Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andreas Delon's Compensation. Andreas Delon is a French citizen who has been offered the position of CEO of LakePharma, a large French pharmaceuticals firm. LakePharma

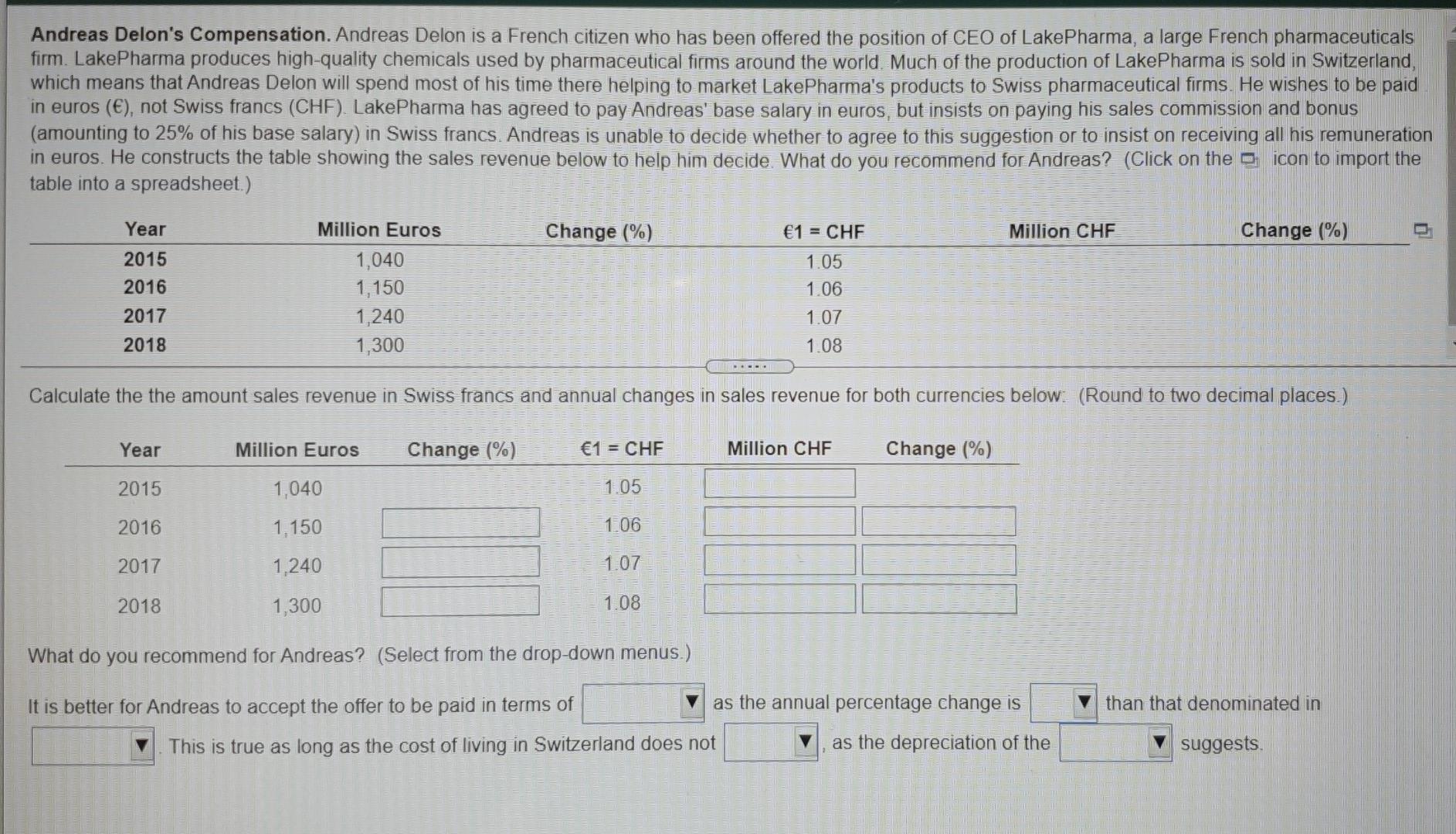

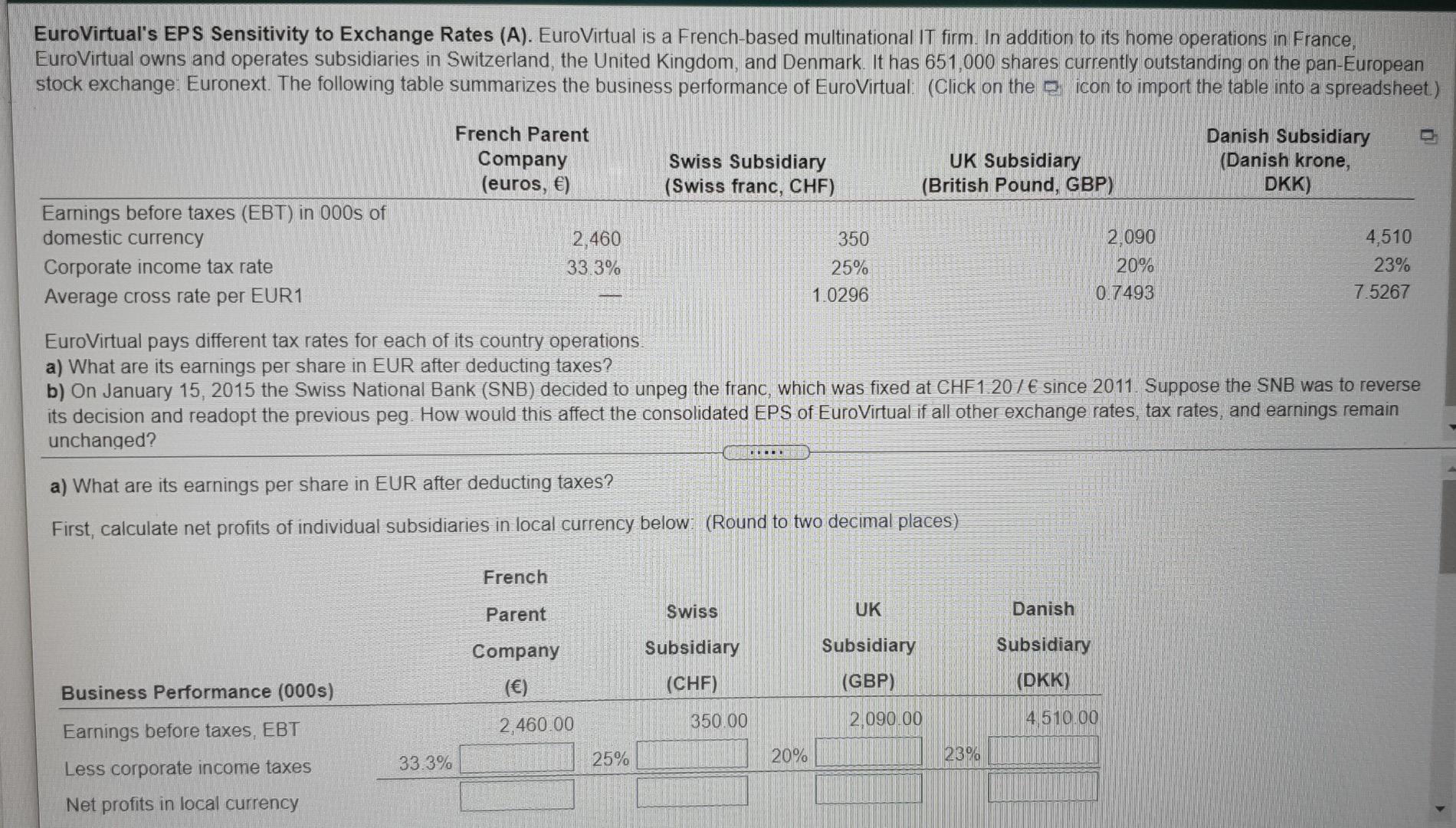

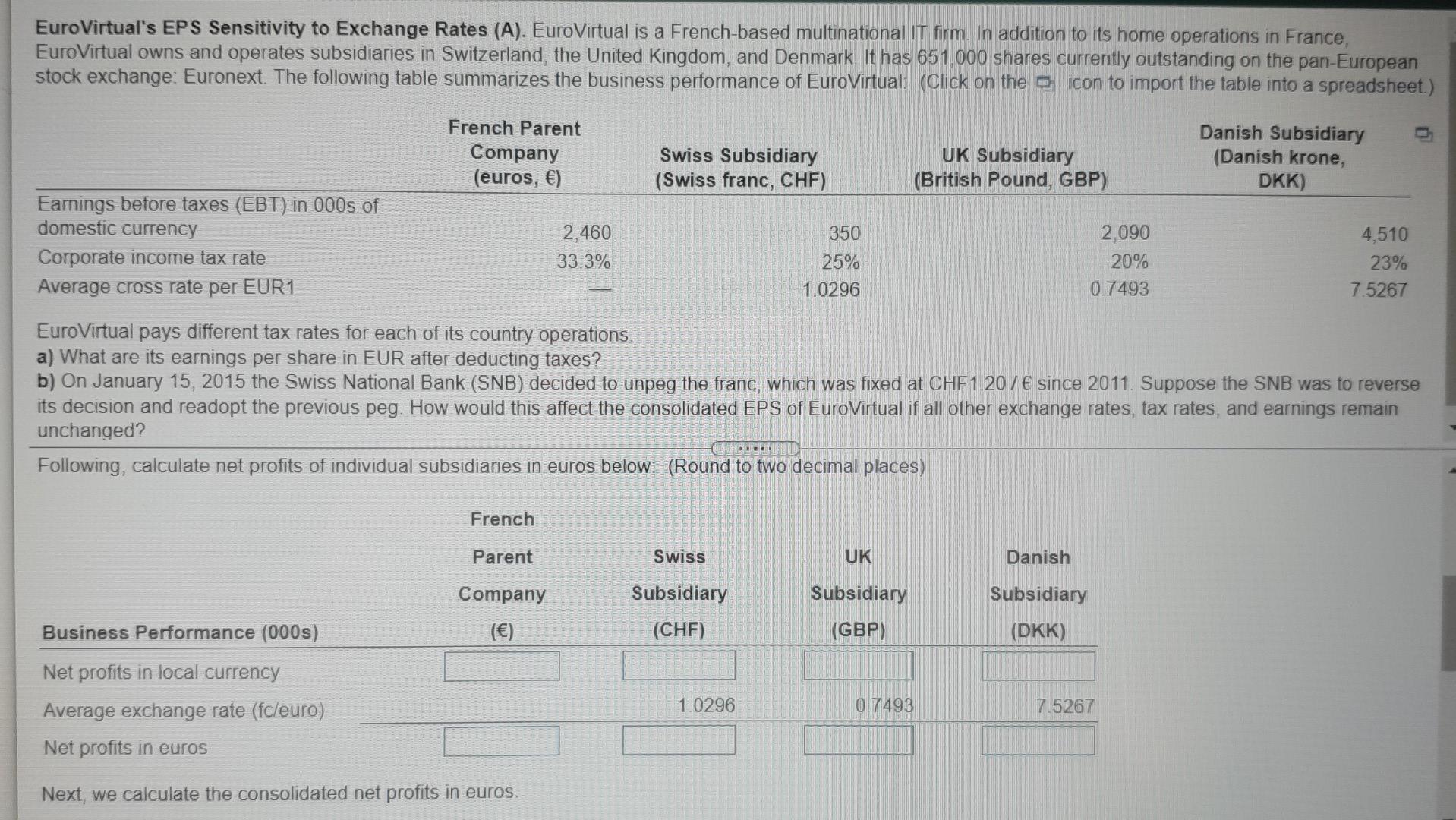

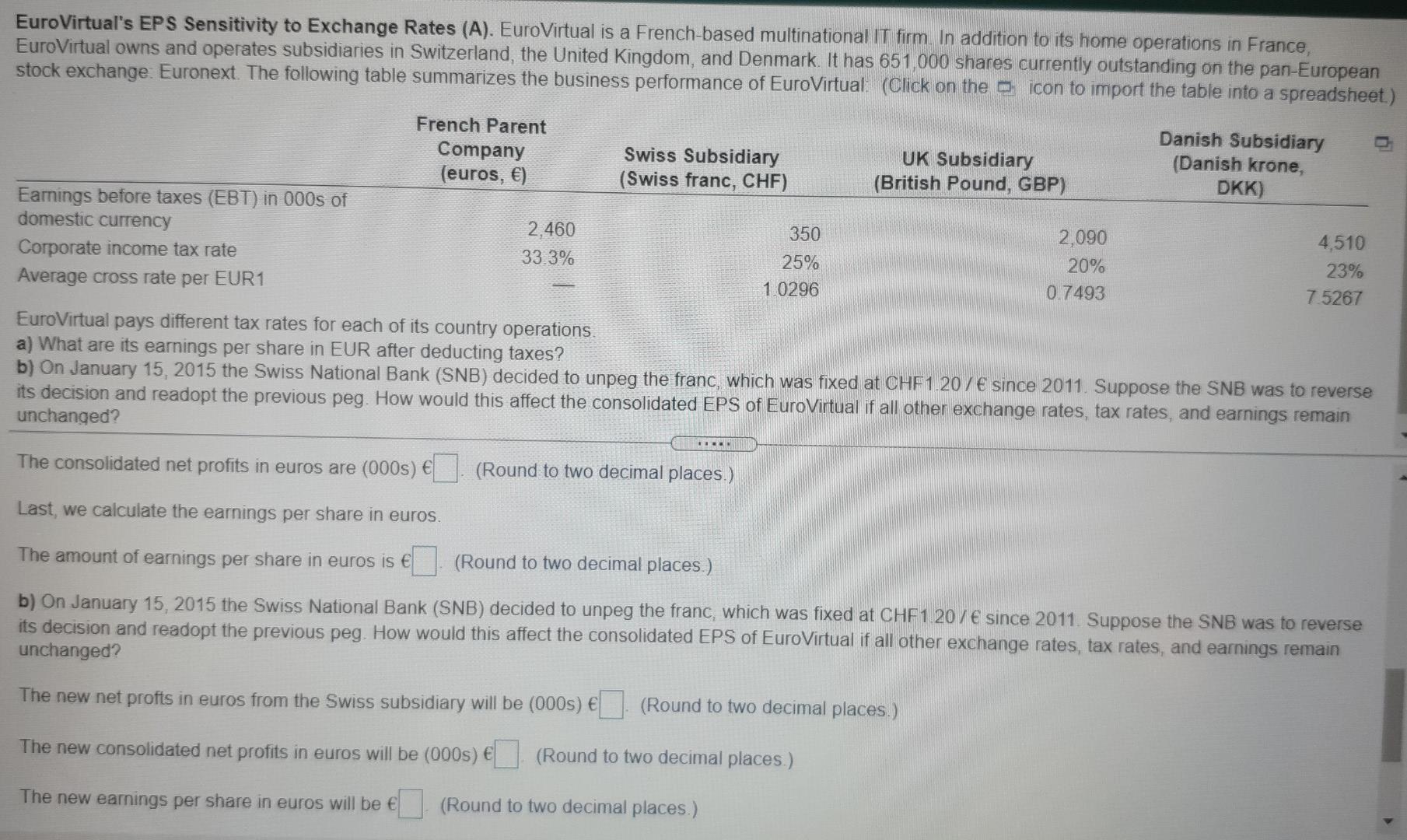

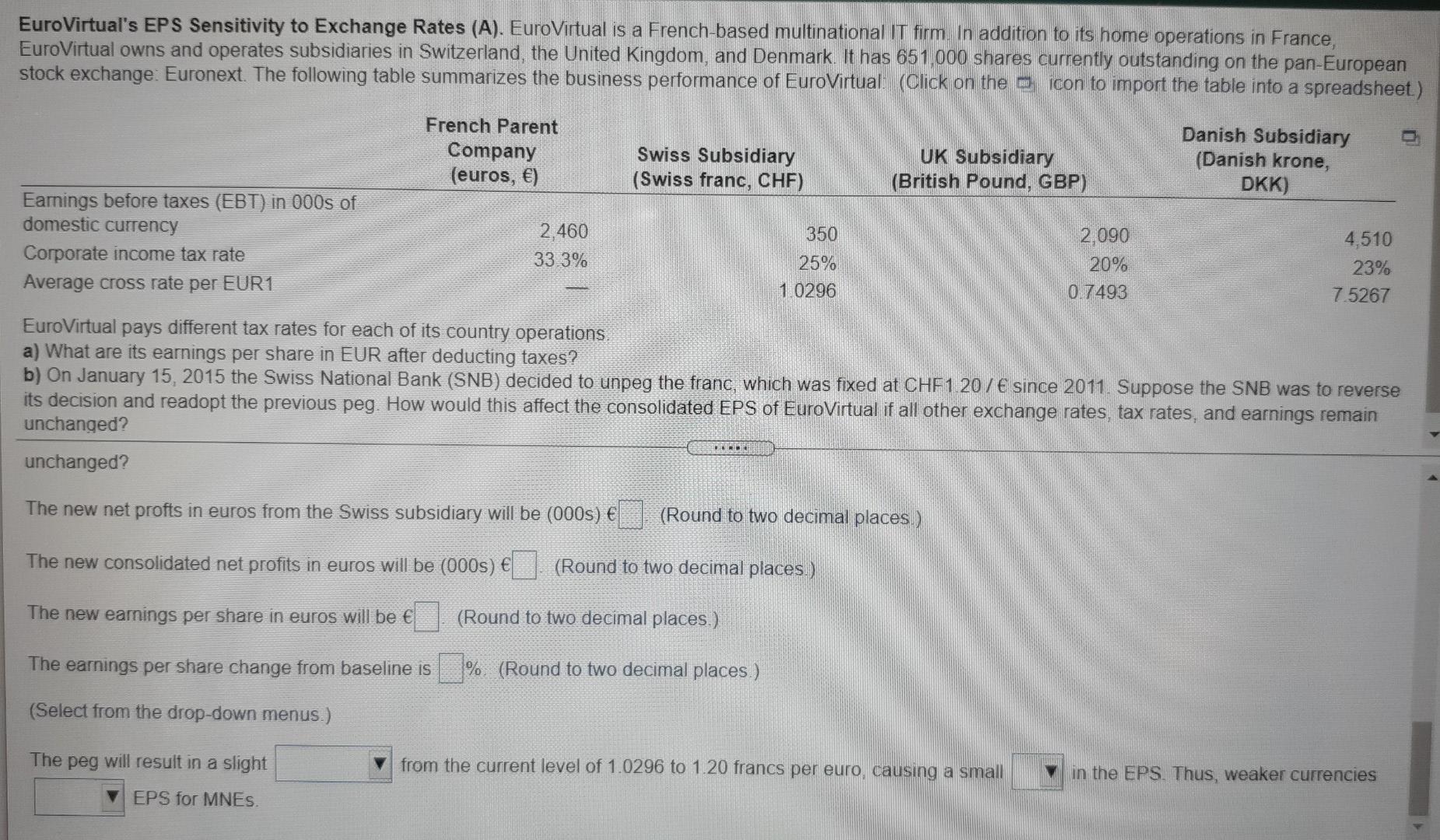

Andreas Delon's Compensation. Andreas Delon is a French citizen who has been offered the position of CEO of LakePharma, a large French pharmaceuticals firm. LakePharma produces high-quality chemicals used by pharmaceutical firms around the world. Much of the production of LakePharma is sold in Switzerland, which means that Andreas Delon will spend most of his time there helping to market LakePharma's products to Swiss pharmaceutical firms. He wishes to be paid in euros (), not Swiss francs (CHF). LakePharma has agreed to pay Andreas' base salary in euros, but insists on paying his sales commission and bonus (amounting to 25% of his base salary) in Swiss francs. Andreas is unable to decide whether to agree to this suggestion or to insist on receiving all his remuneration in euros. He constructs the table showing the sales revenue below to help him decide. What do you recommend for Andreas? (Click on the icon to import the table into a spreadsheet.) Change (%) 1 = CHF Million CHF Change (%) Year 2015 2016 2017 Million Euros 1,040 1,150 1,240 1,300 1.05 1.06 1.07 1.08 2018 Calculate the the amount sales revenue in Swiss francs and annual changes in sales revenue for both currencies below. (Round to two decimal places.) Year Million Euros Change (%) 1 = CHF Million CHF Change (%) 2015 1,040 1.05 2016 106 1,150 1,240 2017 1.07 2018 1,300 1.08 What do you recommend for Andreas? (Select from the drop-down menus.) It is better for Andreas to accept the offer to be paid in terms of as the annual percentage change is than that denominated in This is true as long as the cost of living in Switzerland does not as the depreciation of the suggests EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual : (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 2,460 33.3% 350 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.207 since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? a) What are its earnings per share in EUR after deducting taxes? First, calculate net profits of individual subsidiaries in local currency below. (Round to two decimal places) French Parent Swiss UK Danish Company Subsidiary Subsidiary (GBP) Subsidiary (DKK) Business Performance (000s) () (CHF) 350.00 2,460.00 2.090.00 4,510.00 Earnings before taxes, EBT 25% 33.3% 20% 23% Less corporate income taxes Net profits in local currency EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual. (Click on the icon to import the table into a spreadsheet.) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 2,460 33.3% 350 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1 20 / since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? Following, calculate net profits of individual subsidiaries in euros below. (Round to two decimal places) French Parent Swiss UK Danish Company Subsidiary Subsidiary (CHF) Subsidiary (DKK) Business Performance (000s) () (GBP) Net profits in local currency Average exchange rate (fcleuro) Net profits in euros 1.0296 0.7493 7.5267 Next, we calculate the consolidated net profits in euros. EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange. Euronext. The following table summarizes the business performance of EuroVirtual (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR 1 2,460 33.3% 350 25% 1 0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations. a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.207 since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? PESO The consolidated net profits in euros are (000s) (Round to two decimal places.) Last, we calculate the earnings per share in euros. The amount of earnings per share in euros is (Round to two decimal places.) b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.20 / since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? The new net profts in euros from the Swiss subsidiary will be (000s) (Round to two decimal places.) The new consolidated net profits in euros will be (000s) (Round to two decimal places.) The new earnings per share in euros will be (Round to two decimal places.) EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual: (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 350 2,460 33.3% 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1 20/ since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? unchanged? The new net profts in euros from the Swiss subsidiary will be (000s) E (Round to two decimal places) The new consolidated net profits in euros will be (0005) (Round to two decimal places.) The new earnings per share in euros will be (Round to two decimal places.) The earnings per share change from baseline is % (Round to two decimal places ) (Select from the drop-down menus.) The peg will result in a slight from the current level of 1.0296 to 1.20 francs per euro, causing a small in the EPS. Thus, weaker currencies EPS for MNES. Andreas Delon's Compensation. Andreas Delon is a French citizen who has been offered the position of CEO of LakePharma, a large French pharmaceuticals firm. LakePharma produces high-quality chemicals used by pharmaceutical firms around the world. Much of the production of LakePharma is sold in Switzerland, which means that Andreas Delon will spend most of his time there helping to market LakePharma's products to Swiss pharmaceutical firms. He wishes to be paid in euros (), not Swiss francs (CHF). LakePharma has agreed to pay Andreas' base salary in euros, but insists on paying his sales commission and bonus (amounting to 25% of his base salary) in Swiss francs. Andreas is unable to decide whether to agree to this suggestion or to insist on receiving all his remuneration in euros. He constructs the table showing the sales revenue below to help him decide. What do you recommend for Andreas? (Click on the icon to import the table into a spreadsheet.) Change (%) 1 = CHF Million CHF Change (%) Year 2015 2016 2017 Million Euros 1,040 1,150 1,240 1,300 1.05 1.06 1.07 1.08 2018 Calculate the the amount sales revenue in Swiss francs and annual changes in sales revenue for both currencies below. (Round to two decimal places.) Year Million Euros Change (%) 1 = CHF Million CHF Change (%) 2015 1,040 1.05 2016 106 1,150 1,240 2017 1.07 2018 1,300 1.08 What do you recommend for Andreas? (Select from the drop-down menus.) It is better for Andreas to accept the offer to be paid in terms of as the annual percentage change is than that denominated in This is true as long as the cost of living in Switzerland does not as the depreciation of the suggests EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual : (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 2,460 33.3% 350 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.207 since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? a) What are its earnings per share in EUR after deducting taxes? First, calculate net profits of individual subsidiaries in local currency below. (Round to two decimal places) French Parent Swiss UK Danish Company Subsidiary Subsidiary (GBP) Subsidiary (DKK) Business Performance (000s) () (CHF) 350.00 2,460.00 2.090.00 4,510.00 Earnings before taxes, EBT 25% 33.3% 20% 23% Less corporate income taxes Net profits in local currency EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual. (Click on the icon to import the table into a spreadsheet.) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 2,460 33.3% 350 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1 20 / since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? Following, calculate net profits of individual subsidiaries in euros below. (Round to two decimal places) French Parent Swiss UK Danish Company Subsidiary Subsidiary (CHF) Subsidiary (DKK) Business Performance (000s) () (GBP) Net profits in local currency Average exchange rate (fcleuro) Net profits in euros 1.0296 0.7493 7.5267 Next, we calculate the consolidated net profits in euros. EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange. Euronext. The following table summarizes the business performance of EuroVirtual (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR 1 2,460 33.3% 350 25% 1 0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations. a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.207 since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? PESO The consolidated net profits in euros are (000s) (Round to two decimal places.) Last, we calculate the earnings per share in euros. The amount of earnings per share in euros is (Round to two decimal places.) b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1.20 / since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? The new net profts in euros from the Swiss subsidiary will be (000s) (Round to two decimal places.) The new consolidated net profits in euros will be (000s) (Round to two decimal places.) The new earnings per share in euros will be (Round to two decimal places.) EuroVirtual's EPS Sensitivity to Exchange Rates (A). EuroVirtual is a French-based multinational IT firm. In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 651,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual: (Click on the icon to import the table into a spreadsheet) French Parent Company (euros, ) Swiss Subsidiary (Swiss franc, CHF) UK Subsidiary (British Pound, GBP) Danish Subsidiary (Danish krone, DKK) Earnings before taxes (EBT) in 000s of domestic currency Corporate income tax rate Average cross rate per EUR1 350 2,460 33.3% 25% 1.0296 2,090 20% 0.7493 4,510 23% 7.5267 EuroVirtual pays different tax rates for each of its country operations a) What are its earnings per share in EUR after deducting taxes? b) On January 15, 2015 the Swiss National Bank (SNB) decided to unpeg the franc, which was fixed at CHF1 20/ since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged? unchanged? The new net profts in euros from the Swiss subsidiary will be (000s) E (Round to two decimal places) The new consolidated net profits in euros will be (0005) (Round to two decimal places.) The new earnings per share in euros will be (Round to two decimal places.) The earnings per share change from baseline is % (Round to two decimal places ) (Select from the drop-down menus.) The peg will result in a slight from the current level of 1.0296 to 1.20 francs per euro, causing a small in the EPS. Thus, weaker currencies EPS for MNES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started