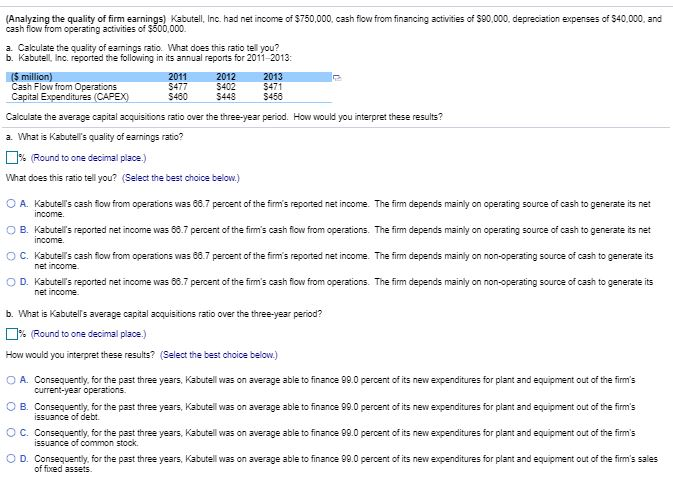

(Analyzing the quality of firm earnings) Kabutell, Inc. had net income of $750,000, cash flow from financing activities of S90,000, depreciation expenses of $40,000, and cash flow from operating activities of $500,000 a. Calculate the quality of earnings ratio. What does this ratio tell you? b. Kabutell, Inc. reported the following in its annual reports for 2011-2013: (5 million) 2011 2012 2013 Cash Flow from Operations $477 402 $471 Capital Expenditures (CAPEX) $460 $448 $458 Calculate the average capital acquisitions ratio over the three-year period. How would you interpret these results? a. What is Kabutel's quality of earnings ratio? 0% (Round to one decimal place.) What does this ratio tell you? (Select the best choice below.) O A. Kabutel's cash flow from operations was 68.7 percent of the firm's reported net income. The fim depends mainly on operating source of cash to generate its net income OB. Kabutel's reported net income was 68.7 percent of the firm's cash flow from operations. The firm depends mainly on operating source of cash to generate its net income O C. Kabutel's cash flow from operations was 88.7 percent of the firm's reported net income. The firm depends mainly on non-operating source of cash to generate its net income OD. Kabutel's reported net income was 68.7 percent of the firm's cash flow from operations. The firm depends mainly on non-operating source of cash to generate its net income b. What is Kabutells average capital acquisitions ratio over the three-year period? % (Round to one decimal place.) How would you interpret these results? (Select the best choice below.) O A. Consequently, for the past three years, Kabutell was on average able to finance 99.0 percent of its new expenditures for plant and equipment out of the firm's current-year operations O B. Consequently, for the past three years, Kabutell was on average able to finance 99.0 percent of its new expenditures for plant and equipment out of the firm's issuance of debt. OC. Consequently, for the past three years, Kabutell was on average able to finance 99.0 percent of its new expenditures for plant and equipment out of the firm's issuance of common stock. OD. Consequently, for the past three years, Kabutell was on average able to finance 99.0 percent of its new expenditures for plant and equipment out of the firm's sales of fixed assets