Answered step by step

Verified Expert Solution

Question

1 Approved Answer

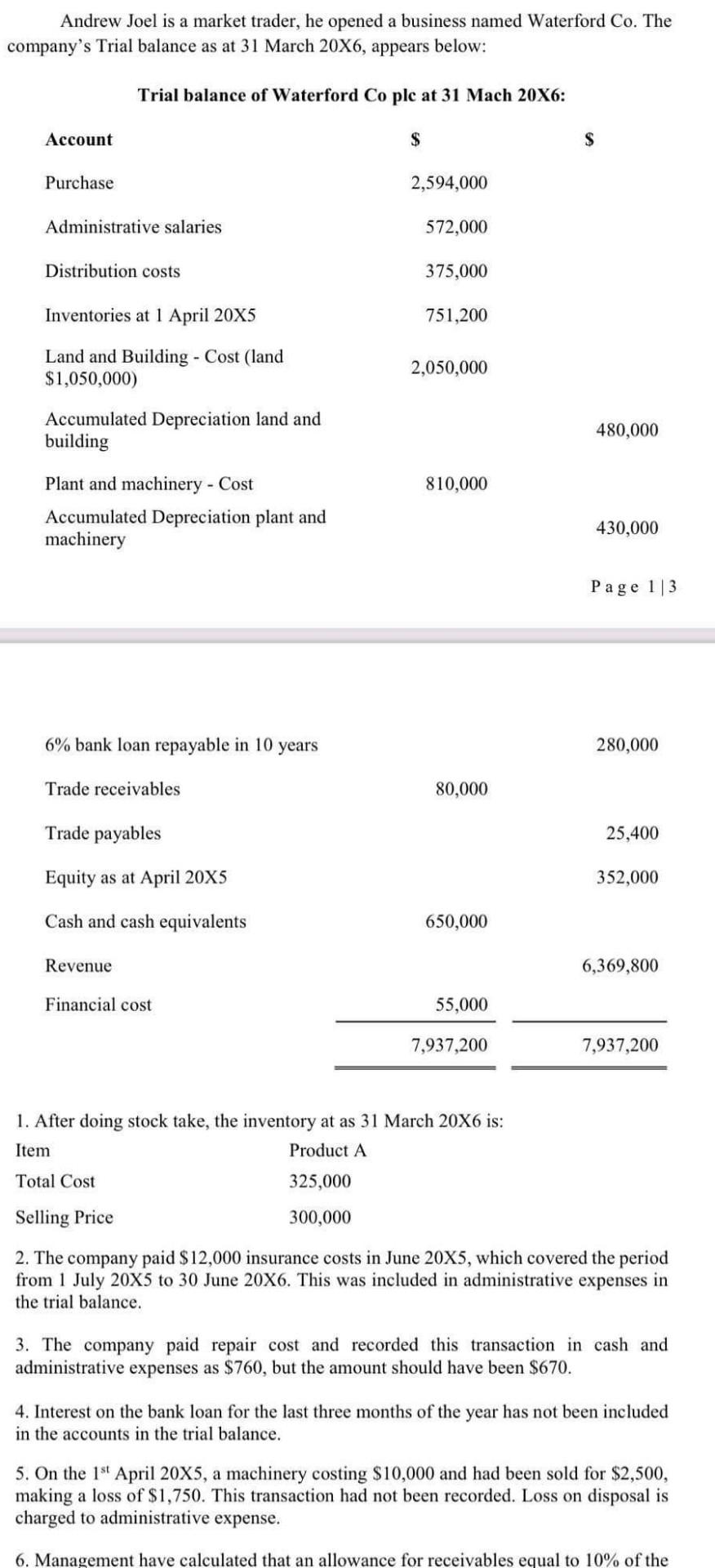

Andrew Joel is a market trader, he opened a business named Waterford Co. The company's Trial balance as at 31 March 20X6, appears below: Trial

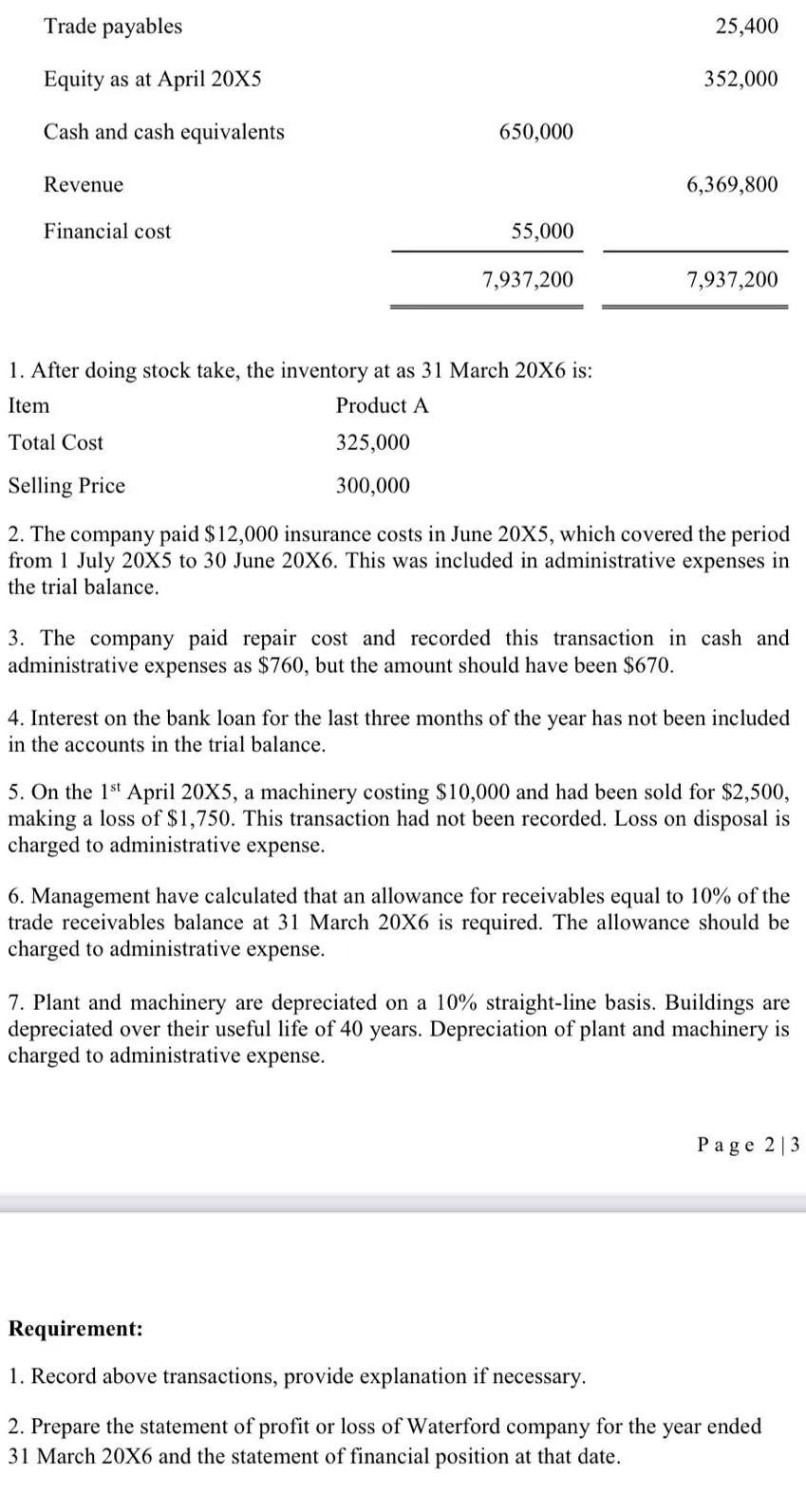

Andrew Joel is a market trader, he opened a business named Waterford Co. The company's Trial balance as at 31 March 20X6, appears below: Trial balance of Waterford Co plc at 31 Mach 20X6: Account $ S Purchase 2,594,000 Administrative salaries 572,000 Distribution costs 375,000 Inventories at 1 April 20X5 751,200 Land and Building - Cost (land $1,050,000) 2,050,000 Accumulated Depreciation land and building 480,000 810,000 Plant and machinery - Cost Accumulated Depreciation plant and machinery 430,000 Page 13 6% bank loan repayable in 10 years 280,000 Trade receivables 80,000 Trade payables 25,400 Equity as at April 20X5 352,000 Cash and cash equivalents 650,000 Revenue 6,369,800 Financial cost 55,000 7,937,200 7,937,200 1. After doing stock take, the inventory at as 31 March 20x6 is: Item Product A Total Cost 325,000 Selling Price 300,000 2. The company paid $12,000 insurance costs in June 20X5, which covered the period from 1 July 20X5 to 30 June 20X6. This was included in administrative expenses in the trial balance. 3. The company paid repair cost and recorded this transaction in cash and administrative expenses as $760, but the amount should have been $670. 4. Interest on the bank loan for the last three months of the year has not been included in the accounts in the trial balance. 5. On the 1st April 20X5, a machinery costing $10,000 and had been sold for $2,500, making a loss of $1,750. This transaction had not been recorded. Loss on disposal is charged to administrative expense. 6. Management have calculated that an allowance for receivables equal to 10% of the Trade payables 25,400 Equity as at April 20X5 352,000 Cash and cash equivalents 650,000 Revenue 6,369,800 Financial cost 55,000 7,937,200 7,937,200 1. After doing stock take, the inventory at as 31 March 20X6 is: Item Product A Total Cost 325,000 Selling Price 300,000 2. The company paid $ 12,000 insurance costs in June 20X5, which covered the period from 1 July 20X5 to 30 June 20X6. This was included in administrative expenses in the trial balance. 3. The company paid repair cost and recorded this transaction in cash and administrative expenses as $760, but the amount should have been $670. 4. Interest on the bank loan for the last three months of the year has not been included in the accounts in the trial balance. 5. On the 1st April 20X5, a machinery costing $10,000 and had been sold for $2,500, making a loss of $1,750. This transaction had not been recorded. Loss on disposal is charged to administrative expense. 6. Management have calculated that an allowance for receivables equal to 10% of the trade receivables balance at 31 March 20X6 is required. The allowance should be charged to administrative expense. 7. Plant and machinery are depreciated on a 10% straight-line basis. Buildings are depreciated over their useful life of 40 years. Depreciation of plant and machinery is charged to administrative expense. Page 23 Requirement: 1. Record above transactions, provide explanation if necessary. 2. Prepare the statement of profit or loss of Waterford company for the year ended 31 March 20X6 and the statement of financial position at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started