Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anderson Construction Associates accepted a contract to build an office building on January 2, 2022. The company will complete the contract within two years. Anderson

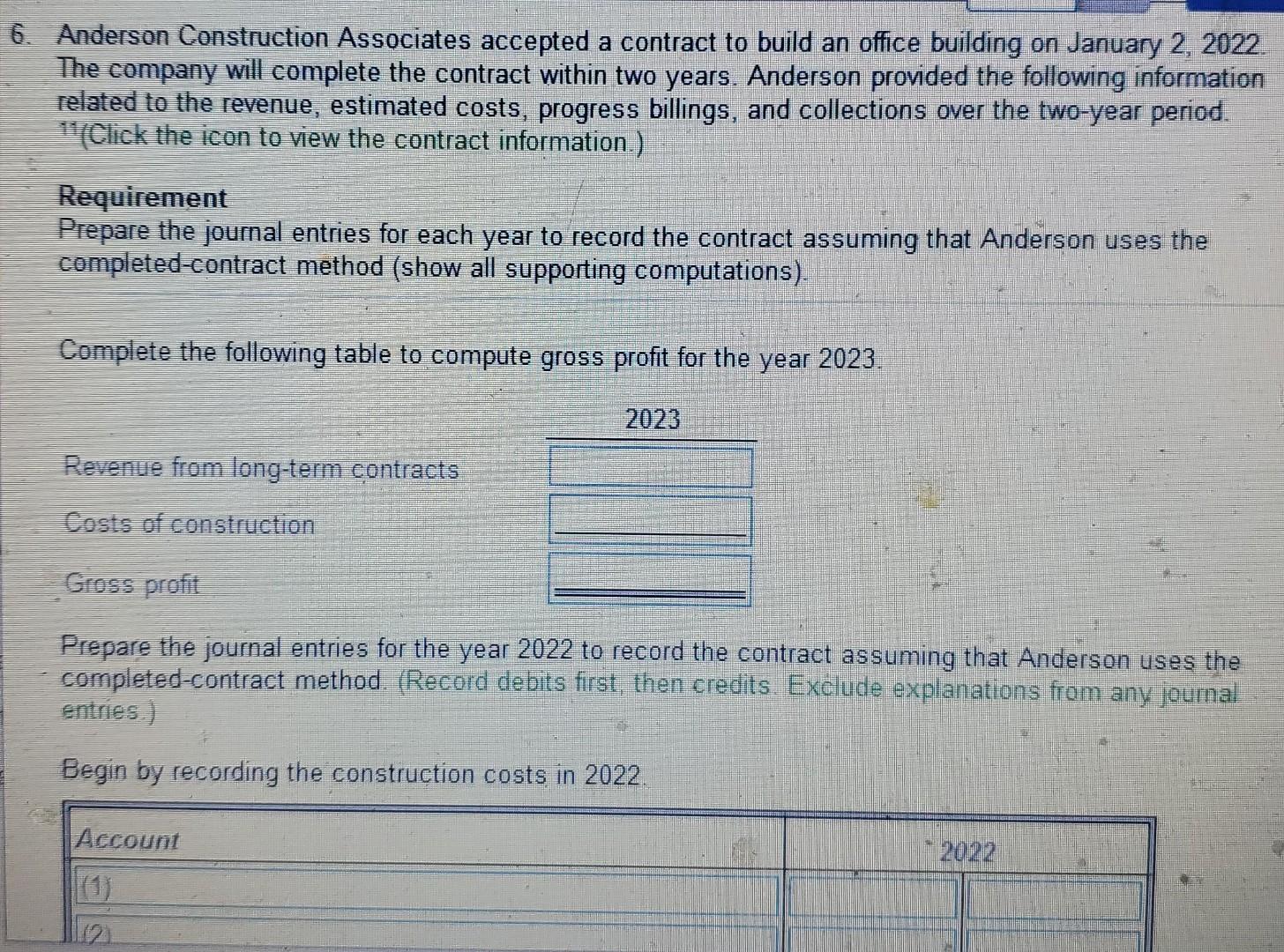

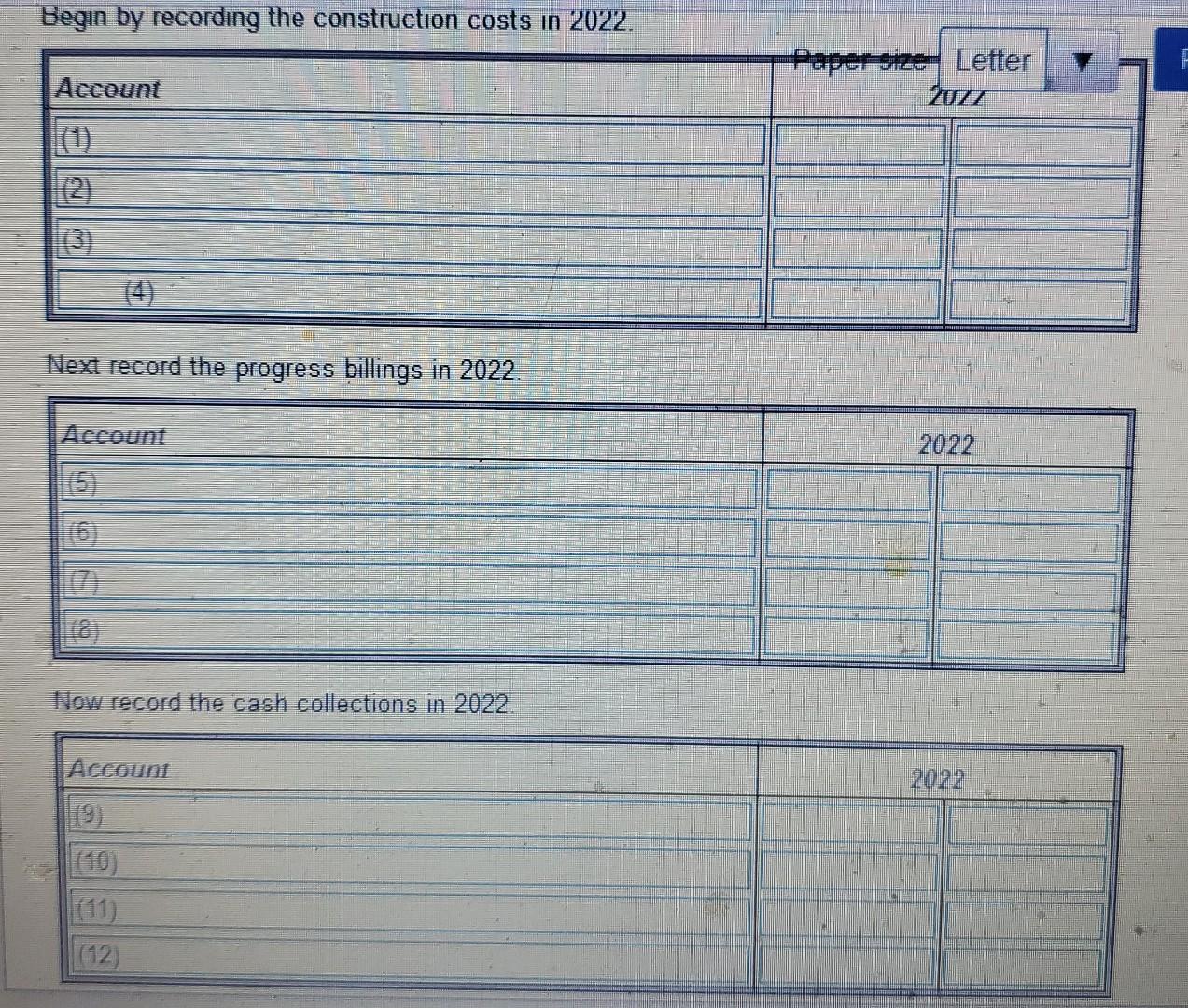

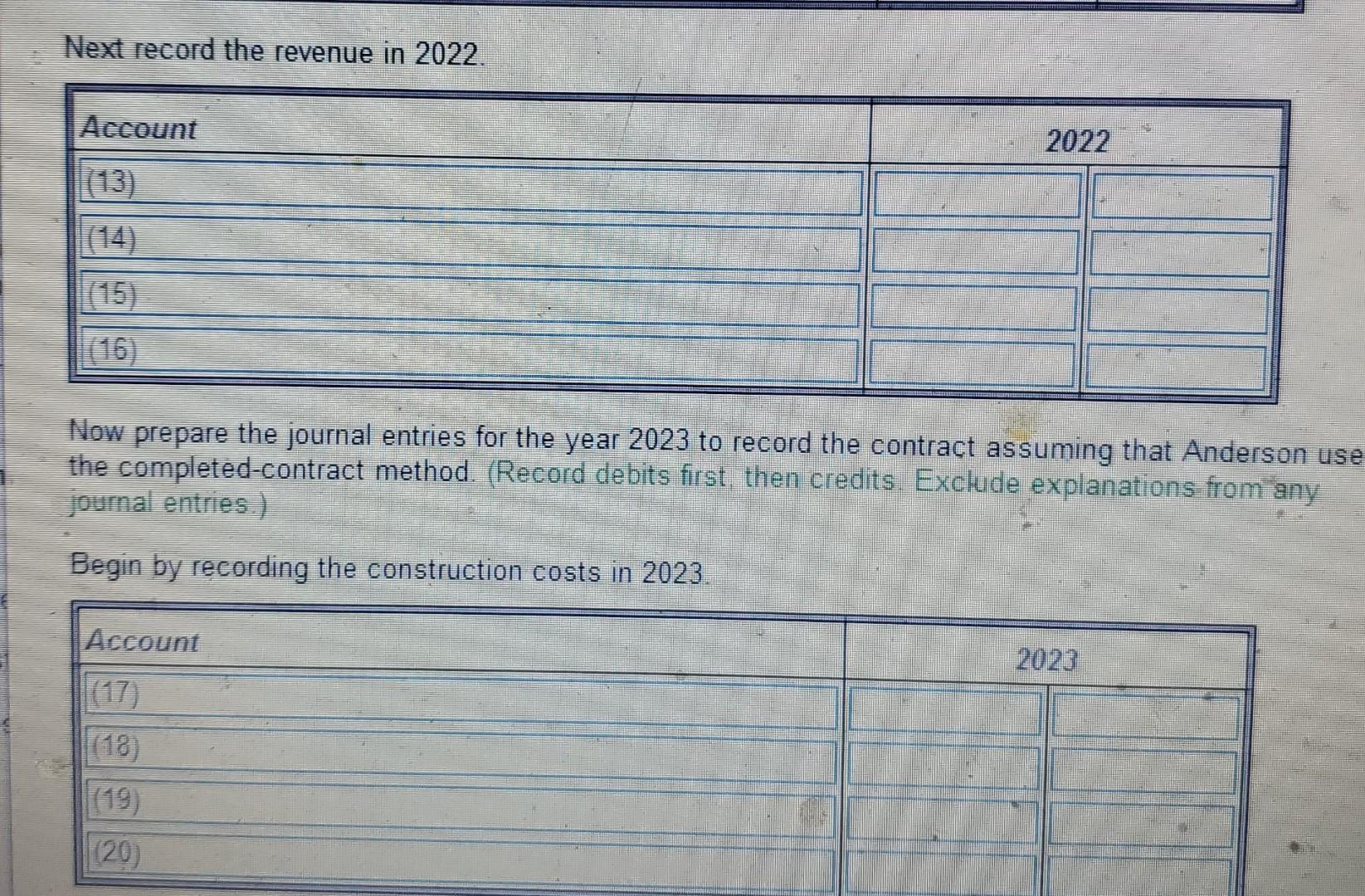

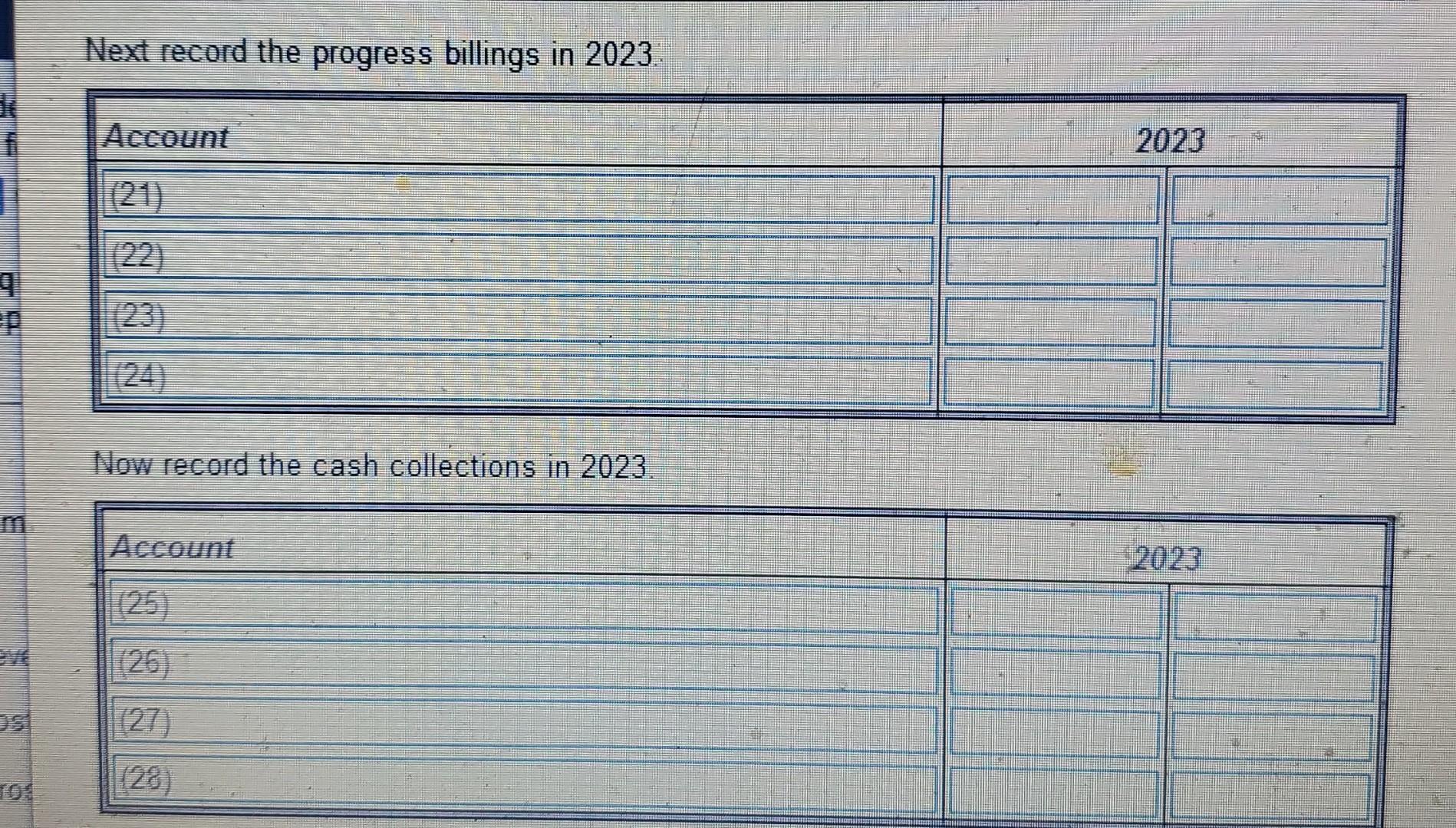

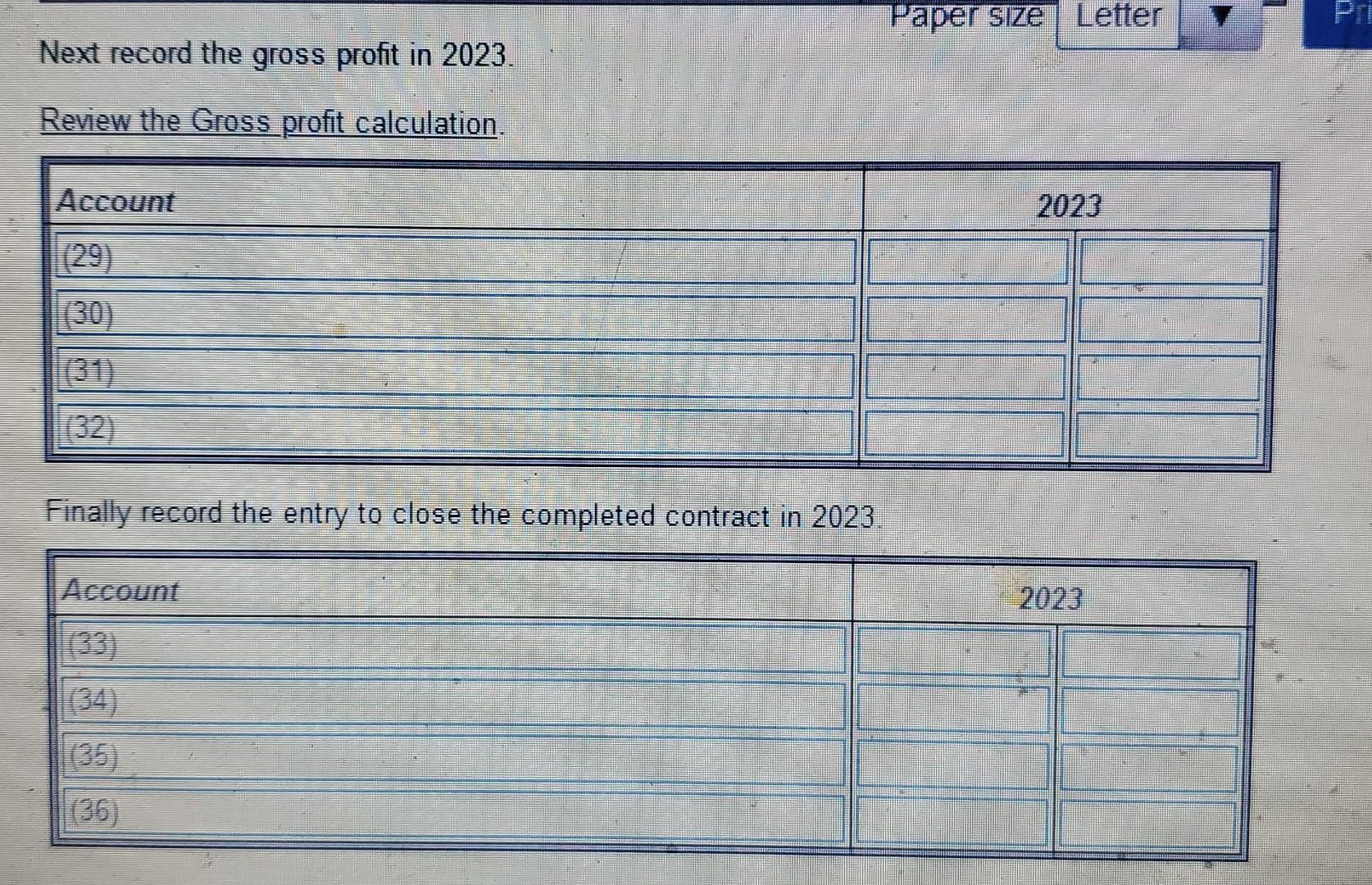

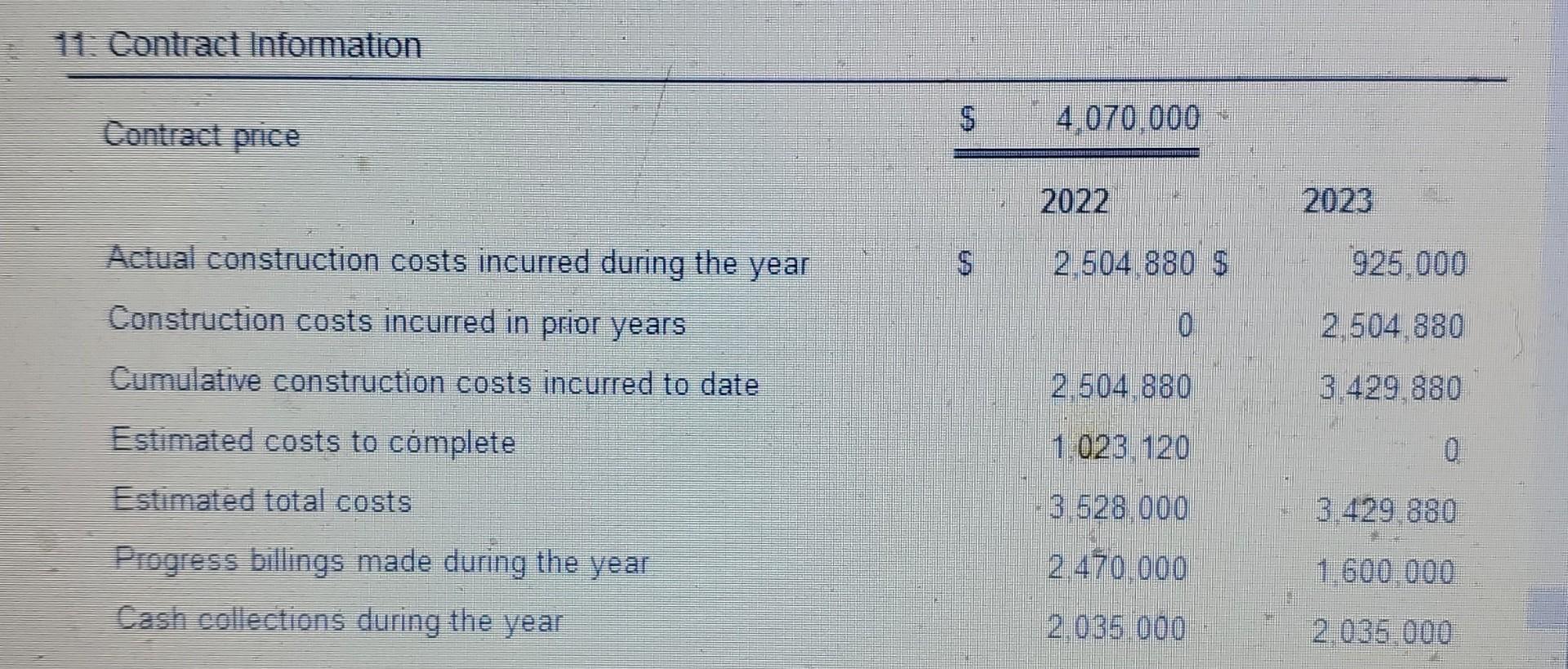

Anderson Construction Associates accepted a contract to build an office building on January 2, 2022. The company will complete the contract within two years. Anderson provided the following information related to the revenue, estimated costs, progress billings, and collections over the two-year period. "(Click the icon to view the contract information.) Requirement Prepare the journal entries for each year to record the contract assuming that Anderson uses the completed-contract method (show all supporting computations). Complete the following table to compute gross profit for the year 2023. Prepare the journal entries for the year 2022 to record the contract assuming that Anderson uses the completed-contract method. (Record debits first, then credits. Exclude explanations from any joumal entries.) Begin by recording the construction costs in 2022 . Begin by recording the construction costs in 2022 . Next record the progress billings in 2022. Now record the cash collections in 2022 . Next record the revenue in 2022 . Now prepare the journal entries for the year 2023 to record the contract assuming that Anderson us the completed-contract method. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by recording the construction costs in 2023 . Next record the progress billings in 2023 Now record the cash collections in 2023 Finally record the entry to close the completed contract in 2023 . 11: Contract Information Contract price \begin{tabular}{rrr} $ & 4,070,000 & \\ \hline \hline & 2022 & \\ $ & 2,504,880$ & 2023 \\ & 0 & 2,504,880 \\ & 2,504,880 & 3,429,880 \\ & 1,023,120 & 0 \\ & 3,528,000 & 3,429,880 \\ & 2,470,000 & 1,600,000 \\ & 2,035,000 & 2,035,000 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started