Answered step by step

Verified Expert Solution

Question

1 Approved Answer

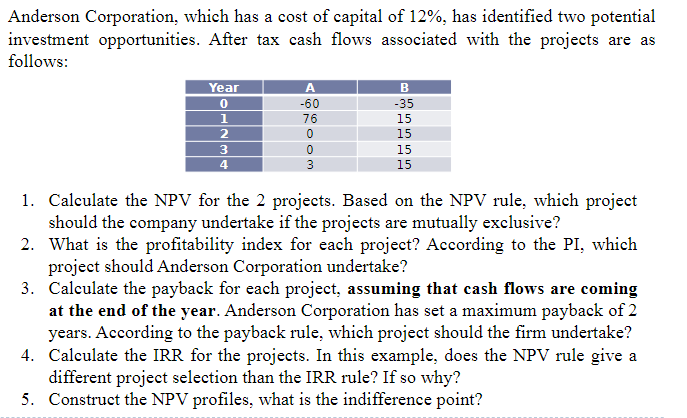

Anderson Corporation, which has a cost of capital of 12%, has identified two potential investment opportunities. After tax cash flows associated with the projects

Anderson Corporation, which has a cost of capital of 12%, has identified two potential investment opportunities. After tax cash flows associated with the projects are as follows: Year A -60 76 0 0 3 B -35 2222@ 15 In ini in 15 15 15 1. Calculate the NPV for the 2 projects. Based on the NPV rule, which project should the company undertake if the projects are mutually exclusive? 2. What is the profitability index for each project? According to the PI, which project should Anderson Corporation undertake? 3. Calculate the payback for each project, assuming that cash flows are coming at the end of the year. Anderson Corporation has set a maximum payback of 2 years. According to the payback rule, which project should the firm undertake? 4. Calculate the IRR for the projects. In this example, does the NPV rule give a different project selection than the IRR rule? If so why? 5. Construct the NPV profiles, what is the indifference point?

Step by Step Solution

★★★★★

3.62 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV for the two projects we need to discount the cash flows to their present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started