Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and part c) The standard deviation of the Mark II's present value is only 26% (vs 41%)? Thank you! Assumptions 1. The decision to invest

and part c)

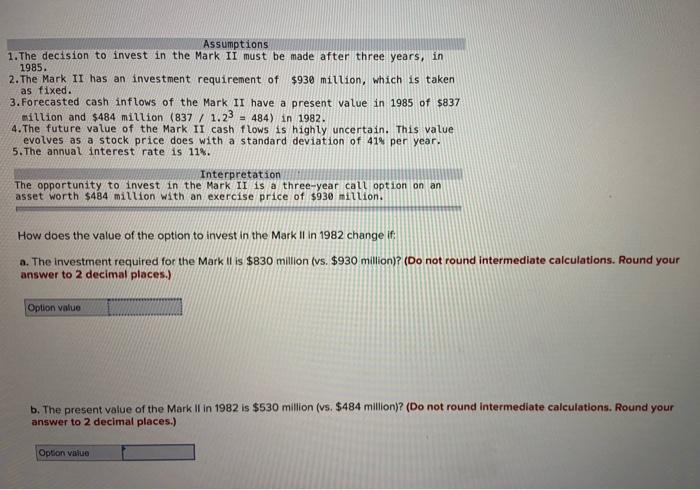

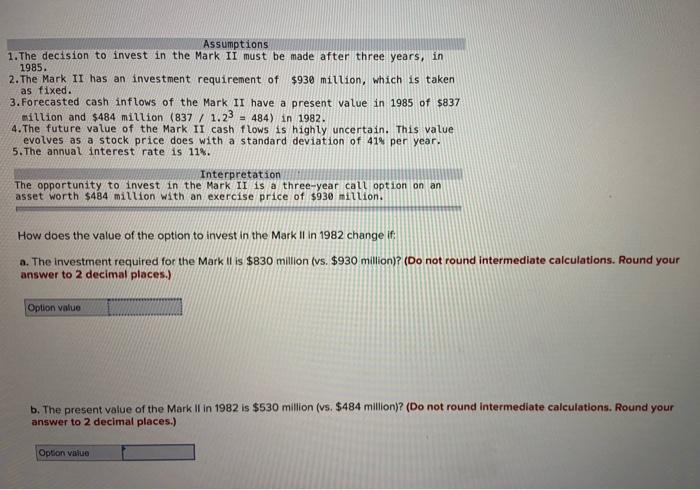

Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $930 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $837 million and $484 million (837 / 1.23 = 484) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 414 per year. 5. The annual interest rate is 11%. Interpretation The opportunity to invest in the Mark II 1s a three-year call option on an asset worth $484 million with an exercise price of $930 million. How does the value of the option to invest in the Mark Il in 1982 change if: a. The investment required for the Mark It is $830 million (vs. $930 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value b. The present value of the Mark II in 1982 is $530 million (vs. $484 million)? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Option value Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $930 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $837 million and $484 million (837 / 1.23 = 484) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 414 per year. 5. The annual interest rate is 11%. Interpretation The opportunity to invest in the Mark II 1s a three-year call option on an asset worth $484 million with an exercise price of $930 million. How does the value of the option to invest in the Mark Il in 1982 change if: a. The investment required for the Mark It is $830 million (vs. $930 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value b. The present value of the Mark II in 1982 is $530 million (vs. $484 million)? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Option value The standard deviation of the Mark II's present value is only 26% (vs 41%)?

Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started