Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrew is employed by Travel Pty Ltd. At the end of the current year of assessment Travel Pty Ltd entered into an agreement with Andrew

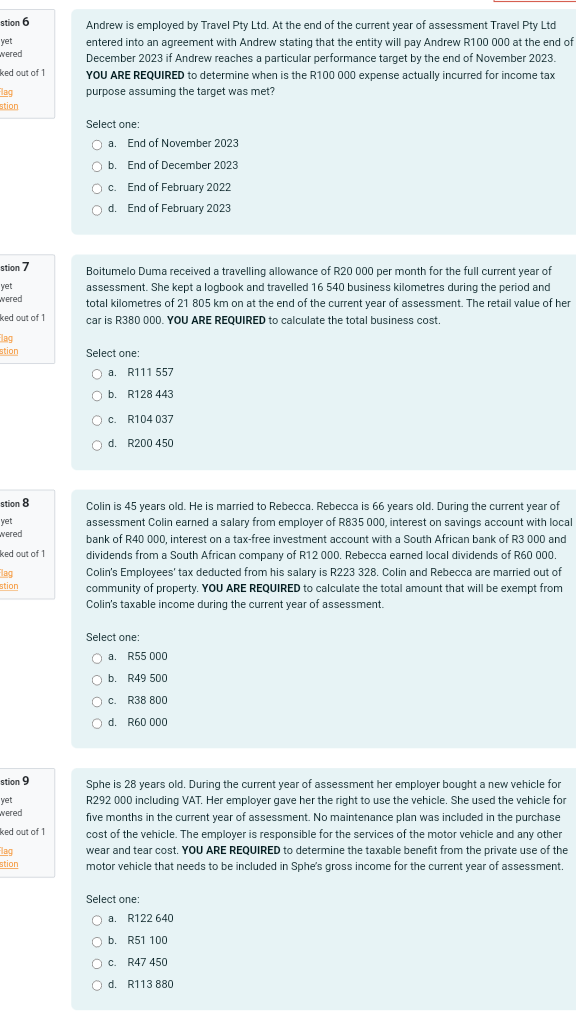

Andrew is employed by Travel Pty Ltd. At the end of the current year of assessment Travel Pty Ltd entered into an agreement with Andrew stating that the entity will pay Andrew R100 000 at the end of December 2023 if Andrew reaches a particular performance target by the end of November 2023. YOU ARE REQUIRED to determine when is the R100 000 expense actually incurred for income tax purpose assuming the target was met? Select one: a. End of November 2023 b. End of December 2023 c. End of February 2022 d. End of February 2023 Boitumelo Duma received a travelling allowance of R20 000 per month for the full current year of assessment. She kept a logbook and travelled 16540 business kilometres during the period and total kilometres of 21805km on at the end of the current year of assessment. The retail value of her car is R380 000. YOU ARE REQUIRED to calculate the total business cost. Select one: a. R111 557 b. R128 443 c. R104 037 d. R200 450 Colin is 45 years old. He is married to Rebecca. Rebecca is 66 years old. During the current year of assessment Colin earned a salary from employer of R835 000, interest on savings account with local bank of R40 000, interest on a tax-free investment account with a South African bank of R3 000 and dividends from a South African company of R12 000. Rebecca earned local dividends of R60 000 . Colin's Employees' tax deducted from his salary is R223 328. Colin and Rebecca are married out of community of property. YOU ARE REQUIRED to calculate the total amount that will be exempt from Colin's taxable income during the current year of assessment. Select one: a. R55000 b. R49 500 c. R38 800 d. R60000 Sphe is 28 years old. During the current year of assessment her employer bought a new vehicle for R292 000 including VAT. Her employer gave her the right to use the vehicle. She used the vehicle for five months in the current year of assessment. No maintenance plan was included in the purchase cost of the vehicle. The employer is responsible for the services of the motor vehicle and any other wear and tear cost. YOU ARE REQUIRED to determine the taxable benefit from the private use of the motor vehicle that needs to be included in Sphe's gross income for the current year of assessment. Select one: a. R122 640 b. R51 100 C. R47 450 d. R113880

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started