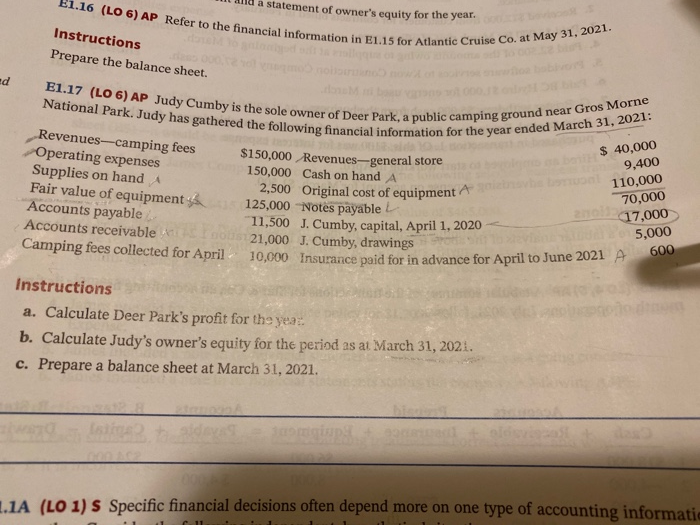

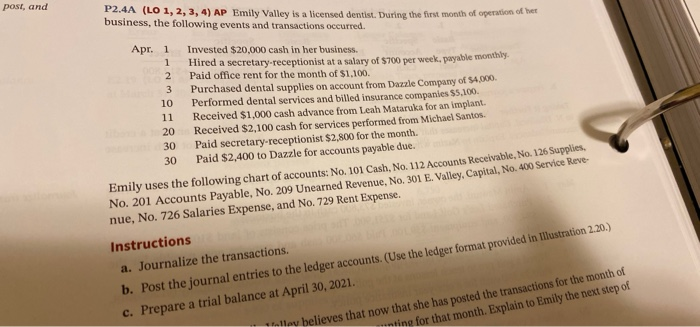

and a statement of owner's equity for the year. E1.16 (LO 6) AP Refer to the financial informatie Instructions Prepare the balance sheet. the financial information in E1.15 for Atlantic Cruise Co. Cruise Co. at May 31, 2021. E1.17 (LO 6) AP Judy Cumby is the sole own National Park. Judy has gathered the following financial information y cumby is the sole owner of Deer Park. a public camping grou Revenues-camping fees Operating expenses Supplies on hand Fair value of equipments Accounts payable Accounts receivable Camping fees collected for April $150,000 Revenues-general store 150,000 Cash on hand A 2,500 Original cost of equipment A 125,000 Notes payable 11,500 J. Cumby, capital, April 1, 2020 21,000 J. Cumby, drawings 10,000 Insurance paid for in advance for Apr imping ground near Gros Morne rmation for the year ended March 31, 2021: $ 40,000 9,400 110,000 70,000 17,000 5,000 id for in advance for April to June 2021 A 600 Instructions a. Calculate Deer Park's profit for the year b. Calculate Judy's owner's equity for the period as at March 31, 2021. c. Prepare a balance sheet at March 31, 2021. 1.1A (LO 1) S Specific financial decisions often depend more on one type of accounting informati post, and P2.4A (LO 1, 2, 3, 4) AP Emily Valley is a licensed dentis. During the first month of operation business, the following events and transactions occurred. Apr. 1 2 3 10 11 20 30 30 Invested $20,000 cash in her business. Hired a secretary-receptionist at a salary of $700 per week, payable monthly Paid office rent for the month of $1,100. Purchased dental supplies on account from Dazzle Company of $4,000 Performed dental services and billed insurance companies $5.100. Received $1,000 cash advance from Leah Mataruka for an implant. Received $2,100 cash for services performed from Michael Santos Paid secretary-receptionist $2,800 for the month. Paid $2,400 to Dazzle for accounts payable due. Emily uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies. No. 201 Accounts Payable, No. 209 Unearned Revenue, No. 301 E. Valley, Capital, No. 400 Service Reve nue, No. 726 Salaries Expense, and No. 729 Rent Expense. Instructions a. Journalize the transactions. b. Post the journal entries to the ledger accounts. (Use the ledger format provided in Illustration 2.20.) c. Prepare a trial balance at April 30, 2021. le believes that now that she has posted the transactions for the month of ting for that month. Explain to Emily the next step of