Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* AnBbCcDd AaBbCcD. AaBbCc AaBbCcl AaBbCcD AaBbCc AaBbCcl AaBbCc Teoc q3 s... Teoc q3 s... Heading 1 1 Heading 2 1 Heading 3 1

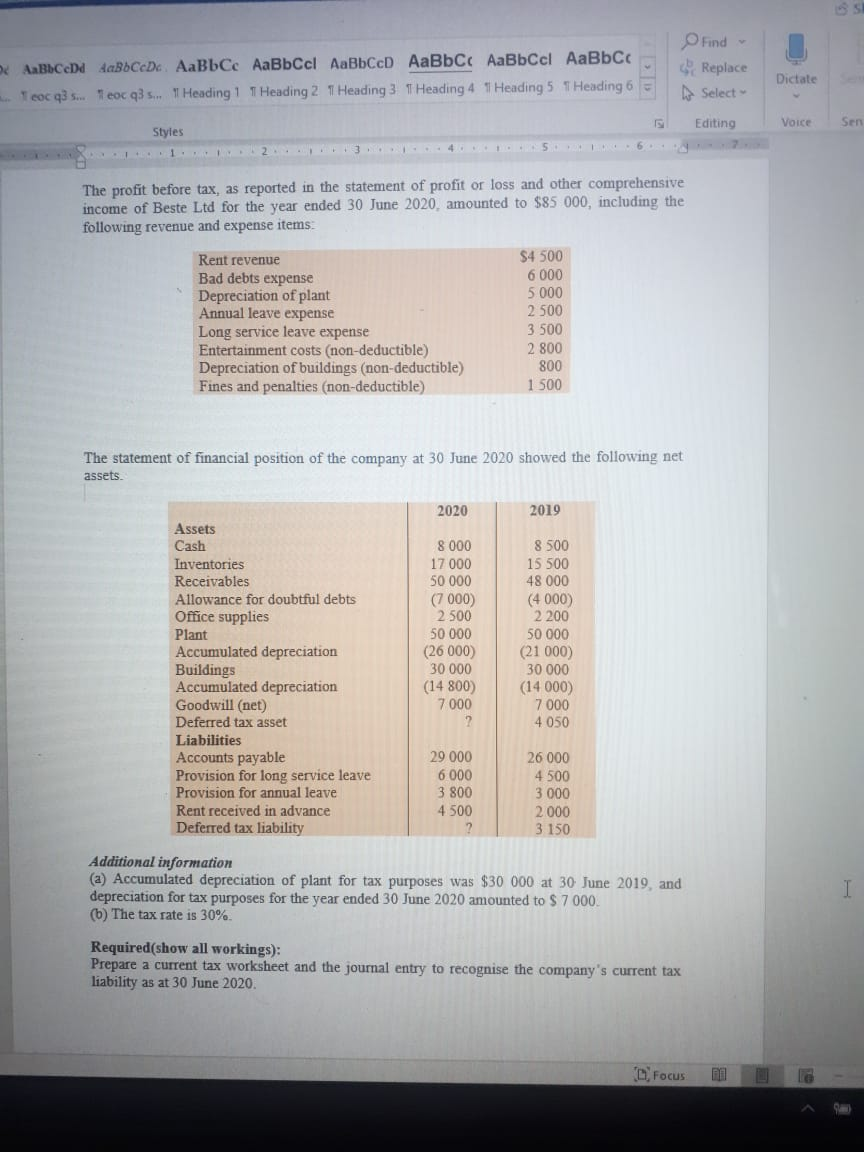

* AnBbCcDd AaBbCcD. AaBbCc AaBbCcl AaBbCcD AaBbCc AaBbCcl AaBbCc Teoc q3 s... Teoc q3 s... Heading 1 1 Heading 2 1 Heading 3 1 Heading 4 1 Heading 5 Heading 6 Styles 1. V Find Replace Select Editing The profit before tax, as reported in the statement of profit or loss and other comprehensive income of Beste Ltd for the year ended 30 June 2020, amounted to $85 000, including the following revenue and expense items: Rent revenue Bad debts expense Depreciation of plant Annual leave expense Long service leave expense Entertainment costs (non-deductible) Depreciation of buildings (non-deductible) Fines and penalties (non-deductible) $4.500 6 000 5.000 2 500 3 500 2 800 800 1.500 The statement of financial position of the company at 30 June 2020 showed the following net assets. 2020 2019 Assets Cash 8 000 8 500 Inventories 17 000 15 500 Receivables 50 000 48 000 Allowance for doubtful debts (7000) (4.000) Office supplies 2 500 2 200 Plant 50 000 50 000 Accumulated depreciation (26 000) (21 000) Buildings 30 000 30 000 Accumulated depreciation (14 800) (14 000) Goodwill (net) 7 000 7 000 Deferred tax asset 2 4 050 Liabilities Accounts payable 29 000 26 000 Provision for long service leave Provision for annual leave 6.000 4 500 3 800 3 000 Rent received in advance 4.500 ? 2000 3 150 Deferred tax liability Additional information (a) Accumulated depreciation of plant for tax purposes was $30 000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2020 amounted to $7000. (b) The tax rate is 30%. Required(show all workings): Prepare a current tax worksheet and the journal entry to recognise the company's current tax liability as at 30 June 2020. Focus Dictate S Voice Sen I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started