Question

Anderson Systems is considering a project that has an initial cash outflow of $1 million and expected cash inflows of $610,000 per year for

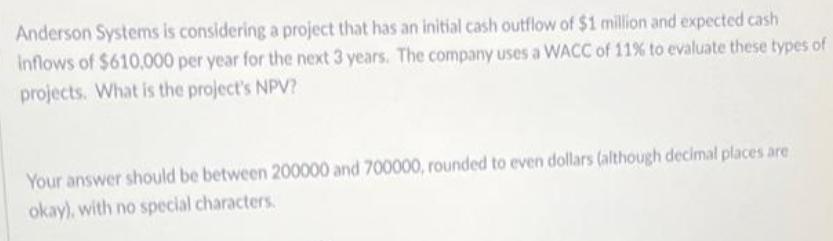

Anderson Systems is considering a project that has an initial cash outflow of $1 million and expected cash inflows of $610,000 per year for the next 3 years. The company uses a WACC of 11% to evaluate these types of projects. What is the project's NPV? Your answer should be between 200000 and 700000, rounded to even dollars (although decimal places are okay), with no special characters.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided bel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

7th Edition

0073382469, 978-0073382463

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App