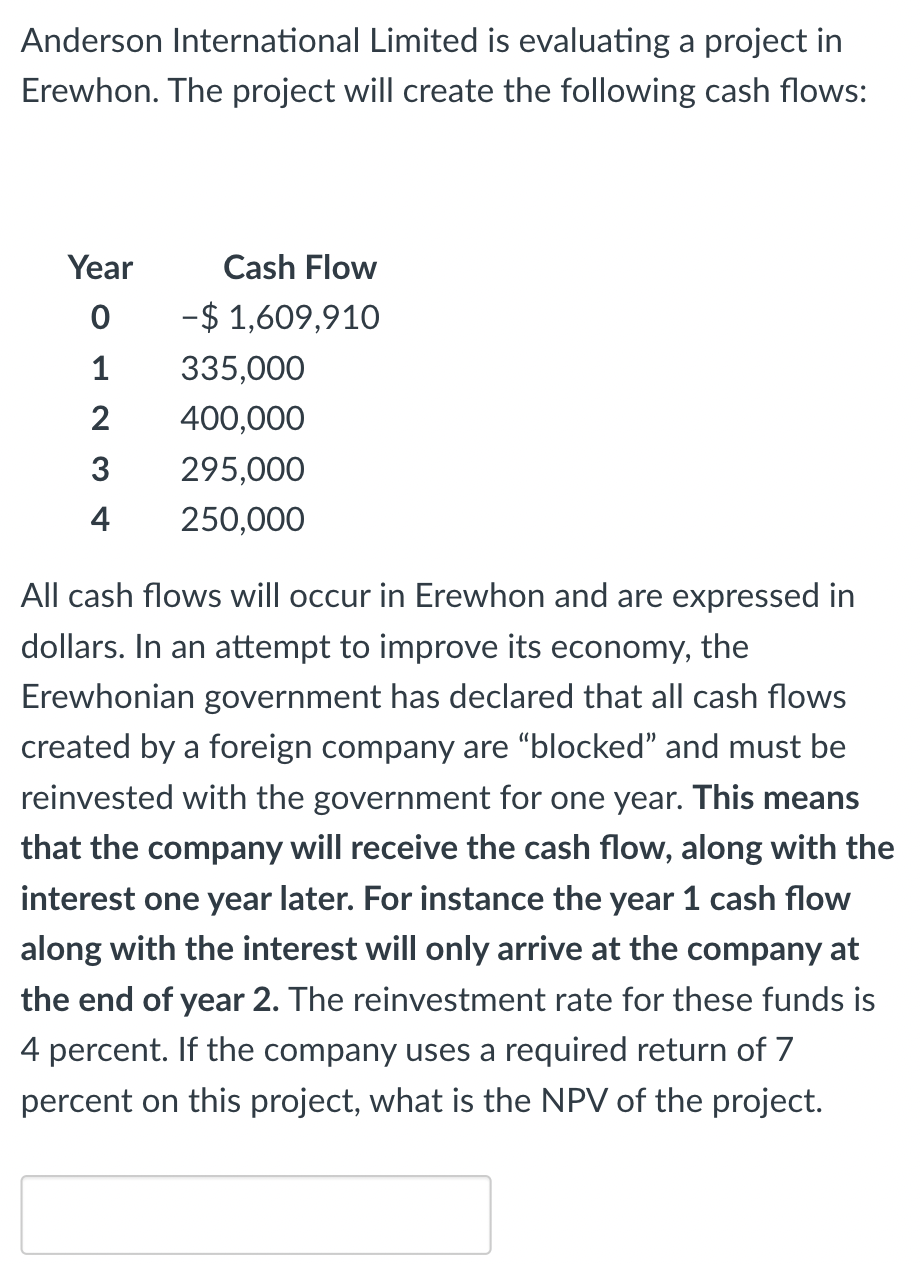

Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow 0 -$1,609,910 1 335,000

Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow 0 -$1,609,910 1 335,000 2 400,000 3 295,000 4 250,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. This means that the company will receive the cash flow, along with the interest one year later. For instance the year 1 cash flow along with the interest will only arrive at the company at the end of year 2. The reinvestment rate for these funds is 4 percent. If the company uses a required return of 7 percent on this project, what is the NPV of the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the project we need to account for the blocked cash flows ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started