Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrea and Zavier Winter are continuing to review business practices. Currently, they are reviewing the company's property, plant, and equipment and have gathered the following

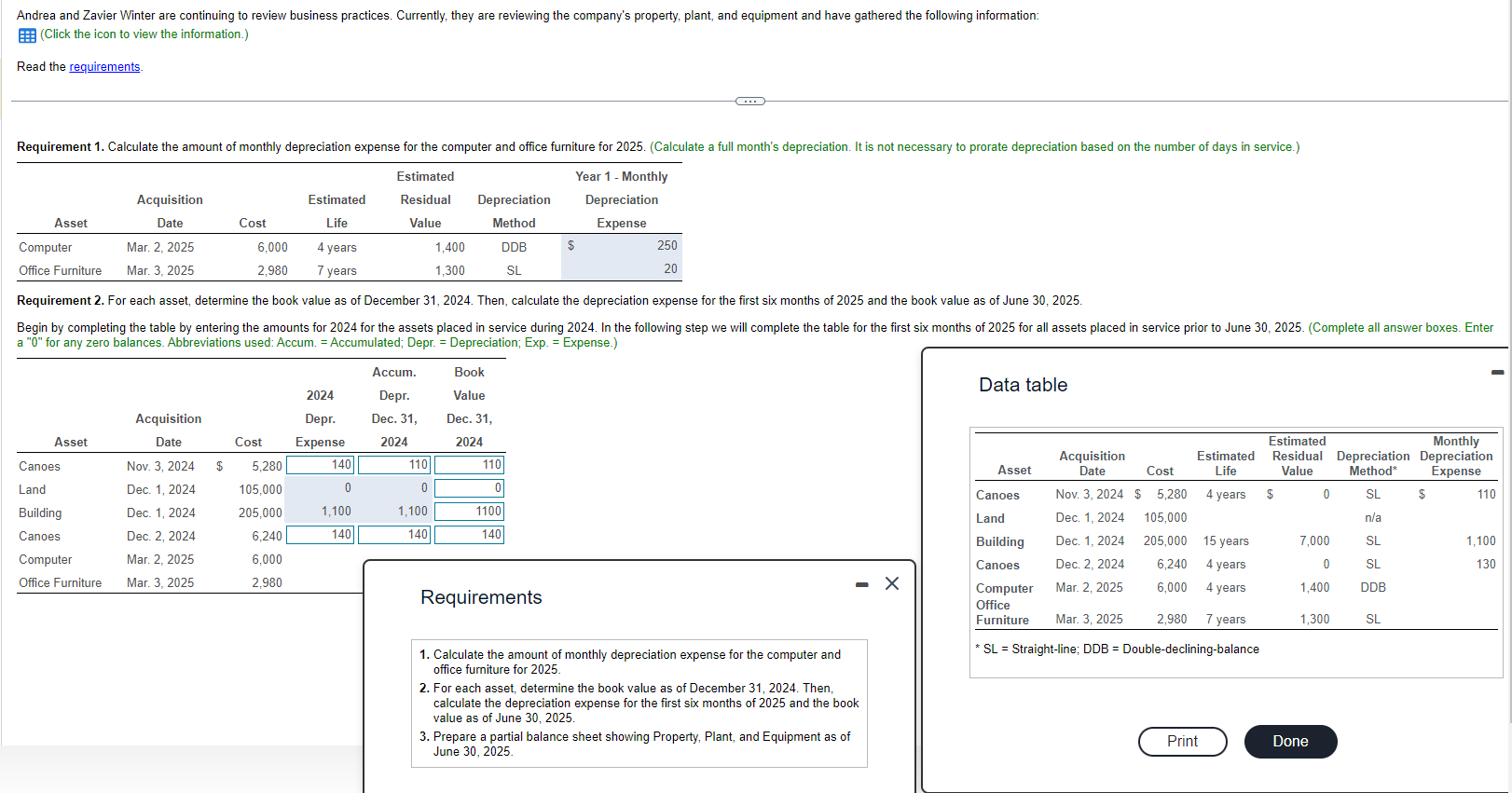

Andrea and Zavier Winter are continuing to review business practices. Currently, they are reviewing the company's property, plant, and equipment and have gathered the following information: (Click the icon to view the information.) Read the Requirement 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. (Calculate a full month's depreciation. It is not necessary to prorate depreciation Requirement 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025 Begin by completing the table by entering the amounts for 2024 for the assets placed in service during 2024. In the following step we will complete the table for the first six months of 2025 for all asset a "0" for any zero balances. Abbreviations used: Accum. = Accumulated; Depr. = Depreciation; Exp. = Expense.) requirentists 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025 . 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025 . 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2025

Andrea and Zavier Winter are continuing to review business practices. Currently, they are reviewing the company's property, plant, and equipment and have gathered the following information: (Click the icon to view the information.) Read the Requirement 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. (Calculate a full month's depreciation. It is not necessary to prorate depreciation Requirement 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025 Begin by completing the table by entering the amounts for 2024 for the assets placed in service during 2024. In the following step we will complete the table for the first six months of 2025 for all asset a "0" for any zero balances. Abbreviations used: Accum. = Accumulated; Depr. = Depreciation; Exp. = Expense.) requirentists 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025 . 2. For each asset, determine the book value as of December 31, 2024. Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025 . 3. Prepare a partial balance sheet showing Property, Plant, and Equipment as of June 30, 2025 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started