Question

Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the last 5 years and Anderson is

Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the last 5 years and Anderson is considering eliminating that division. Andersons information about the two divisions is as follows:

| Book Division | Magazine Division | Total | |||||||||

| Sales Revenue | $ | 7,800,000 | $ | 3,300,000 | $ | 11,100,000 | |||||

| Cost of Goods sold | |||||||||||

| Variable costs | 2,000,000 | 997,000 | 2,997,000 | ||||||||

| Fixed costs | 1,077,500 | 1,200,000 | 2,277,500 | ||||||||

| Gross Profit | $ | 4,722,500 | $ | 1,103,000 | $ | 5,825,500 | |||||

| Operating Expenses | |||||||||||

| Variable | 135,000 | 198,000 | 333,000 | ||||||||

| Fixed | 2,916,000 | 1,189,000 | 4,105,000 | ||||||||

| Net income | $ | 1,671,500 | $ | (284,000 | ) | $ | 1,387,500 | ||||

Only 20 percent of the fixed manufacturing costs and 60 percent of the fixed operating expenses are directly attribute to each division. The remainder are common or shared between the two divisions.

Required:

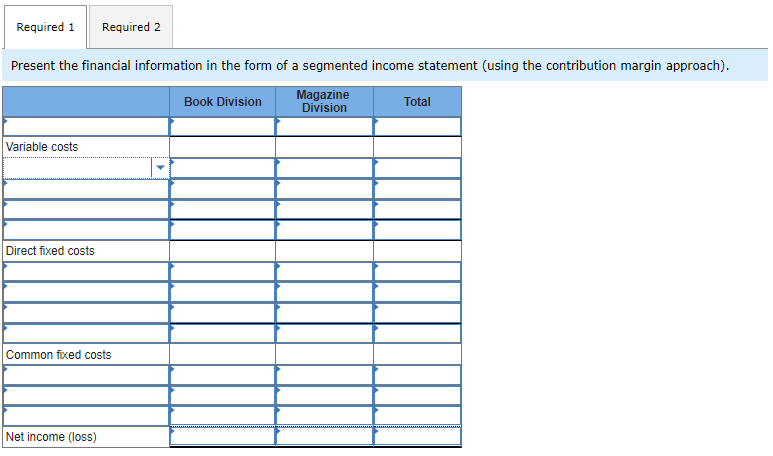

1. Present the financial information in the form of a segmented income statement (using the contribution margin approach).

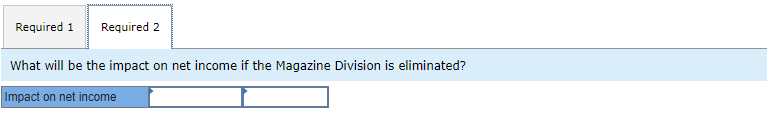

2. What will be the impact on net income if the Magazine Division is eliminated?

Required 1 Present the financial information in the form of a segmented income statement (using the contribution margin approach). Magazine Division Variable costs Direct fixed costs Required 2 Common fixed costs Net income (loss) |- Book Division Total Required 1 Required 2 What will be the impact on net income if the Magazine Division is eliminated? Impact on net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started