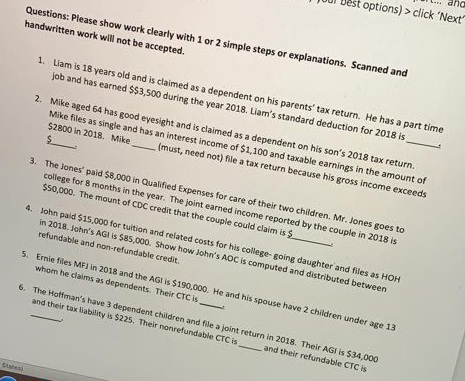

... and JUUDst options) > click 'Next Questions: Please show work clearly with 1 or 2 simple steps or explanations. Scanned and handwritten work will not be accepted. 1. Llam is 18 years old and is claimed as a dependent on his parents' tax return. He has a part time job and has earned S$3,500 during the year 2018. Liam's standard deduction for 2018 is 2. Mike aged 64 has rood eyesight and is claimed as a dependent on his son's 2018 tax return Mike files as single and has an interest income of $1,100 and taxable earnings in the amount of $2800 in 2018. Mike (must, need not) file a tax return because his gross income exceeds 3. The Jones' paid $8,000 in Qualified Expenses for care of their two children. Mr. Jones goes to college for 8 months in the year. The joint earned income reported by the couple in 2018 is $50,000. The mount of CDC credit that the couple could claim is $._ 4. John paid $15,000 for tuition and related costs for his college going daughter and files as HOH in 2018. John's AGA IS 585,000. Show how lohn's ADC is computed and distributed between refundable and non-refundable credit. 5. Ernie files MF) in 2018 and the AGI is $190,000. He and his spouse have 2 children under age 13 whom he claims as dependents. Their CTC is 6. The Hoffman's have 3 dependent children and file a joint return in 2018. Their AGI is $34,000 and their talability is $225. Their nonrefundable CTCs and their refundable CTC IS ... and JUUDst options) > click 'Next Questions: Please show work clearly with 1 or 2 simple steps or explanations. Scanned and handwritten work will not be accepted. 1. Llam is 18 years old and is claimed as a dependent on his parents' tax return. He has a part time job and has earned S$3,500 during the year 2018. Liam's standard deduction for 2018 is 2. Mike aged 64 has rood eyesight and is claimed as a dependent on his son's 2018 tax return Mike files as single and has an interest income of $1,100 and taxable earnings in the amount of $2800 in 2018. Mike (must, need not) file a tax return because his gross income exceeds 3. The Jones' paid $8,000 in Qualified Expenses for care of their two children. Mr. Jones goes to college for 8 months in the year. The joint earned income reported by the couple in 2018 is $50,000. The mount of CDC credit that the couple could claim is $._ 4. John paid $15,000 for tuition and related costs for his college going daughter and files as HOH in 2018. John's AGA IS 585,000. Show how lohn's ADC is computed and distributed between refundable and non-refundable credit. 5. Ernie files MF) in 2018 and the AGI is $190,000. He and his spouse have 2 children under age 13 whom he claims as dependents. Their CTC is 6. The Hoffman's have 3 dependent children and file a joint return in 2018. Their AGI is $34,000 and their talability is $225. Their nonrefundable CTCs and their refundable CTC IS