Answered step by step

Verified Expert Solution

Question

1 Approved Answer

And this is all one problem Required information Problem 8-70 (LO 8.4) (Algo) [The following information applies to the questions displayed below.] Trey has fwo

And this is all one problem

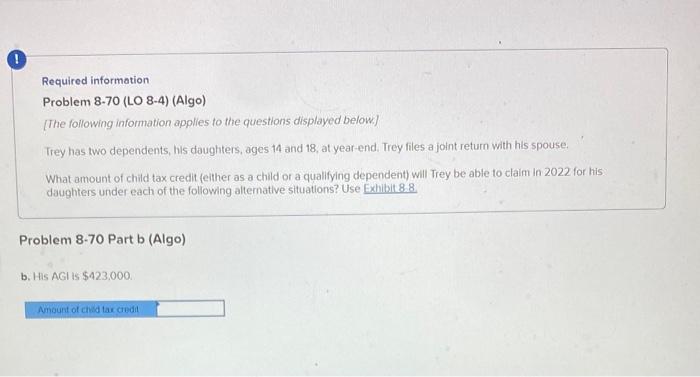

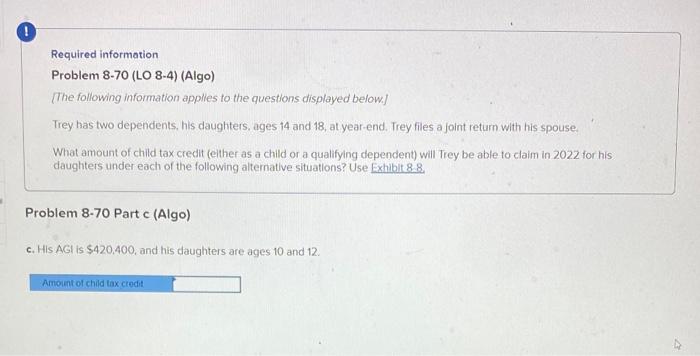

Required information Problem 8-70 (LO 8.4) (Algo) [The following information applies to the questions displayed below.] Trey has fwo dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for hits daughters under each of the following altemative situations? Use Exhlibil 88 . Problem 8-70 Part a (Algo) o. His AGI is $107,900. Required information Problem 8-70 (LO 8-4) (Algo) [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for his daughters under each of the following alternative situations? Use Exhibit 8.8 Problem 8-70 Part b (Algo) b. His AGI is $423,000. Required information Problem 8-70 (LO 8-4) (Algo) [The following information applles to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse. What amount of child tax credit (elther as a child or a qualifying dependent) will Trey be able to ciaim in 2022 for his daughters under each of the following altematlve situations? Use Exhibit 8.8 Problem 8-70 Part c (Algo) c. His AGI is $420,400, and his daughters are ages 10 and 12 . Required information Problem 8-70 (LO 8.4) (Algo) [The following information applies to the questions displayed below.] Trey has fwo dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for hits daughters under each of the following altemative situations? Use Exhlibil 88 . Problem 8-70 Part a (Algo) o. His AGI is $107,900. Required information Problem 8-70 (LO 8-4) (Algo) [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for his daughters under each of the following alternative situations? Use Exhibit 8.8 Problem 8-70 Part b (Algo) b. His AGI is $423,000. Required information Problem 8-70 (LO 8-4) (Algo) [The following information applles to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse. What amount of child tax credit (elther as a child or a qualifying dependent) will Trey be able to ciaim in 2022 for his daughters under each of the following altematlve situations? Use Exhibit 8.8 Problem 8-70 Part c (Algo) c. His AGI is $420,400, and his daughters are ages 10 and 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started