Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrei argues that the MM theorem implies that stocks of firms with identical cash flows must have identical beta regardless of their capital structure. Evaluate

Andrei argues that the MM theorem implies that stocks of firms with identical cash flows must have identical beta regardless of their capital structure. Evaluate Andreis argument. Provide reasons for your conclusion.

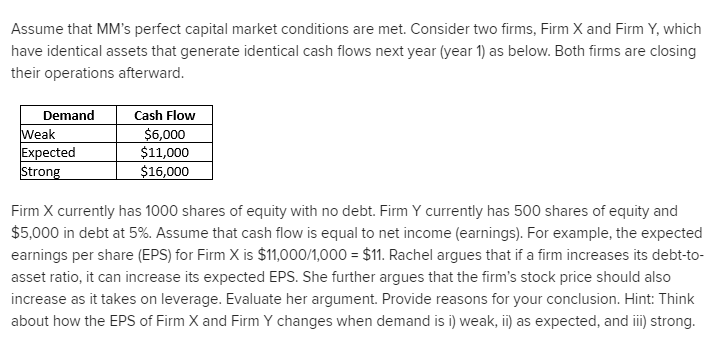

Assume that MM's perfect capital market conditions are met. Consider two firms, Firm X and Firm Y, which have identical assets that generate identical cash flows next year (year 1) as below. Both firms are closing their operations afterward. Demand Weak Expected Strong Cash Flow $6,000 $11,000 $16,000 Firm X currently has 1000 shares of equity with no debt. Firm Y currently has 500 shares of equity and $5,000 in debt at 5%. Assume that cash flow is equal to net income (earnings). For example, the expected earnings per share (EPS) for Firm X is $11,000/1,000 = $11. Rachel argues that if a firm increases its debt-to- asset ratio, it can increase its expected EPS. She further argues that the firm's stock price should also increase as it takes on leverage. Evaluate her argument. Provide reasons for your conclusion. Hint: Think about how the EPS of Firm X and Firm Y changes when demand is i) weak, ii) as expected, and iii) strong. Assume that MM's perfect capital market conditions are met. Consider two firms, Firm X and Firm Y, which have identical assets that generate identical cash flows next year (year 1) as below. Both firms are closing their operations afterward. Demand Weak Expected Strong Cash Flow $6,000 $11,000 $16,000 Firm X currently has 1000 shares of equity with no debt. Firm Y currently has 500 shares of equity and $5,000 in debt at 5%. Assume that cash flow is equal to net income (earnings). For example, the expected earnings per share (EPS) for Firm X is $11,000/1,000 = $11. Rachel argues that if a firm increases its debt-to- asset ratio, it can increase its expected EPS. She further argues that the firm's stock price should also increase as it takes on leverage. Evaluate her argument. Provide reasons for your conclusion. Hint: Think about how the EPS of Firm X and Firm Y changes when demand is i) weak, ii) as expected, and iii) strongStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started