Question

Andrew is the sole owner of a small LLC, specializing in manufacturing ready-to-eat ramen noodle packages. Andrew sends you the following income/expenses items a week

Andrew is the sole owner of a small LLC, specializing in manufacturing ready-to-eat ramen noodle packages. Andrew sends you the following income/expenses items a week ago:

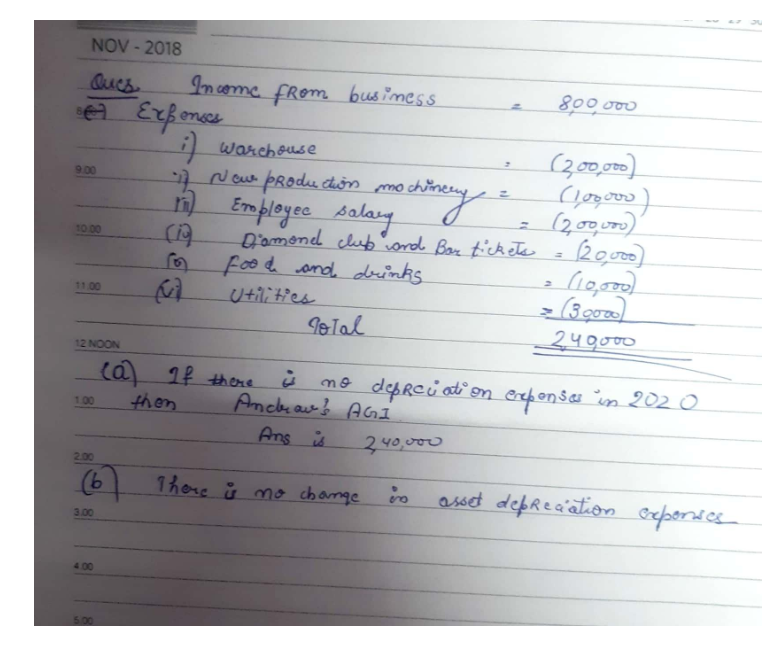

Income from the business: $800 k

Expenses:

Warehouse: $200k purchased on 12/31/2022

New production machinery: $100k purchased on 12/31/2022

Employee salary: 200k (1 full-time manager = 50k, 15 part-time contractors, 10k each)

Andrew needs to meet with a few bosses from HEB and Walmart to advertise his products. Below are the expenses associated with those client meetings that Andrew documented.

Diamond Club and Bar tickets for both Andrew and clients = 20k

Food and Drinks = 10k

Utilities: 30k

Assuming there are no depreciation expenses (no 179, no bonus, and no MACRS) in 2022, calculate Andrews AGI. Show details calculation and explanation.

How would your answer in a) change if we now account for asset depreciation expenses? Show details calculation and explanation.

Based on the purchase date of the warehouse and the machinery, we observe that Andrew is planning some strategy here to reduce his tax liability in 2022. What is the type of that tax strategy? Explain how it helps Andrew to reduce his tax liability in 2022?

PLEASE DO NOT COPY WORK FROM BELOW IT IS WRONG!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started