Answered step by step

Verified Expert Solution

Question

1 Approved Answer

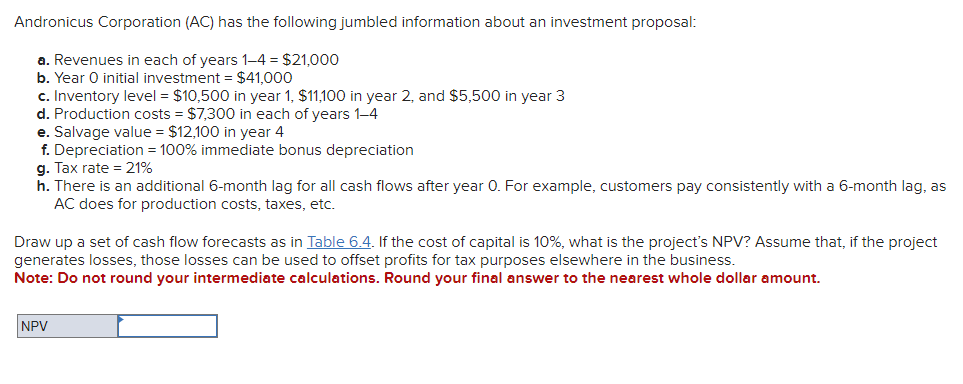

Andronicus Corporation ( AC ) has the following jumbled information about an investment proposal: Revenues in each of years 1 4 = $ 2 1

Andronicus Corporation AC has the following jumbled information about an investment proposal:

Revenues in each of years $

Year initial investment $

Inventory level $ in year $ in year and $ in year

Production costs $ in each of years

Salvage value $ in year

Depreciation immediate bonus depreciation

Tax rate

There is an additional month lag for all cash flows after year For example, customers pay consistently with a month lag, as AC does for production costs, taxes, etc.

Draw up a set of cash flow forecasts as in Table If the cost of capital is what is the projects NPV Assume that, if the project generates losses, those losses can be used to offset profits for tax purposes elsewhere in the business.Andronicus Corporation AC has the following jumbled information about an investment proposal:

a Revenues in each of years $

b Year initial investment $

c Inventory level $ in year $ in year and $ in year

d Production costs $ in each of years

e Salvage value $ in year

f Depreciation immediate bonus depreciation

g Tax rate

h There is an additional month lag for all cash flows after year For example, customers pay consistently with a month lag, as

does for production costs, taxes, etc.

Draw up a set of cash flow forecasts as in Table If the cost of capital is what is the project's NPV Assume that, if the project

generates losses, those losses can be used to offset profits for tax purposes elsewhere in the business.

Note: Do not round your intermediate calculations. Round your final answer to the nearest whole dollar amount.

NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started