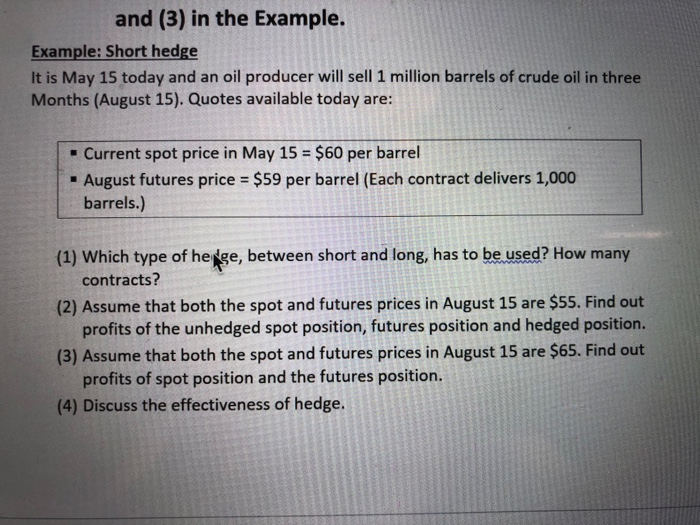

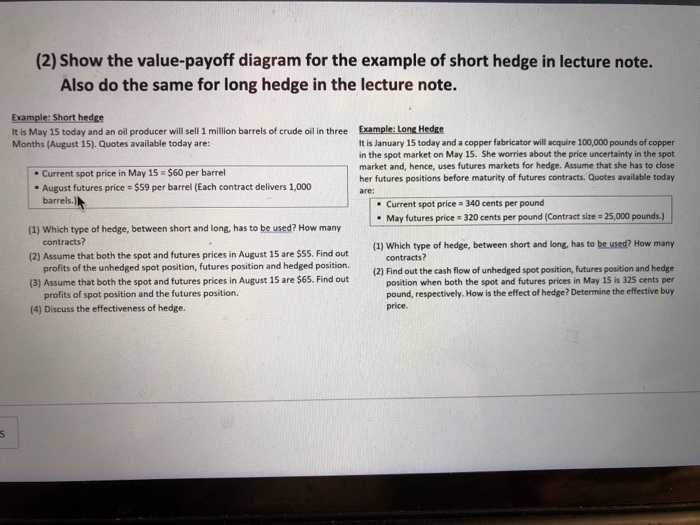

and (3) in the Example. Example: Short hedge It is May 15 today and an oil producer will sell 1 million barrels of crude oil in three Months (August 15). Quotes available today are: - Current spot price in May 15 = $60 per barrel August futures price = $59 per barrel (Each contract delivers 1,000 barrels.) (1) Which type of hege, between short and long, has to be used? How many contracts? (2) Assume that both the spot and futures prices in August 15 are $55. Find out profits of the unhedged spot position, futures position and hedged position. (3) Assume that both the spot and futures prices in August 15 are $65. Find out profits of spot position and the futures position. (4) Discuss the effectiveness of hedge. (2) Show the value-payoff diagram for the example of short hedge in lecture note. Also do the same for long hedge in the lecture note. Example: Short hedge It is May 15 today and an oil producer will sell 1 million barrels of crude oil in three Months (August 15). Quotes available today are: Example: Long Hedge It is January 15 today and a copper fabricator will acquire 100,000 pounds of copper in the spot market on May 15. She worries about the price uncertainty in the spot market and, hence, uses futures markets for hedge. Assume that she has to close her futures positions before maturity of futures contracts. Quotes available today - Current spot price in May 15 = $60 per barrel - August futures price = $59 per barrel (Each contract delivers 1,000 barrels. . Current spot price = 340 cents per pound . May futures price = 320 cents per pound (Contract size=25,000 pounds.) (1) Which type of hedge, between short and long, has to be used? How many contracts? (2) Assume that both the spot and futures prices in August 15 are $55. Find out profits of the unhedged spot position, futures position and hedged position. (3) Assume that both the spot and futures prices in August 15 are $65. Find out profits of spot position and the futures position. (4) Discuss the effectiveness of hedge. (1) Which type of hedge, between short and long, has to be used? How many contracts? (2) Find out the cash flow of unhedged spot position, futures position and hedge position when both the spot and futures prices in May 15 is 325 cents per pound, respectively. How is the effect of hedge? Determine the effective buy price