Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andy Bailey recently graduated from the University of MF and is joining the Bank of MF as a financial analyst. He is assigned to

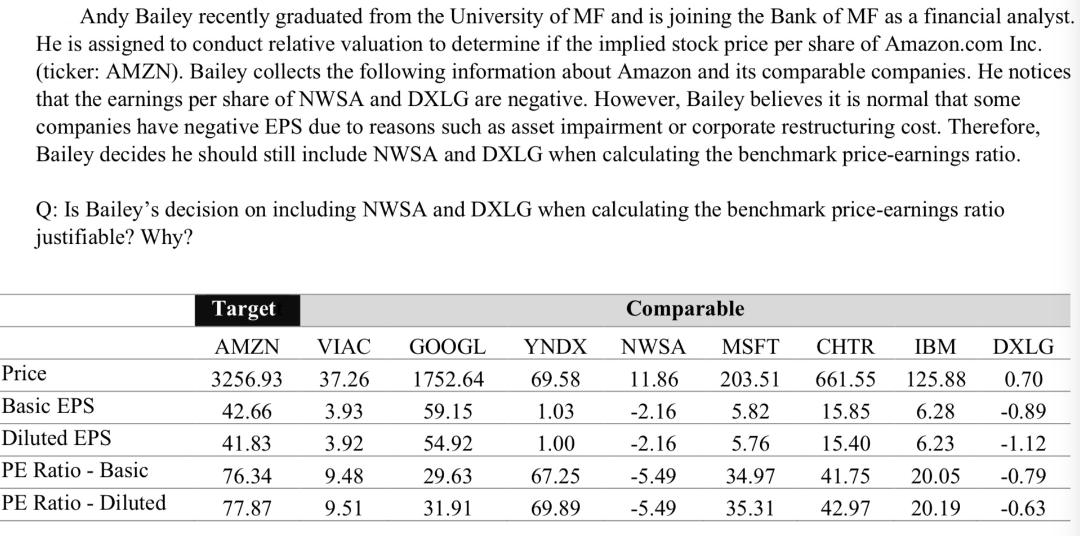

Andy Bailey recently graduated from the University of MF and is joining the Bank of MF as a financial analyst. He is assigned to conduct relative valuation to determine if the implied stock price per share of Amazon.com Inc. (ticker: AMZN). Bailey collects the following information about Amazon and its comparable companies. He notices that the earnings per share of NWSA and DXLG are negative. However, Bailey believes it is normal that some companies have negative EPS due to reasons such as asset impairment or corporate restructuring cost. Therefore, Bailey decides he should still include NWSA and DXLG when calculating the benchmark price-earnings ratio. Q: Is Bailey's decision on including NWSA and DXLG when calculating the benchmark price-earnings ratio justifiable? Why? Price Basic EPS Diluted EPS PE Ratio Basic PE Ratio - Diluted Target Comparable AMZN VIAC GOOGL YNDX 3256.93 37.26 NWSA MSFT CHTR IBM DXLG 11.86 203.51 661.55 125.88 0.70 1752.64 69.58 42.66 3.93 59.15 1.03 -2.16 5.82 15.85 6.28 -0.89 41.83 3.92 54.92 1.00 -2.16 5.76 15.40 6.23 -1.12 76.34 9.48 29.63 67.25 -5.49 34.97 41.75 20.05 -0.79 77.87 9.51 31.91 69.89 -5.49 35.31 42.97 20.19 -0.63

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Baileys decision to include NWSA and DXLG when calculating the benchmark PE ratio is not justifiable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started