Answered step by step

Verified Expert Solution

Question

1 Approved Answer

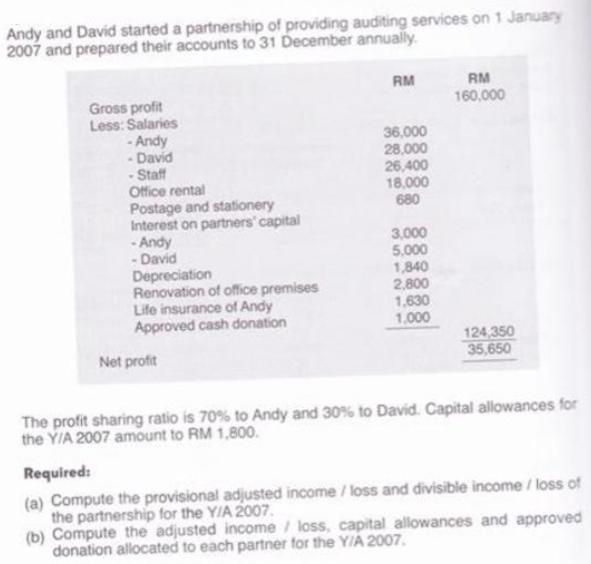

Andy and David started a partnership of providing auditing services on 1 January 2007 and prepared their accounts to 31 December annually. RM RM

Andy and David started a partnership of providing auditing services on 1 January 2007 and prepared their accounts to 31 December annually. RM RM 160,000 Gross profit Less: Salaries - Andy - David - Staff Office rental Postage and stationery Interest on partners capital - Andy - David Depreciation Renovation of office premises Life insurance of Andy Approved cash donation 36,000 28,000 26,400 18,000 680 3,000 5,000 1,840 2,800 1,630 1,000 124,350 35,650 Net profit The profit sharing ratio is 70% to Andy and 30 % to David. Capital allowances for the Y/A 2007 amount to RM 1,800. Required: (a) Compute the provisional adjusted income / loss and divisible income / loss of the partnership for the Y/A 2007. (b) Compute the adjusted income / loss, capital allowances and approved donation allocated to each partner for the Y/A 2007.

Step by Step Solution

★★★★★

3.60 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer leauisiouae adjiestid Iucaul I los fole fealuded z007 leseticullles laed...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started