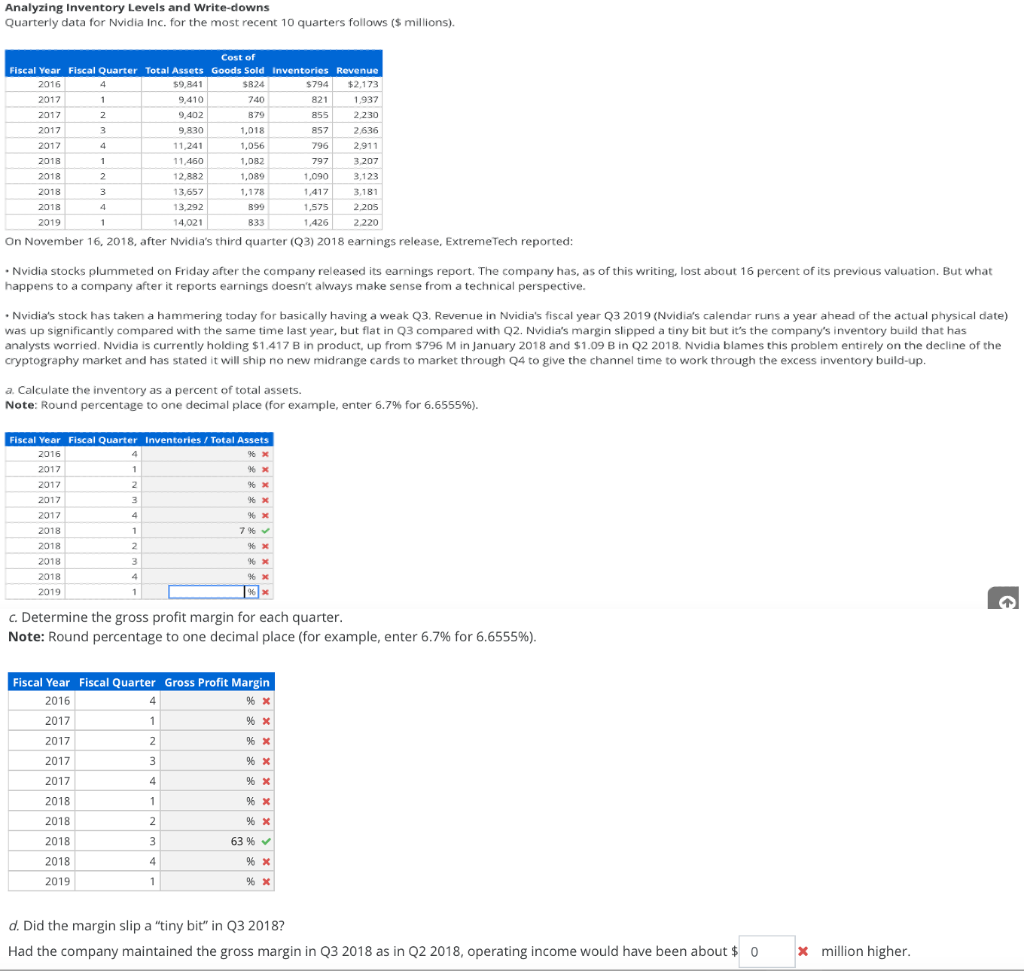

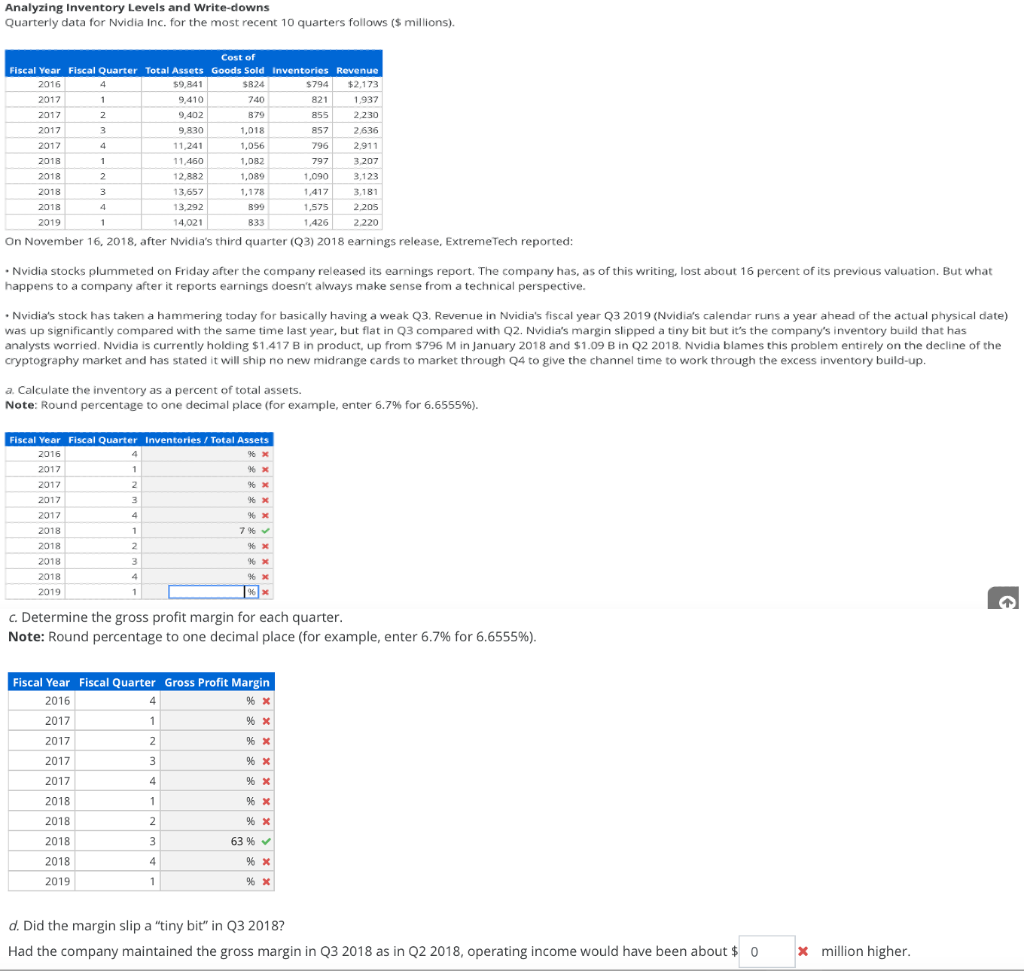

Analyzing Inventory Levels and Write-downs Quarterly data for Nvidia Inc. for the most recent 10 quarters follows ($ millions).

Analyzing Inventory Levels and Write-downs Quarterly data for Nvidia Inc. for the most recent 10 quarters follows ($ millions). Cost of Fiscal Year Fiscal Quarter Total Assets Goods Sold Inventories Revenue 2016 4 $9,841 824 $794 $2,173 2017 1 9,410 740 821 1,937 2017 2 9,402 879 855 2,230 2017 3 9,830 1,018 857 2,636 2017 4 11,241 1,056 796 2,911 2018 1 11,460 1,082 797 3.207 2018 2 2 12,882 1,089 1,090 3,123 3,125 2018 3 13,657 1,178 1,417 2018 4 13,292 899 1,575 2.205 2019 1 14,021 833 1,426 2,220 On November 16, 2018, after Nvidia's third quarter (Q3) 2018 earnings release, Extreme Tech reported: 3,181 Nvidia stocks plummeted on Friday after the company released its earnings report. The company has, as of this writing, lost about 16 percent of its previous valuation. But what happens to a company after it reports earnings doesn't always make sense from a technical perspective. Nvidia's stock has taken a hammering today for basically having a weak Q3. Revenue in Nvidia's fiscal year Q3 2019 (Nvidia's calendar runs a year ahead of the actual physical date) was up significantly compared with the same time last year, but flat in Q3 compared with Q2. Nvidia's margin slipped a tiny bit but it's the company's inventory build that has analysts worried. Nvidia is currently holding $1.417 B in product, up from $796 M in January 2018 and $1.09 B in Q2 2018. Nvidia blames this problem entirely on the decline of the cryptography market and has stated it will ship no new midrange cards to market through 24 to give the channel time to work through the excess inventory build-up. a. Calculate the inventory as a percent of total assets. Note: Round percentage to one decimal place (for example, enter 6.7% for 6.655596). Fiscal Year Fiscal Quarter Inventories/Total Assets 2016 4 96 x 2017 1 %6 x 2017 4 2 % X 2017 3 96 x 2017 4 96 x 2018 1 7 % 2018 2. % X 2018 3 9 X 2018 4 4 4 x 2019 96 G c. Determine the gross profit margin for each quarter. Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555%). Fiscal Year Fiscal Quarter Gross Profit Margin 2016 4 % x 2017 1 % X 2017 2 % x 2017 3 % x 2017 4 % x 2018 1 % x 2018 2 % x 2018 3 63 % 2018 4 % X 2019 1 % X d. Did the margin slip a "tiny bit" in Q3 2018? Had the company maintained the gross margin in Q3 2018 as in Q2 2018, operating income would have been about $ 0 * million higher