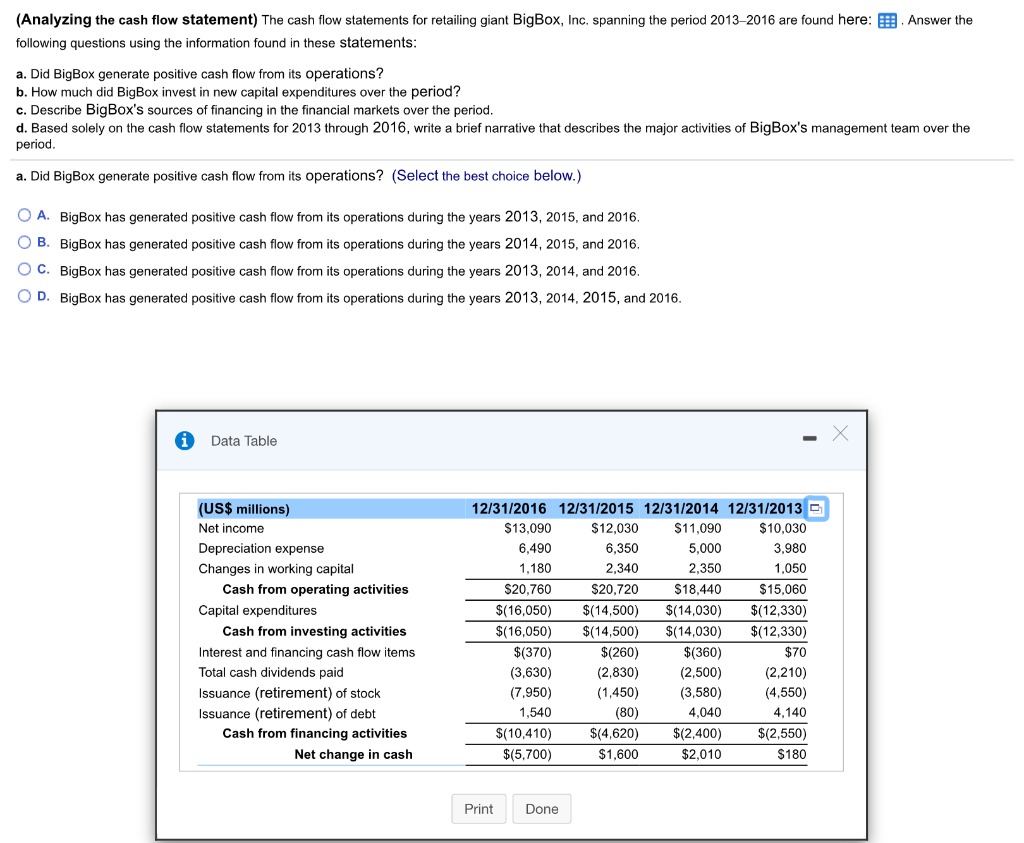

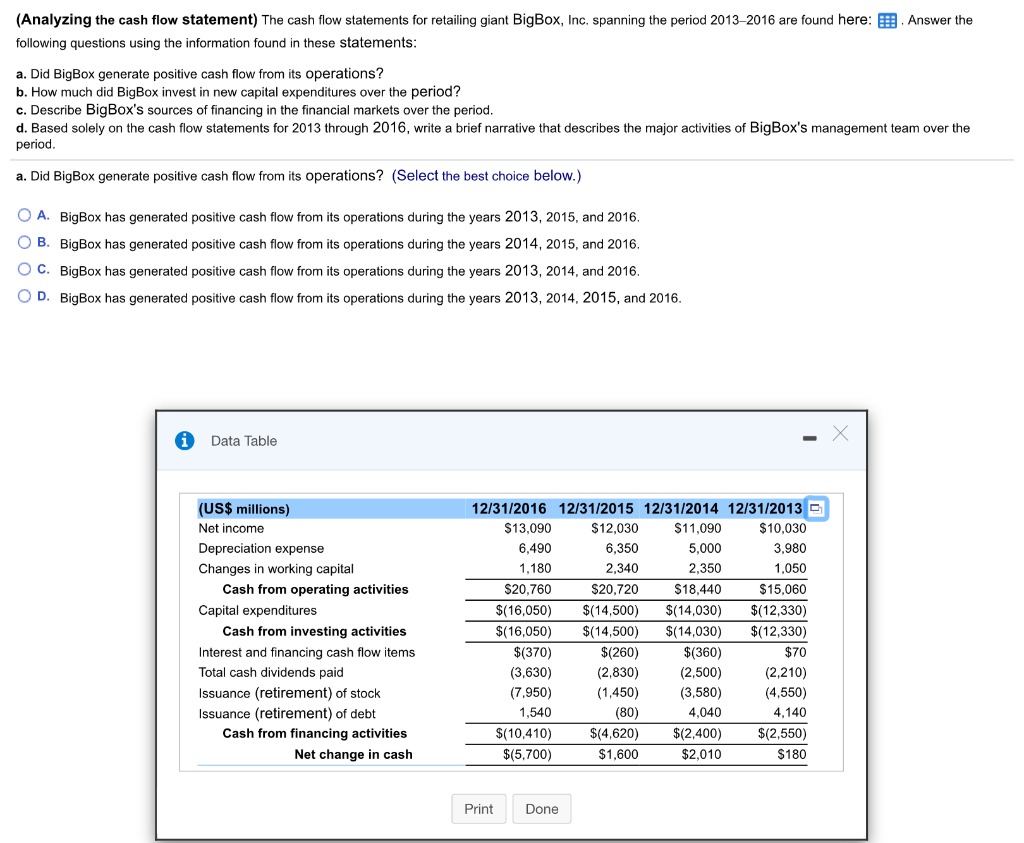

(Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc. spanning the period 2013-2016 are found here: . Answer the following questions using the information found in these statements: a. Did BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over the period? c. Describe BigBox's sources of financing in the financial markets over the period. d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over the period. a. Did BigBox generate positive cash flow from its operations? (Select the best choice below.) O A. BigBox has generated positive cash flow from its operations during the years 2013, 2015, and 2016. O B. BigBox has generated positive cash flow from its operations during the years 2014, 2015, and 2016. O c. BigBox has generated positive cash flow from its operations during the years 2013, 2014, and 2016. O D. BigBox has generated positive cash flow from its operations during the years 2013, 2014, 2015, and 2016. 0 Data Table (US$ millions) Net income Depreciation expense Changes in working capital Cash from operating activities Capital expenditures Cash from investing activities Interest and financing cash flow items Total cash dividends paid Issuance (retirement) of stock Issuance (retirement) of debt Cash from financing activities Net change in cash 12/31/2016 $13,090 6,490 1,180 $20,760 $(16,050) $(16,050) $(370) (3,630) (7,950) 1,540 $(10,410) $(5,700) 12/31/2015 12/31/2014 12/31/2013 $12,030 $11,090 $10,030 6,350 5,000 3,980 2,340 2,350 1,050 $20,720 $18,440 $15,060 $(14,500) $(14,030) $(12,330) $(14,500) $(14,030) $(12,330) $(260) $(360) $70 (2,830) (2,500) (2,210) (1,450) (3,580) (4,550) (80) 4,040 4,140 $(4,620) $(2,400) $(2,550) $1,600 $2,010 $180 Print Done (Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc. spanning the period 2013-2016 are found here: . Answer the following questions using the information found in these statements: a. Did BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over the period? c. Describe BigBox's sources of financing in the financial markets over the period. d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over the period. a. Did BigBox generate positive cash flow from its operations? (Select the best choice below.) O A. BigBox has generated positive cash flow from its operations during the years 2013, 2015, and 2016. O B. BigBox has generated positive cash flow from its operations during the years 2014, 2015, and 2016. O c. BigBox has generated positive cash flow from its operations during the years 2013, 2014, and 2016. O D. BigBox has generated positive cash flow from its operations during the years 2013, 2014, 2015, and 2016. 0 Data Table (US$ millions) Net income Depreciation expense Changes in working capital Cash from operating activities Capital expenditures Cash from investing activities Interest and financing cash flow items Total cash dividends paid Issuance (retirement) of stock Issuance (retirement) of debt Cash from financing activities Net change in cash 12/31/2016 $13,090 6,490 1,180 $20,760 $(16,050) $(16,050) $(370) (3,630) (7,950) 1,540 $(10,410) $(5,700) 12/31/2015 12/31/2014 12/31/2013 $12,030 $11,090 $10,030 6,350 5,000 3,980 2,340 2,350 1,050 $20,720 $18,440 $15,060 $(14,500) $(14,030) $(12,330) $(14,500) $(14,030) $(12,330) $(260) $(360) $70 (2,830) (2,500) (2,210) (1,450) (3,580) (4,550) (80) 4,040 4,140 $(4,620) $(2,400) $(2,550) $1,600 $2,010 $180 Print Done