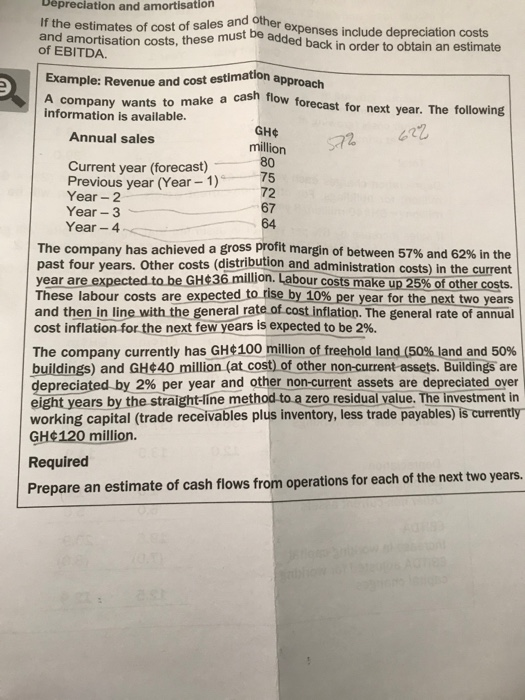

and amortisation costs, these must be added back in order to obtain an estimate If the estimates of cost of sales and other expenses include depreciation costs Example: Revenue and cost estimation approach A company wants to make a cash flow forecast for next year. The following Depreciation and amortisation of EBITDA information is available. Annual sales 572 GHC million 80 75 72 Current year (forecast) Previous year (Year - 1) Year - 2 Year - 3 67 Year - 4 64 The company has achieved a gross profit margin of between 57% and 62% in the past four years. Other costs (distribution and administration costs) in the current year are expected to be GH36 million. Labour costs make up 25% of other costs. These labour costs are expected to rise by 10% per year for the next two years and then in line with the general rate of cost inflation. The general rate of annual cost inflation for the next few years is expected to be 2%. The company currently has GH100 million of freehold land (50% land and 50% buildings) and GH40 million (at cost) of other non-current assets. Buildings are depreciated by 2% per year and other non-current assets are depreciated over eight years by the straight-line method to a zero residual value. The investment in working capital (trade receivables plus inventory, less trade payables) is currently GH120 million. Required Prepare an estimate of cash flows from operations for each of the next two years. and amortisation costs, these must be added back in order to obtain an estimate If the estimates of cost of sales and other expenses include depreciation costs Example: Revenue and cost estimation approach A company wants to make a cash flow forecast for next year. The following Depreciation and amortisation of EBITDA information is available. Annual sales 572 GHC million 80 75 72 Current year (forecast) Previous year (Year - 1) Year - 2 Year - 3 67 Year - 4 64 The company has achieved a gross profit margin of between 57% and 62% in the past four years. Other costs (distribution and administration costs) in the current year are expected to be GH36 million. Labour costs make up 25% of other costs. These labour costs are expected to rise by 10% per year for the next two years and then in line with the general rate of cost inflation. The general rate of annual cost inflation for the next few years is expected to be 2%. The company currently has GH100 million of freehold land (50% land and 50% buildings) and GH40 million (at cost) of other non-current assets. Buildings are depreciated by 2% per year and other non-current assets are depreciated over eight years by the straight-line method to a zero residual value. The investment in working capital (trade receivables plus inventory, less trade payables) is currently GH120 million. Required Prepare an estimate of cash flows from operations for each of the next two years