Question

and Suppose that we then estimated the following pair of regressions: [1] f = 5000 + 50t + 0.1s, (1000) (32) (0.02) - -

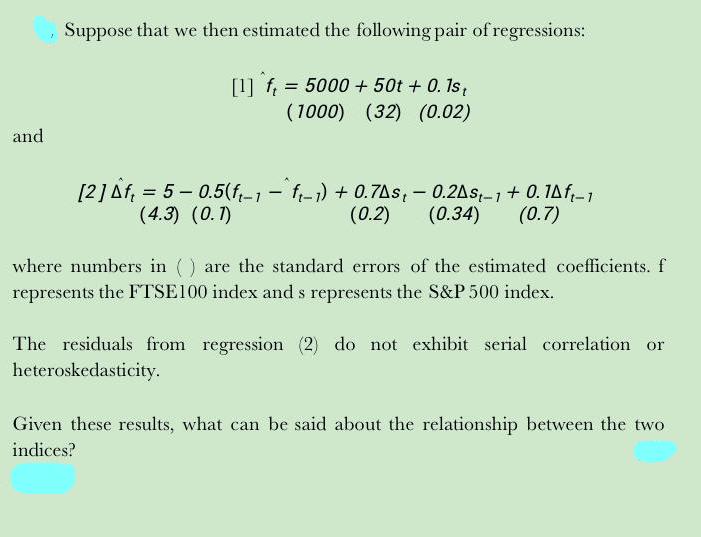

and Suppose that we then estimated the following pair of regressions: [1] f = 5000 + 50t + 0.1s, (1000) (32) (0.02) - - [2] Af = 50.5(f-1 f-1) + 0.70s 0.2As-1 + 0.1Aft-1 (4.3) (0.1) (0.2) (0.34) (0.7) where numbers in () are the standard errors of the estimated coefficients. f represents the FTSE100 index and s represents the S&P 500 index. The residuals from regression (2) do not exhibit serial correlation or heteroskedasticity. Given these results, what can be said about the relationship between the two indices?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the two regressions we can say the following about the relationship between the FTSE100 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Basic Econometrics

Authors: Damodar N. Gujrati, Dawn C. Porter

5th edition

73375772, 73375779, 978-0073375779

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App