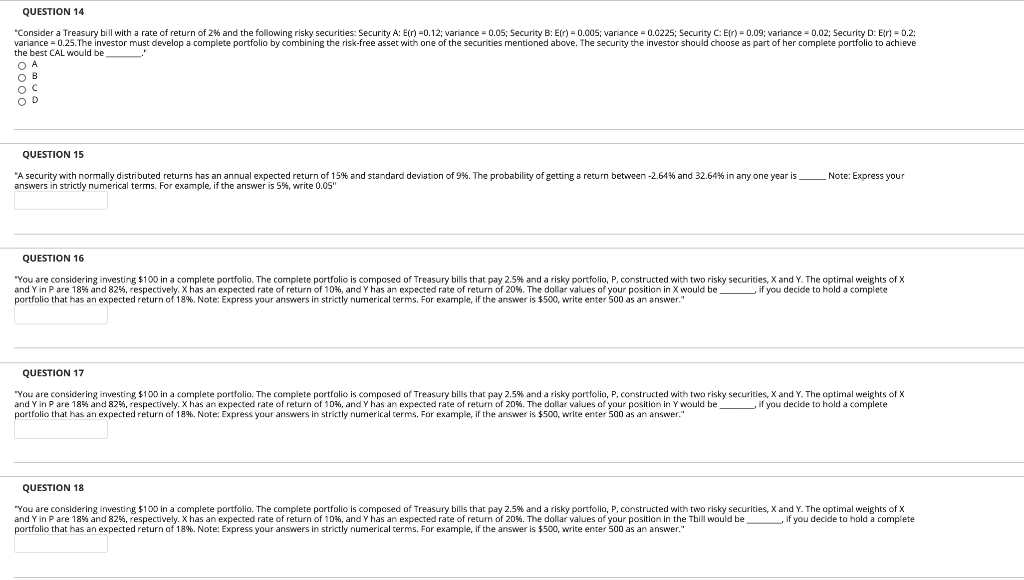

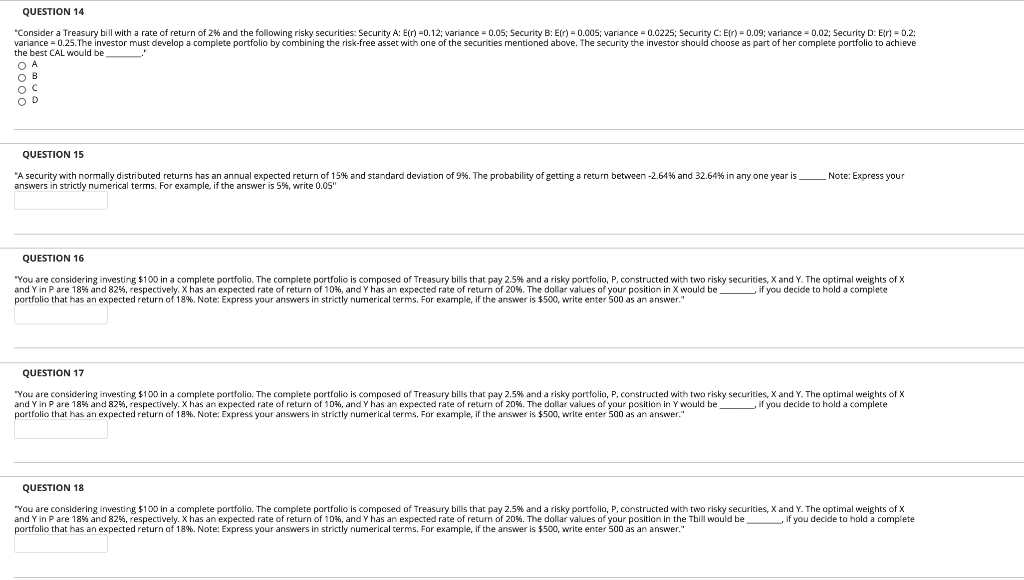

and Yin para investing X has an expected rate of return of 10% and Y has an expected rate of return of 20%. The dollar values of your position in X would be securities, X and Y. The optimal weights of X QUESTION 14 "Consider a Treasury bill with a rate of return of 2% and the following risky securities: Security A: E()=0.12; variance = 0.05; Security B: Etr) = 0.005; variance = 0.0225; Security C:Er) = 0.09; variance = 0.02; Security D: Er} = 0.2: variance = 0.25. The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of her complete portfolio to achieve the best CAL would be OA QUESTION 15 "A A security with normally distributed returns hi s has an annual expected return of 15% and standard deviation of The probability of getting a return between -2.64% and 32.64% in any one year is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 QUESTION 16 You are considering are 18% and . e $100 in a . % portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." if decide to QUESTION 17 "You are considering investing $100 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 2.5% and a risky portfolio, P. constructed with two risky securities, X and Y. The optimal weights of X and Yin P are 186 and 82%, respectively. X has an expected rate of return of 10%, and Y has an expected rate of return of 20%. The dollar values of your position in Y would be if you decide to hold a complete portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer QUESTION 18 "You are considering investing $100 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 2.5% and a risky portfolio, P. constructed with two risky securities, X and Y. The optimal weights of X and Yin P are 18% and 82%, respectively. X has an expected rate of return of 10%, and Y has an expected rate of return of 20%. The dollar values of your position in the Tbill would be if you decide to hold a complete portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." and Yin para investing X has an expected rate of return of 10% and Y has an expected rate of return of 20%. The dollar values of your position in X would be securities, X and Y. The optimal weights of X QUESTION 14 "Consider a Treasury bill with a rate of return of 2% and the following risky securities: Security A: E()=0.12; variance = 0.05; Security B: Etr) = 0.005; variance = 0.0225; Security C:Er) = 0.09; variance = 0.02; Security D: Er} = 0.2: variance = 0.25. The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of her complete portfolio to achieve the best CAL would be OA QUESTION 15 "A A security with normally distributed returns hi s has an annual expected return of 15% and standard deviation of The probability of getting a return between -2.64% and 32.64% in any one year is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 QUESTION 16 You are considering are 18% and . e $100 in a . % portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." if decide to QUESTION 17 "You are considering investing $100 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 2.5% and a risky portfolio, P. constructed with two risky securities, X and Y. The optimal weights of X and Yin P are 186 and 82%, respectively. X has an expected rate of return of 10%, and Y has an expected rate of return of 20%. The dollar values of your position in Y would be if you decide to hold a complete portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer QUESTION 18 "You are considering investing $100 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 2.5% and a risky portfolio, P. constructed with two risky securities, X and Y. The optimal weights of X and Yin P are 18% and 82%, respectively. X has an expected rate of return of 10%, and Y has an expected rate of return of 20%. The dollar values of your position in the Tbill would be if you decide to hold a complete portfolio that has an expected return of 18%. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an