Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Analyzing profitability) Last year the P. M. Postem Corporation had sales of $400,000, with a cost of goods sold of $112,000. The firms operating expenses

(Analyzing profitability) Last year the P. M. Postem Corporation had sales of $400,000, with a cost of goods sold of $112,000. The firms operating expenses were $130,000, and its increase in retained earnings was $58,000. There are currently 22,000 shares of common stock outstanding, the firm pays a $1.60 dividend per share, and the firm has no interest-bearing debt.

a. Assuming the firms earnings are taxed at 35 percent, construct the firms income statement.

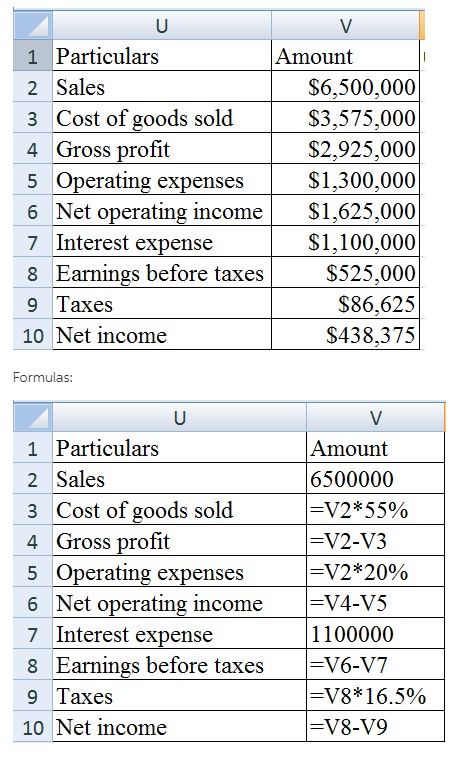

b. Compute the firms operating profit margin.

U V 1 Particulars Amount 2 Sales $6,500,000 3 Cost of goods sold $3,575,000 4 Gross profit $2,925,000 5 Operating expenses $1,300,000 6 Net operating income $1,625,000 7 Interest expense $1,100,000 8 Earnings before taxes $525,000 9 Taxes $86,625 10 Net income $438,375 Formulas: U V 1 Particulars 2 Sales 3 Cost of goods sold 4 Gross profit 5 Operating expenses 6 Net operating income 7 Interest expense 8 Earnings before taxes 9 Taxes Amount 6500000 =V2*55% =V2-V3 =V2*20% =V4-V5 1100000 =V6-V7 =V8*16.5% =V8-19 10 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started