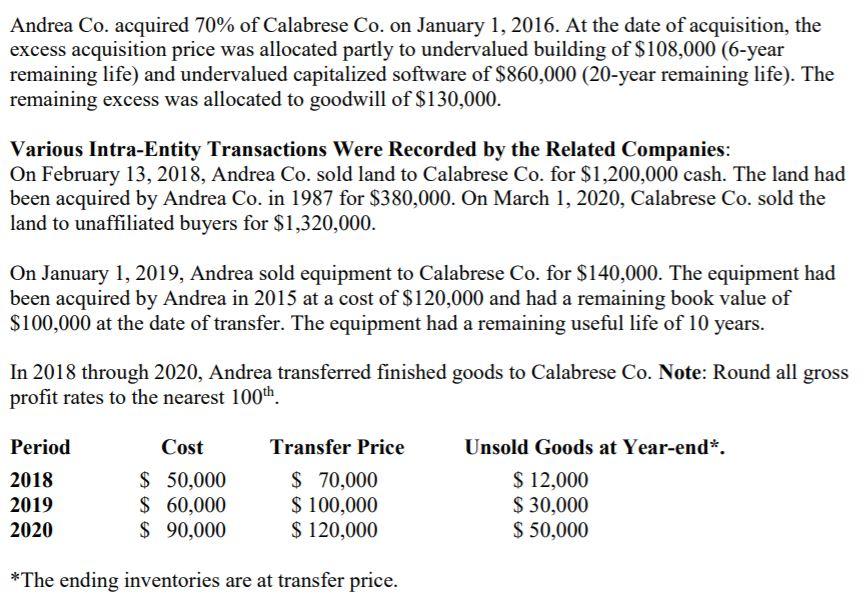

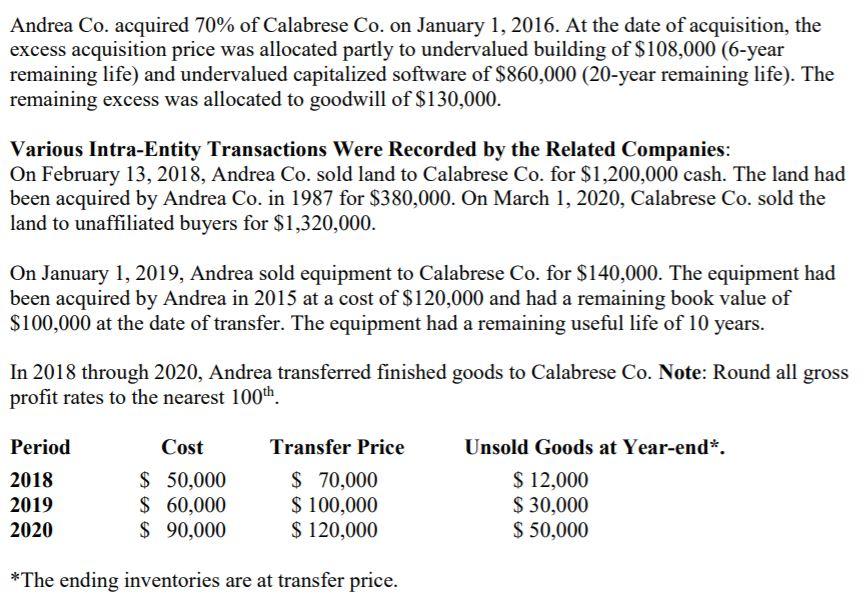

Andrea Co. acquired 70% of Calabrese Co. on January 1, 2016. At the date of acquisition, the excess acquisition price was allocated partly to undervalued building of $108,000 (6-year remaining life) and undervalued capitalized software of $860,000 (20-year remaining life). The remaining excess was allocated to goodwill of $130,000. Various Intra-Entity Transactions Were Recorded by the Related Companies: On February 13, 2018, Andrea Co. sold land to Calabrese Co. for $1,200,000 cash. The land had been acquired by Andrea Co. in 1987 for $380,000. On March 1, 2020, Calabrese Co. sold the land to unaffiliated buyers for $1,320,000. On January 1, 2019, Andrea sold equipment to Calabrese Co. for $140,000. The equipment had been acquired by Andrea in 2015 at a cost of $120,000 and had a remaining book value of $100,000 at the date of transfer. The equipment had a remaining useful life of 10 years. In 2018 through 2020, Andrea transferred finished goods to Calabrese Co. Note: Round all gross profit rates to the nearest 100th Period Cost 2018 2019 2020 $ 50,000 $ 60,000 $ 90,000 Transfer Price $ 70,000 $ 100,000 $ 120,000 Unsold Goods at Year-end*. $ 12,000 $ 30,000 $ 50,000 *The ending inventories are at transfer price. 21. Consolidation Worksheet Entry TI at the end of 2020 would require a: Andrea Co. acquired 70% of Calabrese Co. on January 1, 2016. At the date of acquisition, the excess acquisition price was allocated partly to undervalued building of $108,000 (6-year remaining life) and undervalued capitalized software of $860,000 (20-year remaining life). The remaining excess was allocated to goodwill of $130,000. Various Intra-Entity Transactions Were Recorded by the Related Companies: On February 13, 2018, Andrea Co. sold land to Calabrese Co. for $1,200,000 cash. The land had been acquired by Andrea Co. in 1987 for $380,000. On March 1, 2020, Calabrese Co. sold the land to unaffiliated buyers for $1,320,000. On January 1, 2019, Andrea sold equipment to Calabrese Co. for $140,000. The equipment had been acquired by Andrea in 2015 at a cost of $120,000 and had a remaining book value of $100,000 at the date of transfer. The equipment had a remaining useful life of 10 years. In 2018 through 2020, Andrea transferred finished goods to Calabrese Co. Note: Round all gross profit rates to the nearest 100th Period Cost 2018 2019 2020 $ 50,000 $ 60,000 $ 90,000 Transfer Price $ 70,000 $ 100,000 $ 120,000 Unsold Goods at Year-end*. $ 12,000 $ 30,000 $ 50,000 *The ending inventories are at transfer price. 21. Consolidation Worksheet Entry TI at the end of 2020 would require a