Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and 2. Harry O'Brien operates Leather Warehouse, a leather shop that sells luggage, handbags, business cases, i other leather goods. During the month of May,

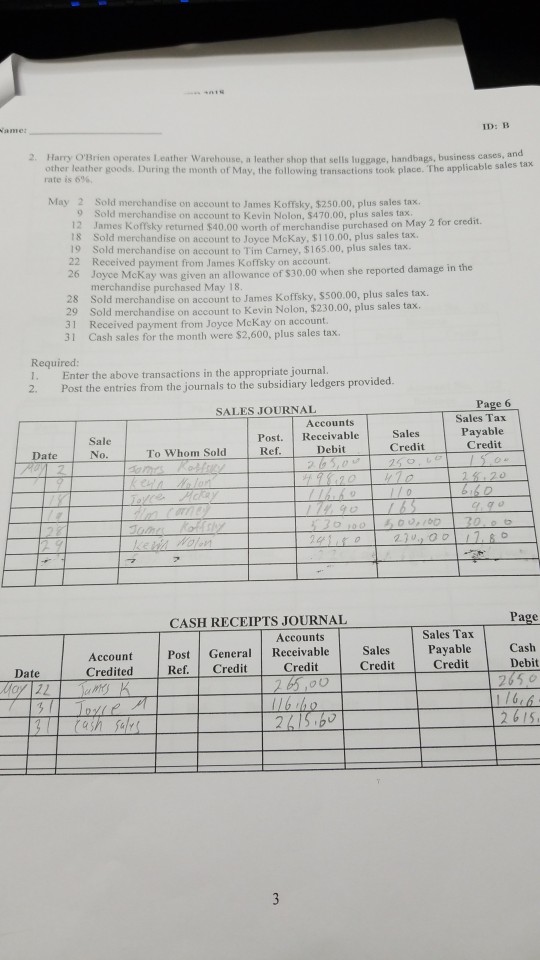

and 2. Harry O'Brien operates Leather Warehouse, a leather shop that sells luggage, handbags, business cases, i other leather goods. During the month of May, the following transactions took place. The applicable sales tax rate is 6%. May 2 Sold merchandise on account to James Koffsky, $250.00, plus sales tax. 9 Sold merchandise on account to Kevin Nolon, $470.00, plus sales tax 12 James Koffsky returned $40.00 worth of merchandise purchased on May 2 for credit. 18 Sold merchandise on account to Joyce McKay, $110.00, plus sales tax 19 Sold merchandise on account to Tim Carney. $165.00, plus sales tax. 22 Received payment from James Koffsky on account. 26 Joyce McK ay was given an allowance of $30.00 when she reported damage in the merchandise purchased May 18 28 Sold merchandise on account to James Koffsky, $500.00, plus sales tax 29 Sold merchandise on account to Kevin Nolon, $230.00, plus sales tax. 31 Received payment from Joyce McKay on account. 31 Cash sales for the month were $2,600, plus sales tax Required: 1. Enter the above transactions in the appropriate journal. 2. Post the entries from the journals to the subsidiary ledgers provided. SALES JOURNAL Sales Ta Payable Credit Accounts Sale No Post. Receivable Sales Ref Debit Credit Date To Whom Sold CASH RECEIPTS JOURNAL Accounts Sales Tax Account Post General Receivable SaleslCash Ref. Credit Credit Credit Credit Debit Date Credited or12 2615. ash say

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started