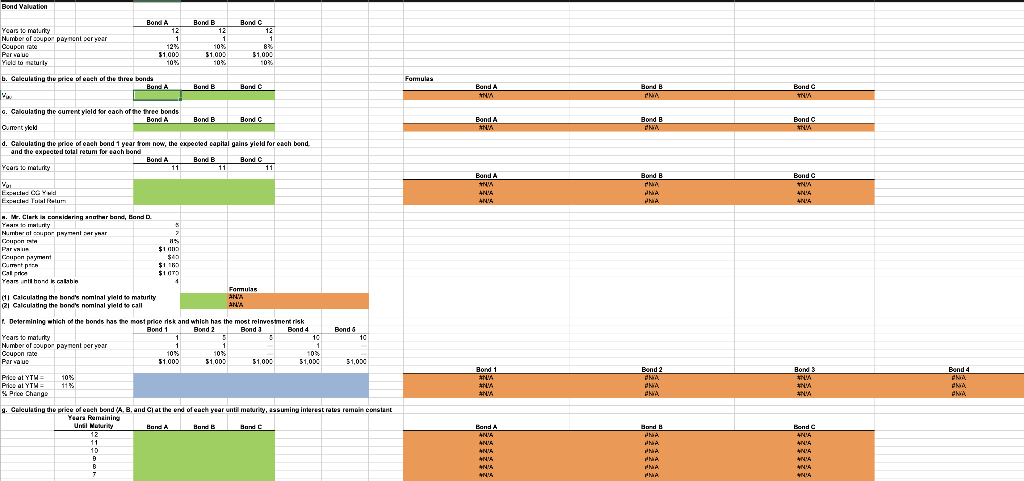

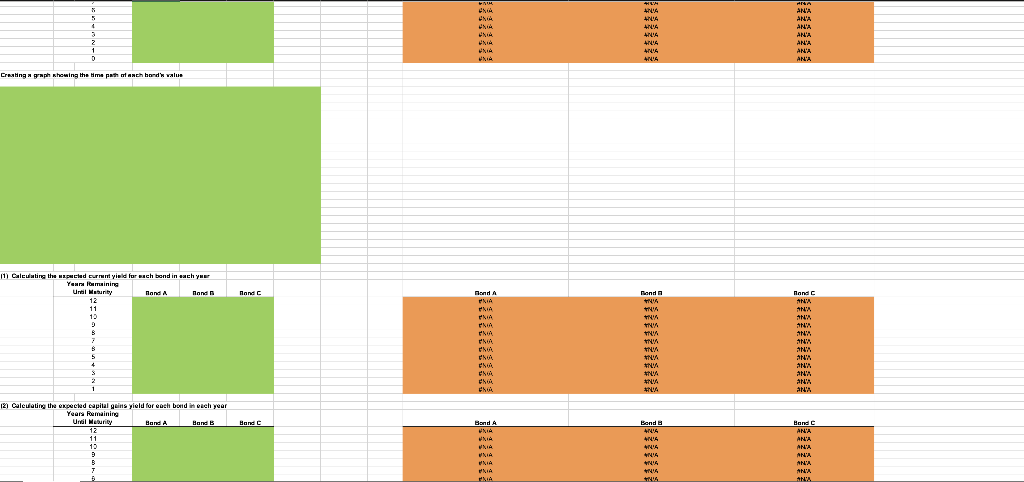

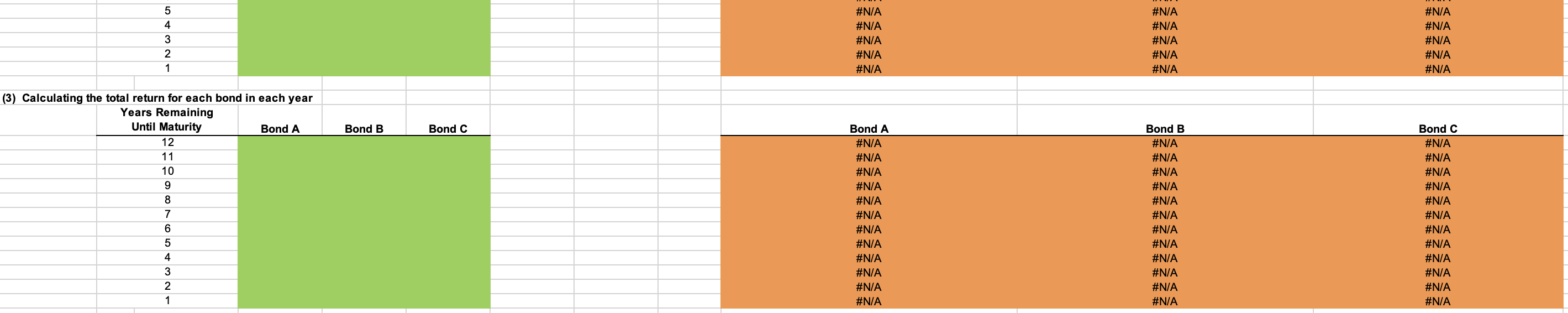

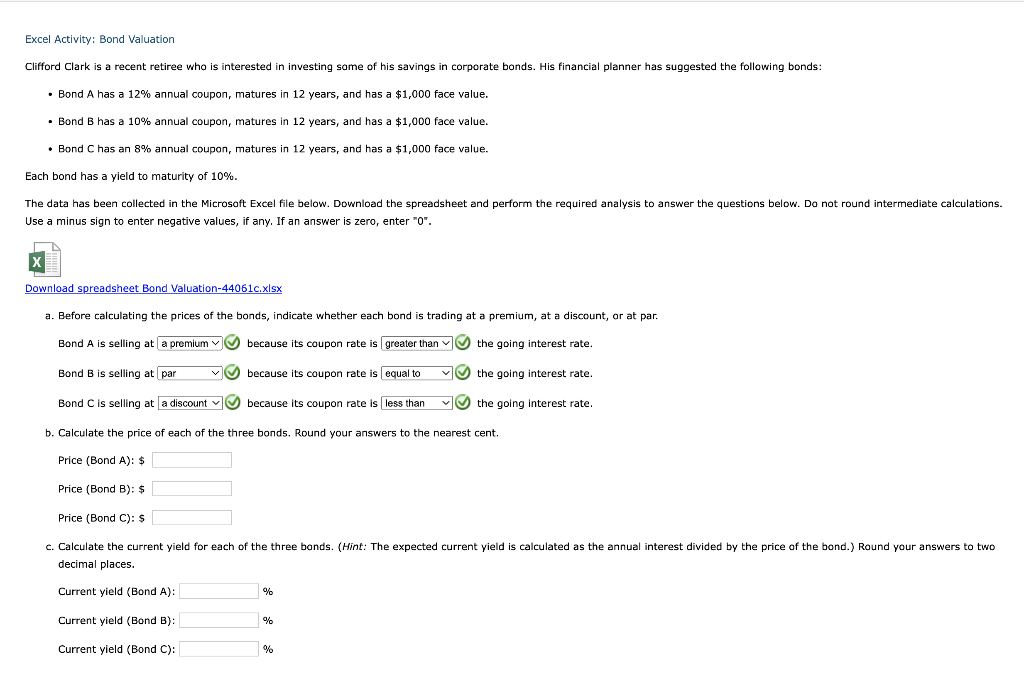

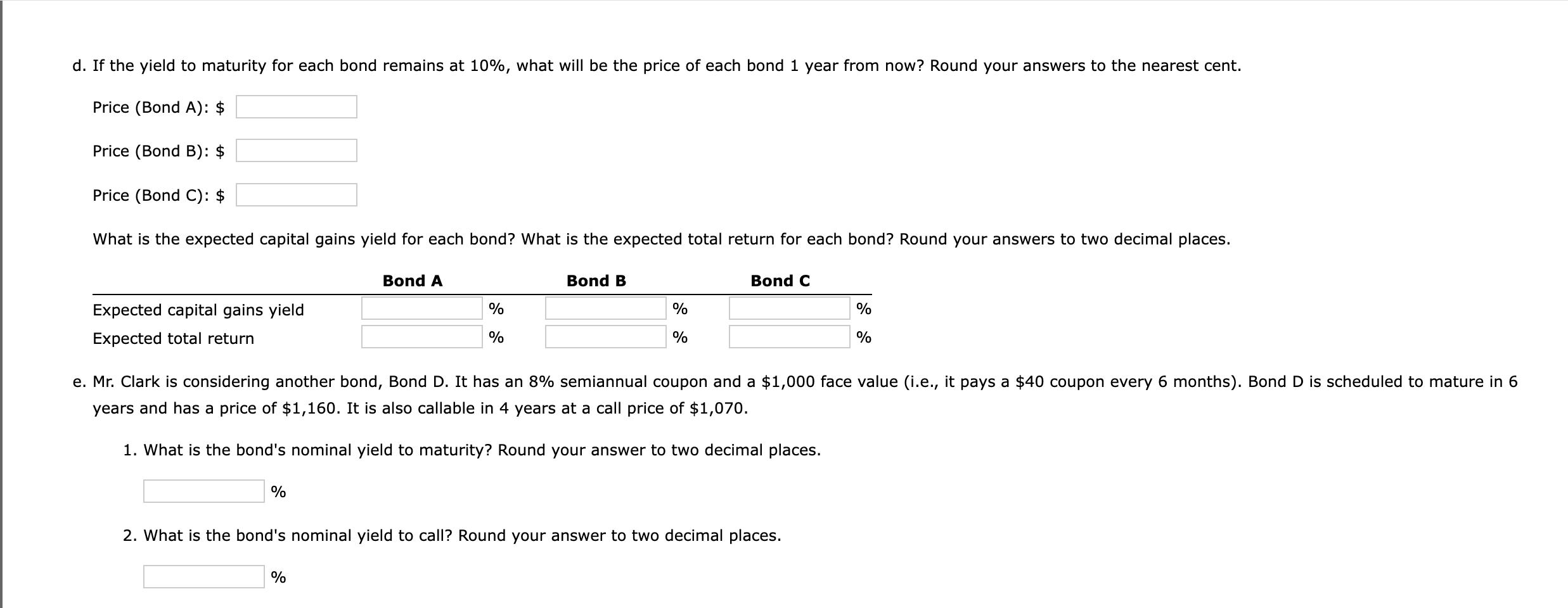

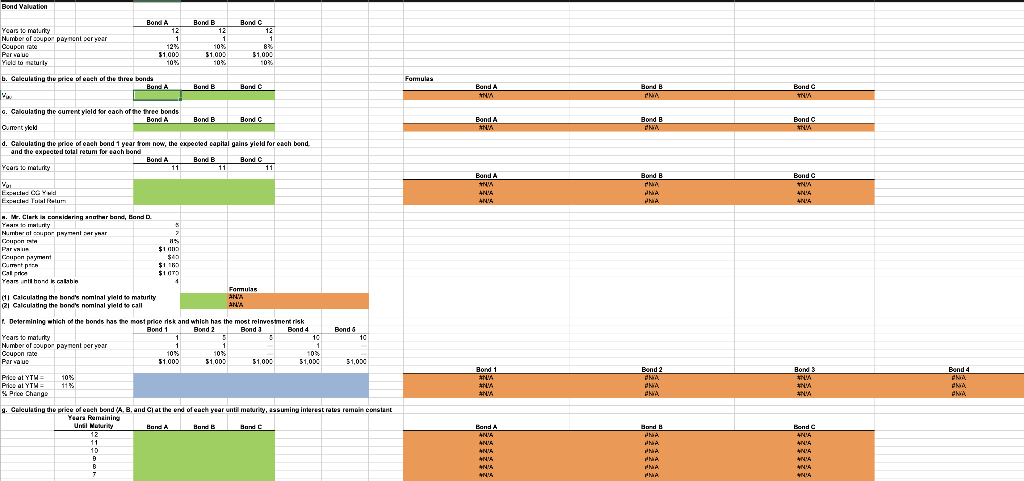

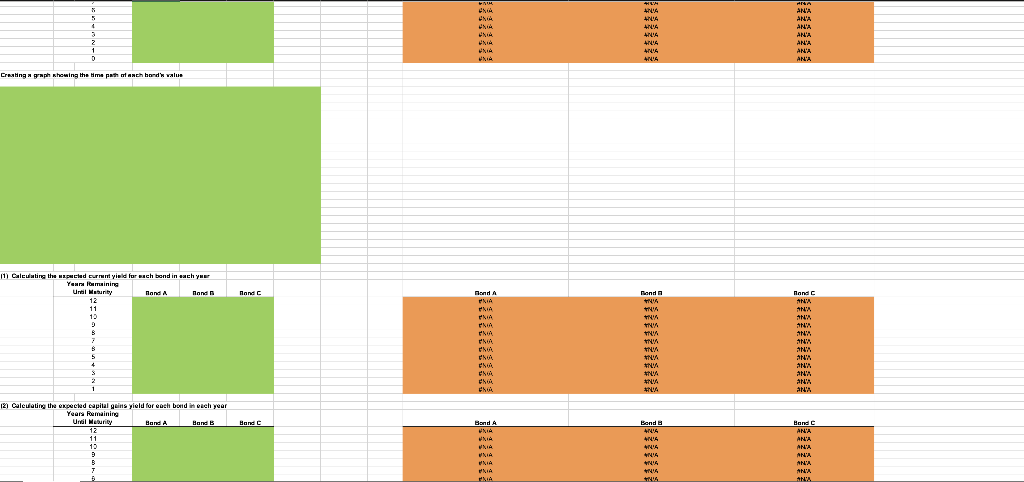

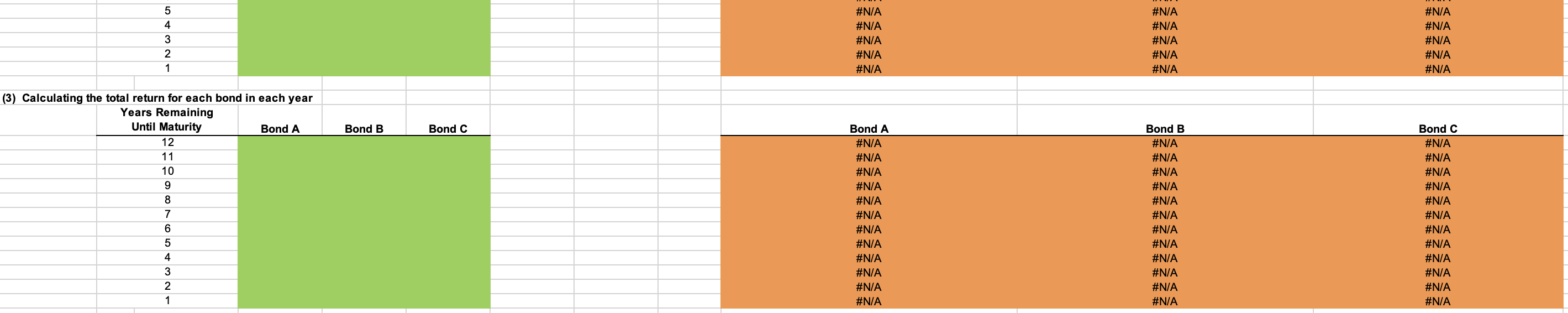

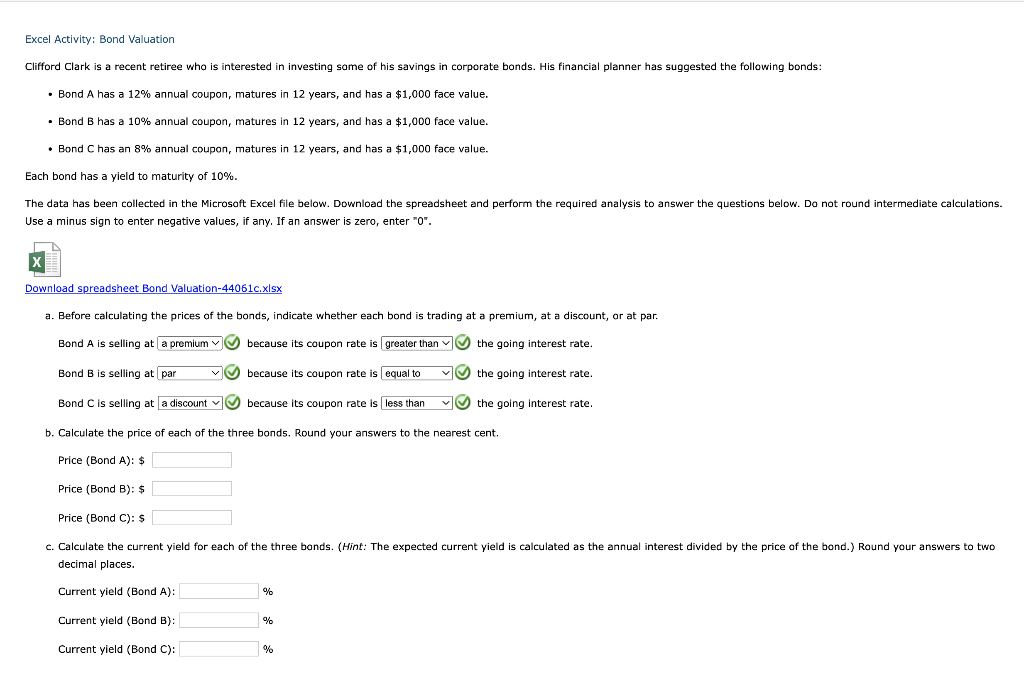

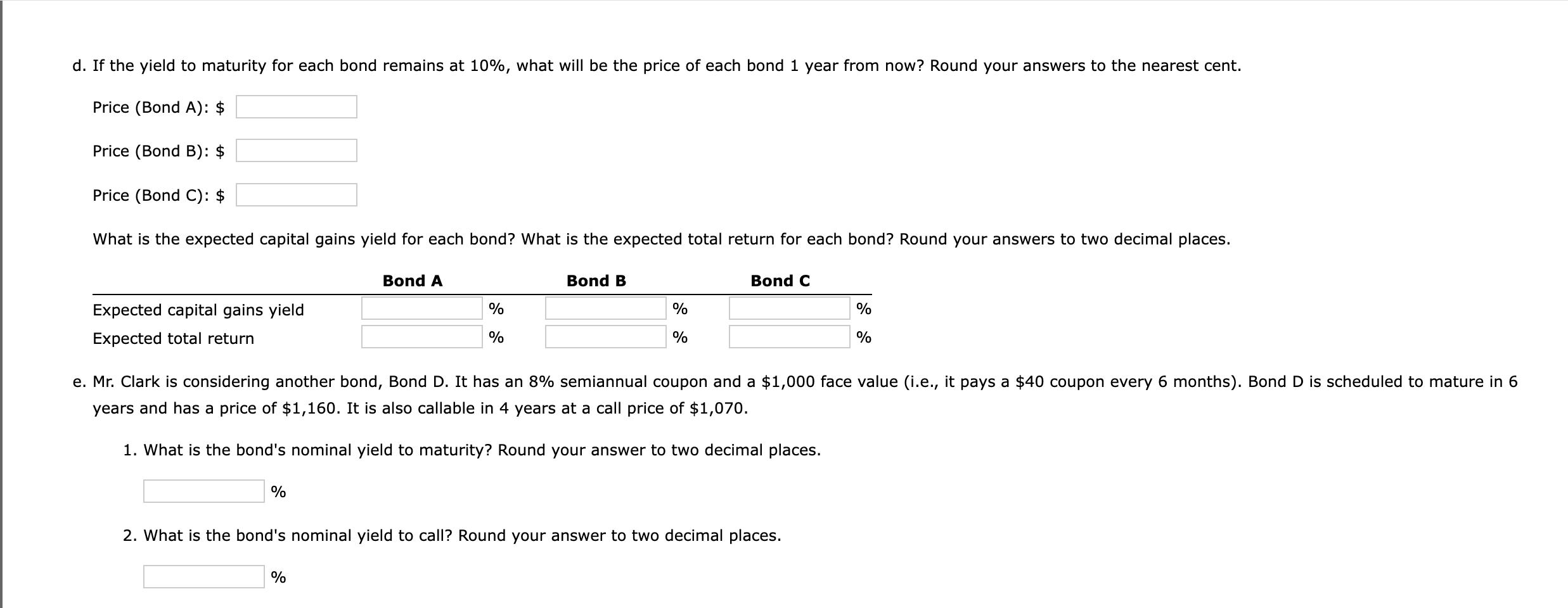

and ti exosebell total reouni for tah bnel (1) Giculsting the hond's nominsl yiold to mshirty Fonmulse (2) Calculsting the hond's nominsl yloid to call At4's Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has a 12% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 10%. Use a minus sign to enter negative values, if any. If an answer is zero, enter " 0 ". Download spreadsheet Bond Valuation-44061c. xsxx a. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par. BondAissellingatBondBissellingatBondCissellingatbecauseitscouponrateisbecauseitscouponrateisbecauseitscouponrateisinterestrate. b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): $ Price (Bond B): $ Price (Bond C): $ decimal places. Current yield (Bond A): % Current yield (Bond B): % Current yield (Bond C): d. If the yield to maturity for each bond remains at 10%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A):$ Price (Bond B): \$ Price (Bond C): $ What is the expected capital gains yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. years and has a price of $1,160. It is also callable in 4 years at a call price $1,070. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. % 2. What is the bond's nominal yield to call? Round your answer to two decimal places. and ti exosebell total reouni for tah bnel (1) Giculsting the hond's nominsl yiold to mshirty Fonmulse (2) Calculsting the hond's nominsl yloid to call At4's Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has a 12% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 10%. Use a minus sign to enter negative values, if any. If an answer is zero, enter " 0 ". Download spreadsheet Bond Valuation-44061c. xsxx a. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par. BondAissellingatBondBissellingatBondCissellingatbecauseitscouponrateisbecauseitscouponrateisbecauseitscouponrateisinterestrate. b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): $ Price (Bond B): $ Price (Bond C): $ decimal places. Current yield (Bond A): % Current yield (Bond B): % Current yield (Bond C): d. If the yield to maturity for each bond remains at 10%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A):$ Price (Bond B): \$ Price (Bond C): $ What is the expected capital gains yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. years and has a price of $1,160. It is also callable in 4 years at a call price $1,070. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. % 2. What is the bond's nominal yield to call? Round your answer to two decimal places