Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andre is a sole trader and is registered for VAT. In the quarter ended 31 March 2022 he had the following transactions: Sales (exclusive

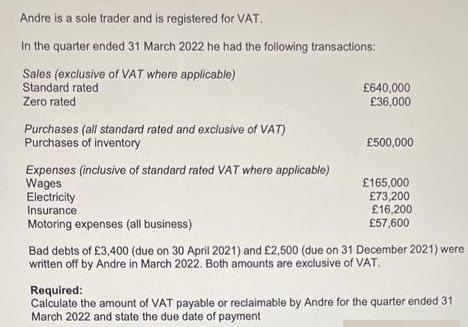

Andre is a sole trader and is registered for VAT. In the quarter ended 31 March 2022 he had the following transactions: Sales (exclusive of VAT where applicable) Standard rated 640,000 36,000 Zero rated Purchases (all standard rated and exclusive of VAT) Purchases of inventory 500,000 Expenses (inclusive of standard rated VAT where applicable) Wages 165,000 Electricity 73,200 Insurance 16,200 Motoring expenses (all business) 57,600 Bad debts of 3,400 (due on 30 April 2021) and 2,500 (due on 31 December 2021) were written off by Andre in March 2022. Both amounts are exclusive of VAT. Required: Calculate the amount of VAT payable or reclaimable by Andre for the quarter ended 31 March 2022 and state the due date of payment

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of VAT PayableReclaimable by Andree for Quarter ended 31st Mar 2022 Particula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started