Question

Andrew has been buying and selling timber slabs for some years, and has recently started repairing furniture. The business transactions are still recorded in a

Andrew has been buying and selling timber slabs for some years, and has recently started repairing furniture. The business transactions are still recorded in a cash receipts book, and then transferred to an Excel Workbook, but Andrew intends to move to an electronic accountancy system in the future.

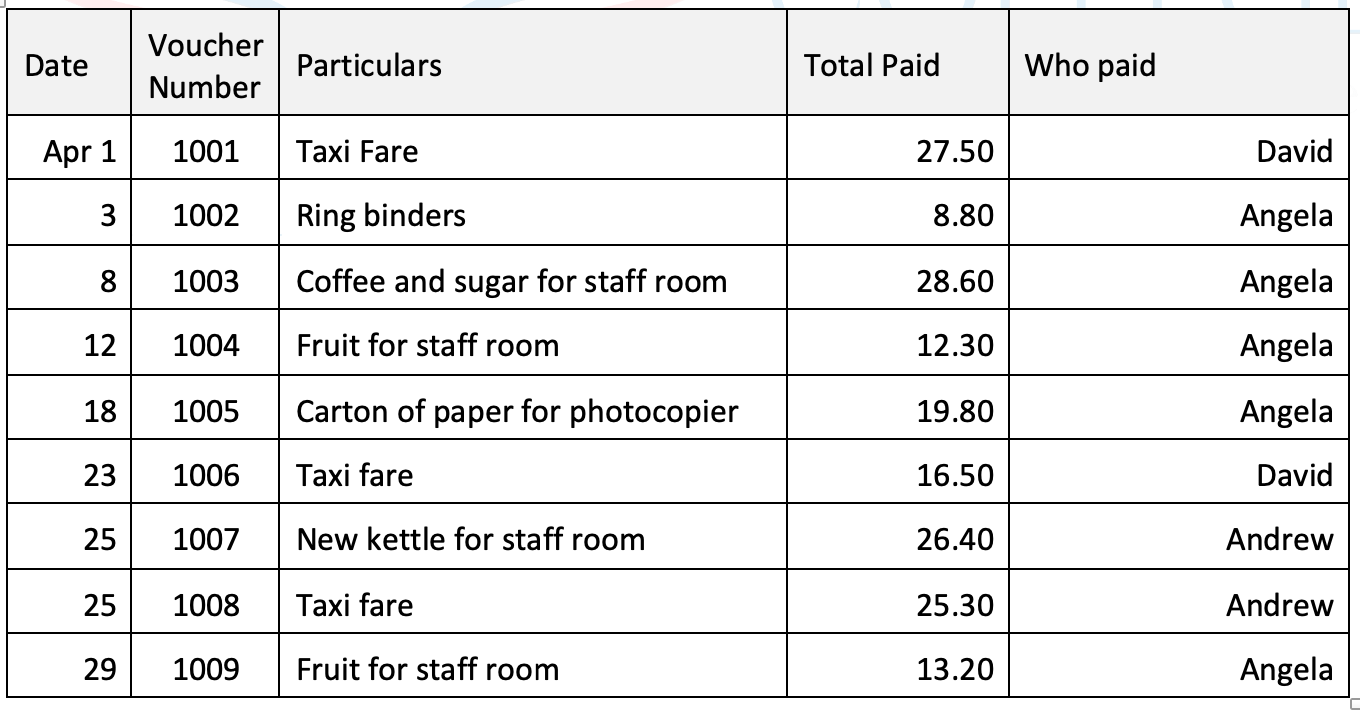

It is the first of May and, as Andrews bookkeeper, you are to balance the Petty Cash box for the previous month and prepare for its reimbursement. The Petty Cash box and log were started a month ago, so that Andrew can have better oversight of what is being spent by the office staff.

It is also your job to collect and batch the previous days cash, cheques, and EFTPOS receipts, balancing that against the previous days transactions.

You will then participate in a meeting with your assessor, who will be roleplaying Andrew. His approval is needed for the months Petty Cash vouchers and for the Journal before it can be posted to Ledger, as set out in Andrews Slabs Financial Policy and Procedures.

You will then role play the visit to the bank to reconcile the petty cash box and to deposit the previous days cheques and cash takings.

5. Enter previous days transactions into the Cash Receipts Book in the Andrews Workbook Template, and then enter the figures into the General Journal.

6. When you have accounted for the days trading and the months petty cash, organise a meeting with Andrew (your assessor).

Send your assessor an email requesting a meeting to look at, and authorise, the Petty Cash vouchers for the last month and the Journals. The text of the email should include: The table you have filled out for activity 2 above.

the previous days cash takings, total cheques, total EFTPOS transactions and total revenue for the day.

the total value of cash that you intend to deposit in the bank.

the amount that will be necessary for reimbursement of Petty Cash.

The covering email should be written in polite and technically correct English. Terminology should be used accurately and appropriately.

7. At the meeting you will be expected to:

- Give the Petty Cash Vouchers and Petty Cash Receipts to your assessor for authorisation.

- Make any changes to your Workbook entries that are requested.

- Obtain authorisation to post the Journals to Ledger.

- Detail what cash and cheques you will be bringing to the bank, role playing the process of depositing these and receiving a receipt.

- Give the amount of cash that you wish to withdraw for the Petty Cash Reconciliation, also role playing this and your receipt of the withdrawal slip.

- Describe how you would file these two documents.

During the meeting, you will be required to demonstrate effective communication skills as follows:

- Use of appropriate style (formal), tone (encouraging, respectful) and vocabulary (professional, business language) for the meeting

- Active listening skills

- Asking questions and listening to responses to clarify understanding.

8. At the above meeting, your assessor will also ask you about safety and security in relation to the companys deposit facilities.

Before attending the meeting, research the safety and security measures that may be appropriate for a business the size of Andrews Slabs. Ensure that you have recommendations on:

- which deposit facilities are appropriate

- measures that can be taken to enhance safety and security.

9. When the meeting has been completed, reconcile the banking documentation with the companys records.

- Adjust the Petty Cash transactions in the Petty Cash Book and the Journals to reflect the information that Andrew has given you.

- Post the approved Journal entries to Ledger

- Record the days trading in the Cash Receipts Book within the timeframe given in the Policy and Procedures, ensuring that the figures reconcile with the banking documentation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started