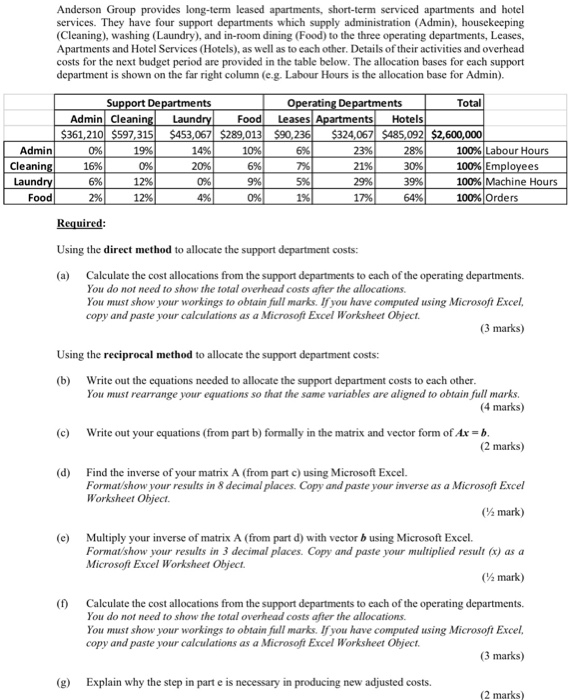

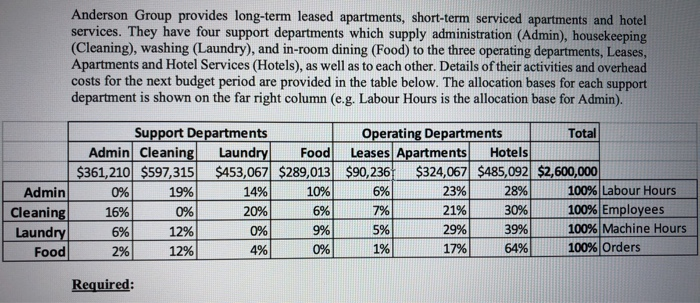

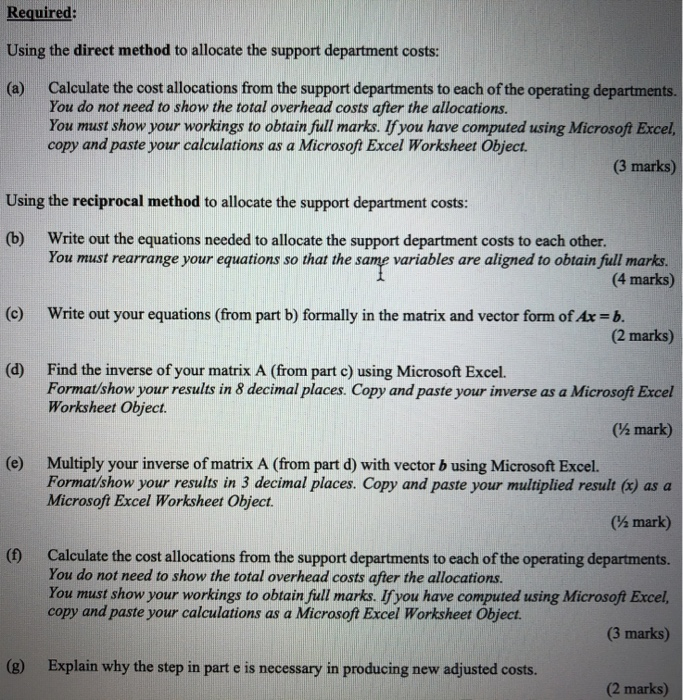

Anderson Group provides long-term leased apartments, short-term serviced apartments and hotel services. They have four support departments which supply administration (Admin), housekeeping (Cleaning), washing (Laundry), and in-room dining (Food) to the three operating departments, Leases, Apartments and Hotel Services (Hotels), as well as to each other. Details of their activities and overhead costs for the next budget period are provided in the table below. The allocation bases for each support department is shown on the far right column (e.g. Labour Hours is the allocation base for Admin). Admin Cleaning Laundry Food Support Departments Admin Cleaning| Laundry Food $361,210 $597,315 $453,067 $289,013 0% 19% 14% 10% 16% 0%| 20% 6% 6% 12% 0% 9% 2% 12% 4% 0% Operating Departments Total Leases Apartments Hotels $90,236 $324,067 $485,092 $2,600,000 6% 23% 28% 100% Labour Hours 7% 21% 30% 100% Employees 5% 29% 39% 100% Machine Hours 1% 17% 64% 100% Orders Required: Using the direct method to allocate the support department costs: (a) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations You must show your workings to obtain full marks. If you have computed using Microsoft Excel. copy and paste your calculations as a Microsoft Excel Worksheer Object. (3 marks) Using the reciprocal method to allocate the support department costs: (b) Write out the equations needed to allocate the support department costs to each other. You must rearrange your equations so that the same variables are aligned to obtain full marks. (4 marks) (c) Write out your equations (from part b) formally in the matrix and vector form of Axb. (2 marks) (d) Find the inverse of your matrix A (from part c) using Microsoft Excel. Format/show your results in 8 decimal places. Copy and paste your inverse as a Microsoft Excel Worksheet Object. (1 mark) (e) Multiply your inverse of matrix A (from part d) with vector b using Microsoft Excel. Format/show your results in 3 decimal places. Copy and paste your multiplied result (x) as a Microsoft Excel Worksheet Object. (1 mark) Calculate the cost allocations from the support departments to each of the operating departments You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel. copy and paste your calculations as a Microsoft Excel Worksheet Object (3 marks) (g) Explain why the step in parte is necessary in producing new adjusted costs. (2 marks) Required: Using the direct method to allocate the support department costs: (a) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel copy and paste your calculations as a Microsoft Excel Worksheet Object. (3 marks) Using the reciprocal method to allocate the support department costs: (b) Write out the equations needed to allocate the support department costs to each other. You must rearrange your equations so that the same variables are aligned to obtain full marks. (4 marks) (c) Write out your equations (from part b) formally in the matrix and vector form of Ax = b. (2 marks) Find the inverse of your matrix A (from part c) using Microsoft Excel. Format/show your results in 8 decimal places. Copy and paste your inverse as a Microsoft Excel Worksheet Object (1 mark) (e) Multiply your inverse of matrix A (from part d) with vector b using Microsoft Excel. Format/show your results in 3 decimal places. Copy and paste your multiplied result (x) as a Microsoft Excel Worksheet Object. (% mark) (1) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel, copy and paste your calculations as a Microsoft Excel Worksheet Object. (3 marks) (g) Explain why the step in parte is necessary in producing new adjusted costs. (2 marks) Anderson Group provides long-term leased apartments, short-term serviced apartments and hotel services. They have four support departments which supply administration (Admin), housekeeping (Cleaning), washing (Laundry), and in-room dining (Food) to the three operating departments, Leases, Apartments and Hotel Services (Hotels), as well as to each other. Details of their activities and overhead costs for the next budget period are provided in the table below. The allocation bases for each support department is shown on the far right column (e.g. Labour Hours is the allocation base for Admin). Admin Cleaning Laundry Food Support Departments Admin Cleaning| Laundry Food $361,210 $597,315 $453,067 $289,013 0% 19% 14% 10% 16% 0%| 20% 6% 6% 12% 0% 9% 2% 12% 4% 0% Operating Departments Total Leases Apartments Hotels $90,236 $324,067 $485,092 $2,600,000 6% 23% 28% 100% Labour Hours 7% 21% 30% 100% Employees 5% 29% 39% 100% Machine Hours 1% 17% 64% 100% Orders Required: Using the direct method to allocate the support department costs: (a) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations You must show your workings to obtain full marks. If you have computed using Microsoft Excel. copy and paste your calculations as a Microsoft Excel Worksheer Object. (3 marks) Using the reciprocal method to allocate the support department costs: (b) Write out the equations needed to allocate the support department costs to each other. You must rearrange your equations so that the same variables are aligned to obtain full marks. (4 marks) (c) Write out your equations (from part b) formally in the matrix and vector form of Axb. (2 marks) (d) Find the inverse of your matrix A (from part c) using Microsoft Excel. Format/show your results in 8 decimal places. Copy and paste your inverse as a Microsoft Excel Worksheet Object. (1 mark) (e) Multiply your inverse of matrix A (from part d) with vector b using Microsoft Excel. Format/show your results in 3 decimal places. Copy and paste your multiplied result (x) as a Microsoft Excel Worksheet Object. (1 mark) Calculate the cost allocations from the support departments to each of the operating departments You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel. copy and paste your calculations as a Microsoft Excel Worksheet Object (3 marks) (g) Explain why the step in parte is necessary in producing new adjusted costs. (2 marks) Required: Using the direct method to allocate the support department costs: (a) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel copy and paste your calculations as a Microsoft Excel Worksheet Object. (3 marks) Using the reciprocal method to allocate the support department costs: (b) Write out the equations needed to allocate the support department costs to each other. You must rearrange your equations so that the same variables are aligned to obtain full marks. (4 marks) (c) Write out your equations (from part b) formally in the matrix and vector form of Ax = b. (2 marks) Find the inverse of your matrix A (from part c) using Microsoft Excel. Format/show your results in 8 decimal places. Copy and paste your inverse as a Microsoft Excel Worksheet Object (1 mark) (e) Multiply your inverse of matrix A (from part d) with vector b using Microsoft Excel. Format/show your results in 3 decimal places. Copy and paste your multiplied result (x) as a Microsoft Excel Worksheet Object. (% mark) (1) Calculate the cost allocations from the support departments to each of the operating departments. You do not need to show the total overhead costs after the allocations. You must show your workings to obtain full marks. If you have computed using Microsoft Excel, copy and paste your calculations as a Microsoft Excel Worksheet Object. (3 marks) (g) Explain why the step in parte is necessary in producing new adjusted costs. (2 marks)