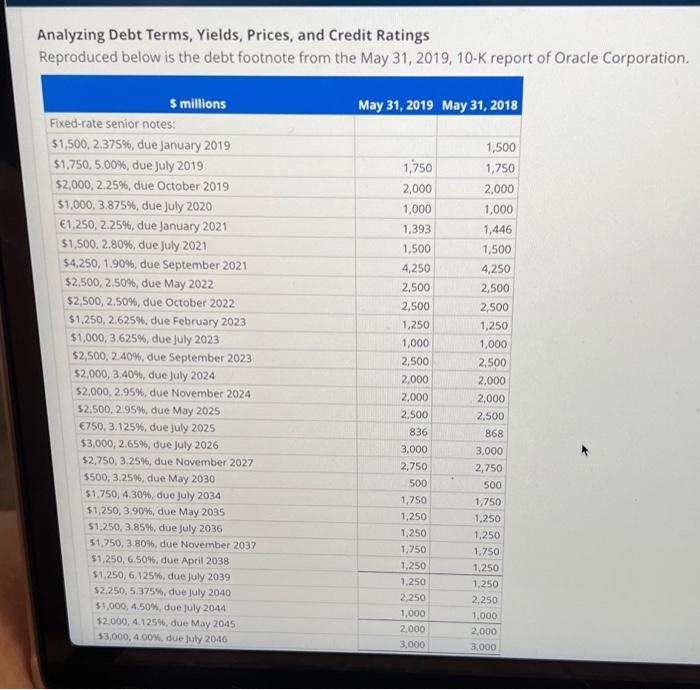

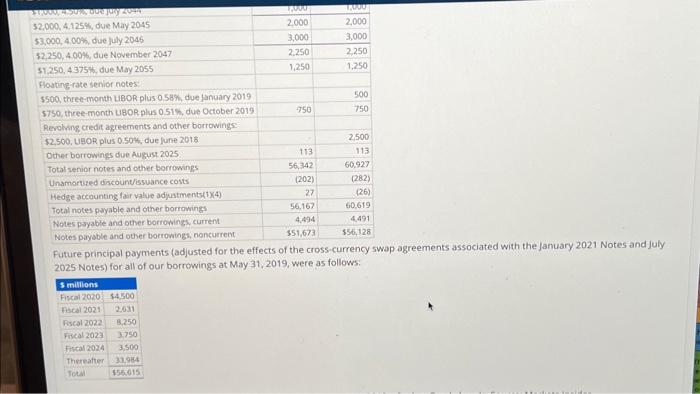

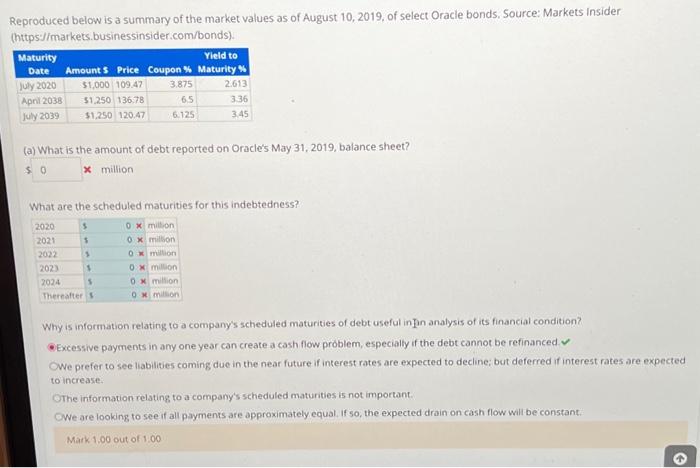

Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the Mav 31, 2019, 10-K report of Oracle Corporation. Future principal payments (adjusted for the effects of the cross-currency swop agreements associated with the January 2021 Notes and July 2025 Notes) for all of our borrowings at May 31, 2019, were as follows: teproduced below is a summary of the market values as of August 10,2019 , of select Oracle bonds. Source: Markets Insider https:/imarkets. businessinsider.com/bonds). (a) What is the amount of debt reported on Oracle's May 31, 2019, balance sheet? milion What are the scheduled maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in in analysis of its financial condition? Excessive payments in any one year can create a cash flow problem, especially if the debt cannot be refinanced. We prefer to see liabilities coming due in the near future if interest rates are expected to decline; but deferred if interest rates are expected to increase The information relating to a company's scheduled maturities is not important. We are looking to see if all payments are approximately equal. If so, the expected drain on cash flow will be constant. Mark 1.00 out of 1.00 Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the Mav 31, 2019, 10-K report of Oracle Corporation. Future principal payments (adjusted for the effects of the cross-currency swop agreements associated with the January 2021 Notes and July 2025 Notes) for all of our borrowings at May 31, 2019, were as follows: teproduced below is a summary of the market values as of August 10,2019 , of select Oracle bonds. Source: Markets Insider https:/imarkets. businessinsider.com/bonds). (a) What is the amount of debt reported on Oracle's May 31, 2019, balance sheet? milion What are the scheduled maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in in analysis of its financial condition? Excessive payments in any one year can create a cash flow problem, especially if the debt cannot be refinanced. We prefer to see liabilities coming due in the near future if interest rates are expected to decline; but deferred if interest rates are expected to increase The information relating to a company's scheduled maturities is not important. We are looking to see if all payments are approximately equal. If so, the expected drain on cash flow will be constant. Mark 1.00 out of 1.00