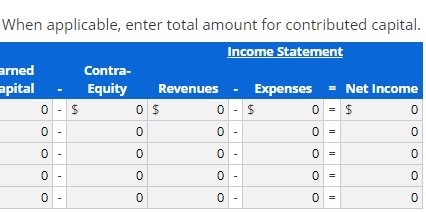

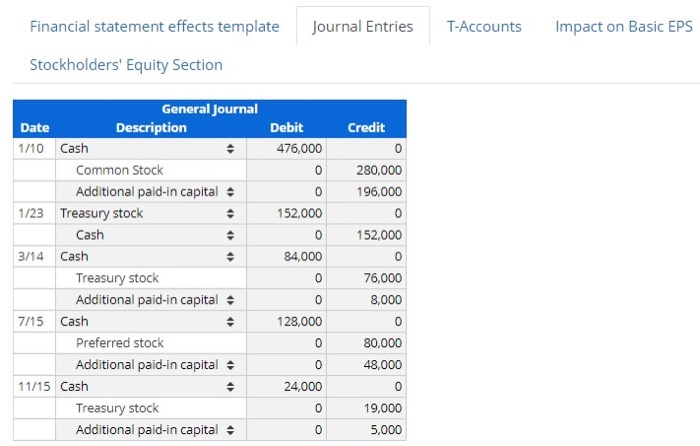

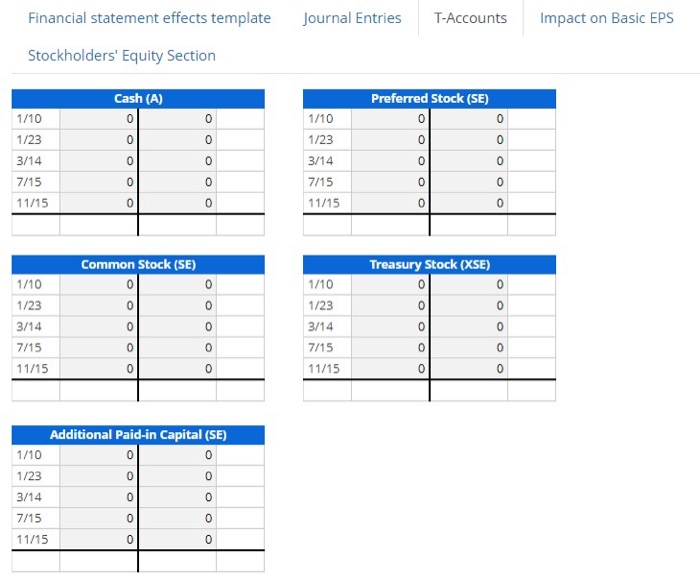

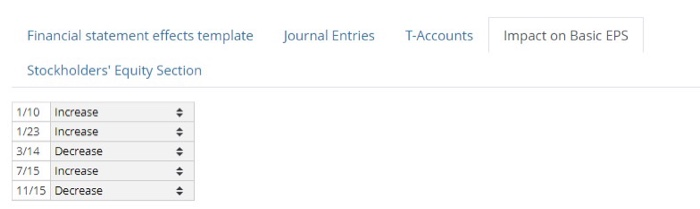

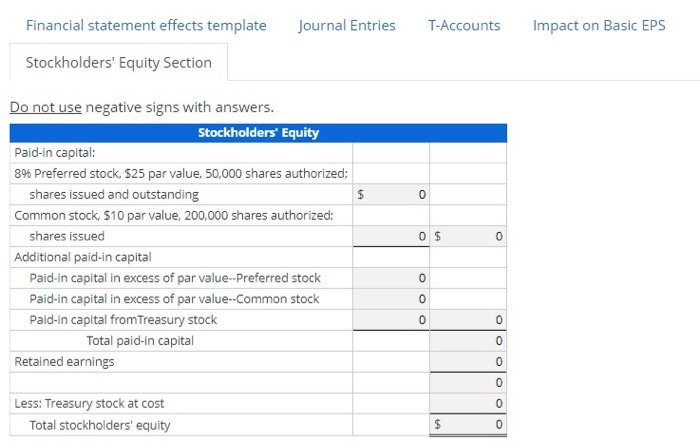

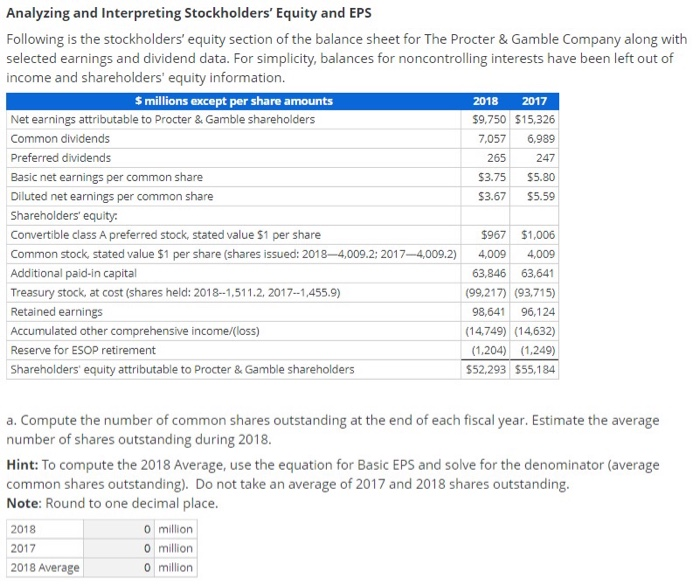

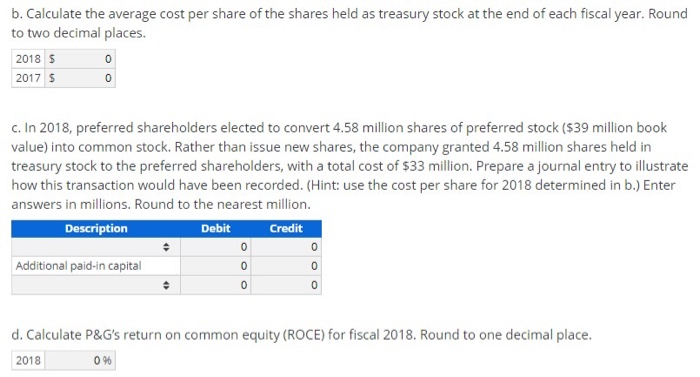

Analyzing and interpreting Stockholders Iquity and Bile kheyon c e or the Pro Gate Company whe n it for plans for contests have been fout of income and shaders uity in the Computerenumber of common Hinto computere 2018 Note und dem way se for the de the w v r o ono n g de 2018 Donkeverf 2017 1. Cl e ar of the were who have mo miliona malown w e r rden e comparar und so there on Calculator oncommon DCEfocal 2011. Round to redemplace Analyzing and Identifying Financial Statement Effects of Stock Transactions The stockholders' equity section of Gupta Company at December 31, 2018, follows. 896 preferred stock, $25 par value, 50,000 shares authorized; 6,800 shares issued and outstanding $170,000 Common stock, $10 par value, 200,000 shares authorized: 50,000 shares issued and outstanding 500,000 Paid-in capital in excess of par value-preferred stock 68,000 Paid-in capital in excess of par value-common stock 200,000 Retained earnings 270,000 During 2019, the following transactions occurred: Jan. 10 Issued 28,000 shares of common stock for $17 cash per share. Jan. 23 Purchased 8,000 shares of common stock for the treasury at $19 cash per share. Mar. 14 Sold one-half of the treasury shares acquired January 23 for $21 cash per share. July 15 Issued 3,200 shares of preferred stock for $128,000 cash. Nov. 15 Sold 1,000 of the treasury shares acquired January 23 for $24 cash per share. Required a. Using the financial statement effects template, illustrate the effects of each transaction. b. Prepare the journal entries for these transactions. c. Post the journal entries from b to the related T-accounts. d. Indicate the impact of each transaction on the calculation of basic EPS. e. Prepare the December 31, 2019, stockholders' equity section of the balance sheet assuming the company reports 2019 net income of $59,000. Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Use negative signs with answers when appropriate. When applicable, enter total amount for contributed capital. Balance Sheet Noncash Contrib. Earned Contra- Transaction Cash Asset + Asset - Liabilities + Capital + Capital Equity Rey 1/10 Issued common stock $ 0 + $ 0 + $ 0 $ 1/23 Purchased treasury stock 0 + 0 - 3/14 Sold treasury stock 0 + 0 + 0- 7/15 issued preferred stock 0 + 0 - 11/15 Sold treasury stock 0 + 0 - 0 0 - $ When applicable, enter total amount for contributed capital. Income Statement arned Contra- apital - Equity Revenues - Expenses - Net Income 0 - $ oo Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Credit Debit 476,000 280,000 196,000 0 152,000 152,000 84,000 General Journal Date Description 1/10 Cash Common Stock Additional paid-in capital 1/23 Treasury stock Cash 3/14 Cash Treasury stock Additional paid-in capital - 7/15 Cash Preferred stock Additional paid-in capital 11/15 Cash Treasury stock Additional paid-in capital 76,000 8,000 128,000 80,000 48,000 24,000 19,000 5,000 Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Cash (A) Preferred Stock (SE) 1/10 1/10 1/23 3/14 1/23 3/14 7/15 11/15 ooooo 7/15 11/15 Common Stock (SE) Treasury Stock (XSE) 1/10 1/23 3/14 7/15 OOOO 1/10 1/23 3/14 7/15 11/15 11/15 Additional Paid-in Capital (SE) 1/10 OO 1/23 3/14 7/15 11/15 Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section 1/10 Increase 1/23 Increase 3/14 Decrease 7/15 Increase 11/15 Decrease Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Do not use negative signs with answers. Stockholders' Equity Paid-in capital: 896 Preferred stock, $25 par value. 50,000 shares authorized; shares issued and outstanding Common stock, $10 par value, 200,000 shares authorized: shares issued Additional paid-in capital Paid-in capital in excess of par value--Preferred stock Paid-in capital in excess of par value--Common stock Paid-in capital from Treasury stock Total paid-in capital Retained earnings O O O O Less: Treasury stock at cost Total stockholders' equity Analyzing and Interpreting Stockholders' Equity and EPS Following is the stockholders' equity section of the balance sheet for The Procter & Gamble Company along with selected earnings and dividend data. For simplicity, balances for noncontrolling interests have been left out of income and shareholders' equity information. $ millions except per share amounts 2018 2017 Net earnings attributable to Procter & Gamble shareholders $9,750 515,326 Common dividends 7,057 6,989 Preferred dividends 265 247 Basic net earnings per common share $3.75 $5.80 Diluted net earnings per common share $3.67 $5.59 Shareholders' equity: Convertible class A preferred stock, stated value $1 per share $967 $1,006 Common stock, stated value $1 per share (shares issued: 2019-4,009.2: 2017-4,009.2) 4,009 4,009 Additional paid-in capital 63,846 63,641 Treasury stock, at cost (shares held: 2018--1,511.2.2017--1,455.9) (99,217) (93.715) Retained earnings 98,641 96,124 Accumulated other comprehensive income/loss) (14,749) (14,632) Reserve for ESOP retirement (1.204) (1,249) Shareholders' equity attributable to Procter & Gamble shareholders 552,293 555,184 a. Compute the number of common shares outstanding at the end of each fiscal year. Estimate the average number of shares outstanding during 2018. Hint: To compute the 2018 Average, use the equation for Basic EPS and solve for the denominator (average common shares outstanding). Do not take an average of 2017 and 2018 shares outstanding. Note: Round to one decimal place. 2018 0 million 2017 0 million 2018 Average 0 million b. Calculate the average cost per share of the shares held as treasury stock at the end of each fiscal year. Round to two decimal places. 2018 5 2017 5 0 c. In 2018, preferred shareholders elected to convert 4.58 million shares of preferred stock ($39 million book value) into common stock. Rather than issue new shares, the company granted 4.58 million shares held in treasury stock to the preferred shareholders, with a total cost of $33 million. Prepare a journal entry to illustrate how this transaction would have been recorded. (Hint: use the cost per share for 2018 determined in b.) Enter answers in millions. Round to the nearest million. Description Debit Credit Additional paid-in capital d. Calculate P&G's return on common equity (ROCE) for fiscal 2018. Round to one decimal place. 2018 096