Answered step by step

Verified Expert Solution

Question

1 Approved Answer

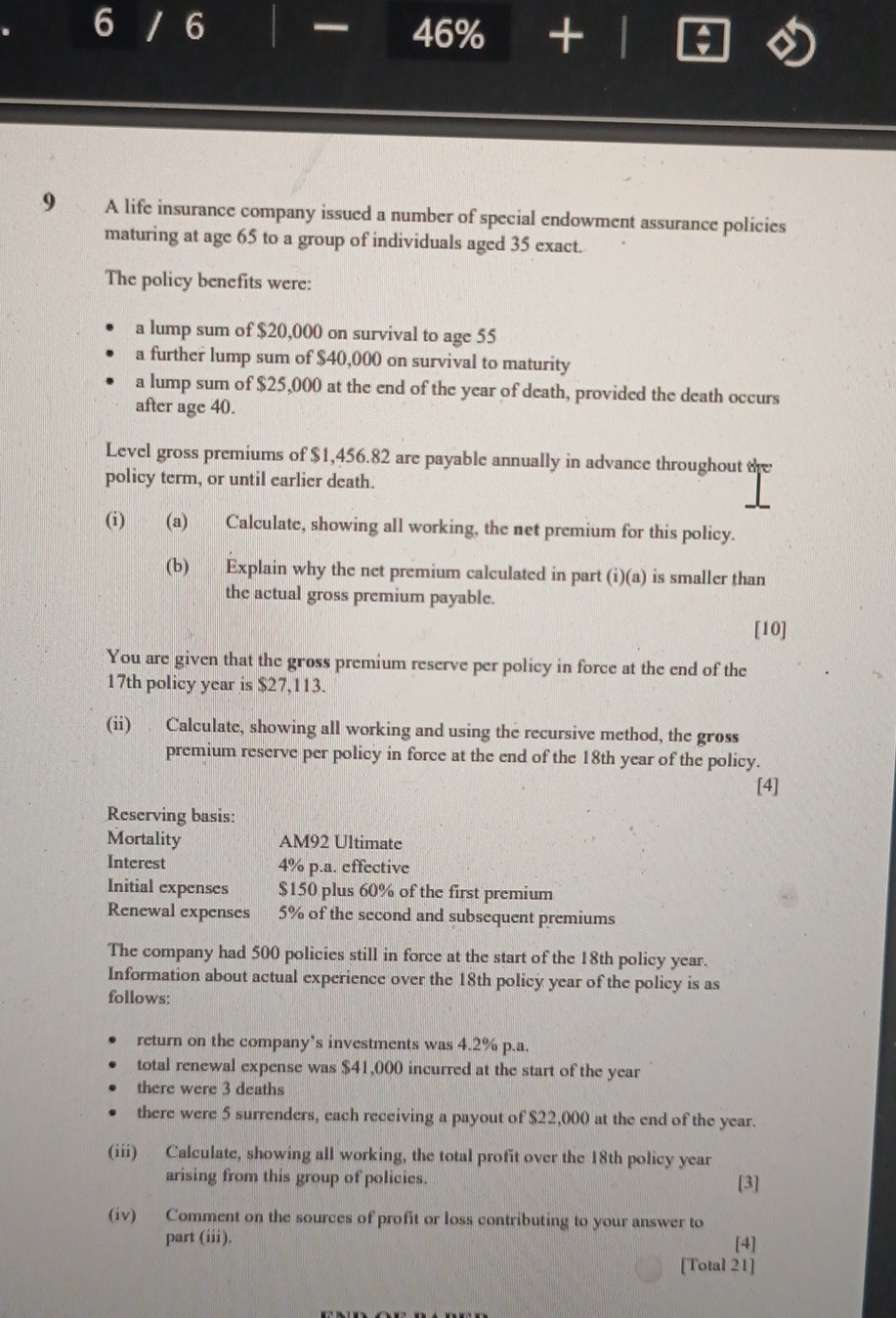

and 4 = > maturing at age 6 5 to a group of individuals aged 3 5 exact.The policy benefits were: a lump sum of

andmaturing at age to a group of individuals aged exact.The policy benefits were:

a lump sum of $ on survival to age

a further lump sum of $ on survival to maturity

a lump sum of $ at the end of the year of death, provided the death occurs after age

Level gross premiums of $ are payable annually in advance throughout of e policy term, or until earlier death.

ia Calculate, showing all working, the net premium for this policy.

b Explain why the net premium calculated in part ia is smaller than the actual gross premium payable.

You are given that the gross premium reserve per policy in force at the end of the th policy year is $

ii Calculate, showing all working and using the recursive method, the gross premium reserve per policy in force at the end of the th year of the policy.

Reserving basis:

Mortality

Interest

Initial expenses

Renewal expenses

AM Ultimate

pa effective

$ plus of the first premium

of the second and subsequent premiums

The company had policies still in force at the start of the th policy year. Information about actual experience over the th policy year of the policy is as follows:

return on the company's investments was pa

total renewal expense was $ incurred at the start of the year

there were deaths

there were surrenders, each receiving a payout of $ at the end of the year.

iii Calculate, showing all working, the total profit over the th policy year arising from this group of policies.

iv Comment on the sources of profit or loss contributing to your answer to part iii

Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started